QPM is counting on synergies with its Moranbah gas project to make its TECH nickel asset even more attractive

QPM’s recently acquired Moranbah gas project secures both gas supplies for the TECH project and generates cash flows. Pic via Getty Images

- Queensland Pacific Nickel’s TECH project has all the right ingredients for success

- The project features strong ESG credentials, binding offtake on 100% of its planned production and projected low capital intensity and operating costs

- Recently acquired Moranbah project will secure gas supplies for TECH

- Generating electricity at the Townsville power station and selling gas to customers will also deliver cash flow

Special Report: There is little doubt that nickel is in the doldrums with low LME prices putting a substantial part of current production at risk and possibly putting new developments at risk.

Indeed, the current slump has sent Western Australia’s nickel miners scrambling to seek relief from the Government, while IGO (ASX:IGO) has put its Cosmo nickel mine on ice.

Rather predictably, it has also led investors who typically only look at the short term to abandon nickel plays in droves.

However, the current slump has been on the crystal balls of forecasters, who have also flagged the key stainless steel ingredient and emerging battery mineral will have its time in the sun again.

The International Energy Agency predicts demand for nickel in lithium-ion batteries in lithium-ion batteries could jump 41 times between 2020 and 2040.

While this is just end-use for the metal, it nonetheless represents a pretty substantial increase in projected demand that will run straight against a very large supply deficit later this decade.

Speaking to Stockhead, Queensland Pacific Nickel (ASX:QPM) managing director Dr Stephen Grocott points to the most bullish of nickel forecasts which anticipate a 62% gap between expected demand and available supply by 2030.

“That’s assuming that that every single project on the books proceeds and clearly they won’t,” he says, adding that a supply deficit would still exist even if all projects went ahead.

While this long-term outlook plays a key role in Grocott’s confidence that QPM will be able to get its advanced TECH nickel project across the line in time to catch the nickel supply deficit wave, it certainly isn’t the only reason.

The TECH project

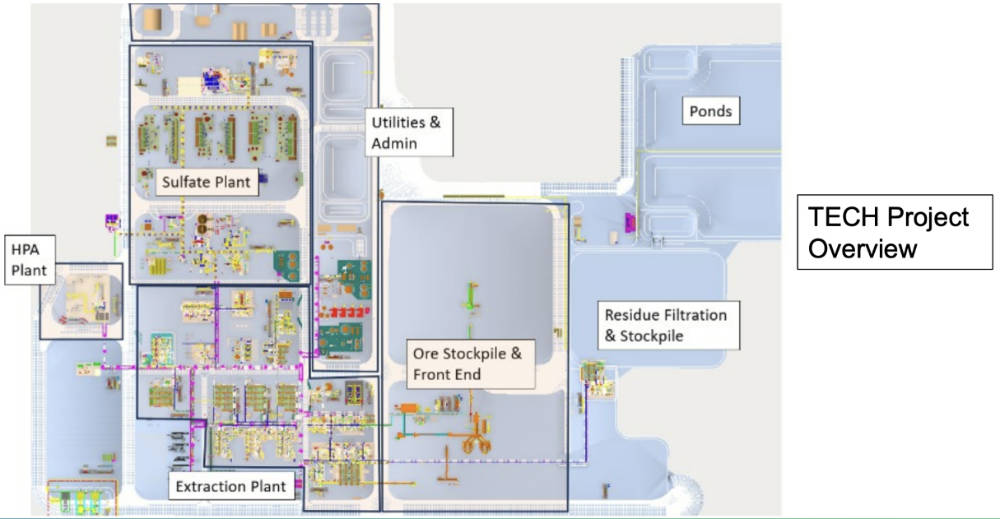

The Townsville Energy Chemicals Hub (TECH) in the Lansdown Eco-Industrial Precinct near Townsville is planned as a modern and sustainable battery materials refinery, processing imported, high-grade laterite ore from New Caledonia to produce 16,000tpa (metal equivalent) of nickel sulphate and 1,750tpa (metal equivalent) cobalt sulphate.

It benefits from access to a major port, extensive industry and supporting infrastructure, engineering services and skilled labour, all of which is in the Townsville region.

Additionally, the project site is well-supported by critical infrastructure such as road, rail, gas pipeline, water pipeline, and the ability to connect to the power grid.

Reflecting its advanced nature, the major pre-final investment decision expenditure for the TECH project has already been completed, with advanced engineering finalised and pilot test work successfully producing on spec products such as nickel sulphate.

The latter is a point of pride for Grocott, who described it as an achievement almost unheard of in this sector.

“To have 100% of your production locked up for the life of your project is fantastic, these are not MoUs that people write and destroy before breakfast, these are legally binding,” he said.

“So if we produce, we have to supply them and they have to take it.

“It is attractive pricing, they have done all their due diligence. Yes there’s risk, there’s always risk, but it is actually relatively low risk and an attractive project.”

Part of the risk stems from the project’s use of relatively new technology, though this is more than offset by long-term market fundamentals, low capital intensity and low operating costs.

It is certainly enough for QPM to have lined up $1.4bn in indicative funding with conditional support from key equipment suppliers and commercial banks.

ESG another strong factor

One of the TECH project’s strong points is its ESG credentials, which Grocott noted was more than greenhouse gas emissions – an area the project incidentally outperforms in as it has no tailings, negative greenhouse gas emissions and zero process liquid discharge.

Rather, it includes things like labour laws, tailings and the displacement of traditional owners.

Grocott bemoaned the performance of much of the world’s nickel production in these areas, saying that most of them would be impossible to consider much less operate in North America, North Asia, the EU and Australia.

He added that many consumers would source from the lowest cost producers.

“That has always been the case in the commodity sector, but what’s changed is EU regulations – which come into force in 2025 – require reporting on the ESG credentials and in 2026, there’s a carbon border adjustment mechanism which will correct for greenhouse gas intensity that’s legislated,” he noted.

“Consumers will be able to walk into the showroom in Frankfurt, scan the QR code on the car and it will tell them everything about where the battery materials and rubber for the tyres and the steel, everything, comes from.

“That is something that didn’t exist 10 years ago.”

Grocott singled out blood diamonds as the only example of the world market taking action, though it was a process which took 10-15 years to implement and was clunky.

“But they have blockchain, provenance tracking, reporting standards, this is something that is already changing. This is putting it in the hands of the customer, the consumer,” he said.

“People are willing to pay more for clean and green, how much more we will see but there will be a differentiation.”

Move to secure gas supply to also deliver first operating revenue

While TECH has all the hallmarks of an attractive flagship project, QPM also acquired the Moranbah gas project in Queensland’s Bowen Basin last year from Arrow Energy and AGL in a bid to secure the gas supplies required for its TECH Project.

Moranbah captures waste mine gas (methane) from coal mines and makes it available for use in power generation.

Taking this waste gas and using it in the TECH project is ideal from an emissions perspective, as fugitive methane emissions have far higher warming potential than carbon dioxide, a significant result as the Bowen Basin region is one of Australia’s single largest methane emitters.

Not only does the acquisition of Moranbah secure gas supplies for the TECH project, the excess gas is also supplied to the Townsville power station, a 240MW gas-fired peaking generator owned by Thai company RATCH.

“We are currently running it and producing electricity in the evenings when the sun is not shining anymore or when the wind is not blowing and we are selling the electricity, we are actually an electricity retailer now,” Grocott said.

“We determine when it operates, how much gas it gets, etc, we don’t operate it during the day when electricity cost is zero or sometimes negative.”

What is especially important for QPM is that the electricity generation business is expected to deliver positive EBITDA for the company and in the month of January 2024, QPM confirmed that it has achieved its first positive operating surplus for the project, a fantastic achievement only 5 months from acquiring the asset.

It is certainly not a bad result at all for QPM, which currently has a market cap of just ~$74.5m.

“It represents a funding stream for the TECH project, conversely, if the world crashed and suddenly decided it didn’t want nickel anymore, it is still a very attractive standalone business,” Grocott noted.

“And we are debottlenecking and improving it, it had been run down and not looked after, it was run by a very dysfunctional joint venture.

“We are already improving on it, in the four months since September 2023 we have already increased gas production by about 20%.”

Moranbah currently produces gas at a rate of ~27-28 terajoules per day.

He also pointed out that Moranbah is actually a stranded gas asset as there was no connection to the east coast gas market.

This meant that the gas could not be used for LNG exports, but could still be fed into the pipeline from Moranbah to Townsville that was originally built to feed gas into the Queensland nickel refinery which shut down in 2014-15.

Here, the gas is fed into the Townsville power station, which is connected to the National Energy Market.

“It is a perfect situation because if the gas wasn’t stranded, we wouldn’t have been able to pick it up for such a low cost, someone would have acquired it for their LNG exports,” Grocott added.

The road ahead

Over the next year, QPM will continue debottlenecking its gas business to deliver immediate cash flow with Grocott saying that Moranbah had transformed from a loss-making concern just 4-5 months ago into one that has just generated its first operating surplus month.

Having greatly reduced cash burn on its TECH project due to the feasibility work being largely completed, the company is focusing its efforts on tweaking and optimising of the flowsheet for the TECH project.

This is aimed at generating real synergies with the Moranbah project.

“Every atom less of gas we consume in the TECH project, we can turn into electricity and before we didn’t have that,” Grocott said.

“We used to just save the cost of gas, but now it is much more than saving the cost of gas, it actually includes the huge revenue from selling electricity, so we are tweaking the TECH project a little bit to optimise that and minimise the capital.

“The critical metals sector is difficult at the moment, but we are still working with financiers and ensuring that we keep them updated about our project and latest developments. .”

This article was developed in collaboration with Queensland Pacific Nickel, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.