QMines positioned as a frontrunner to become Australia’s first zero carbon copper and gold explorer

Pic: Schroptschop / E+ via Getty Images

QMines is moving closer to becoming a Climate Active certified explorer, a milestone that would see the company join just 0.01% of Australian businesses awarded the certification and position it as the country’s first zero carbon copper-gold explorer.

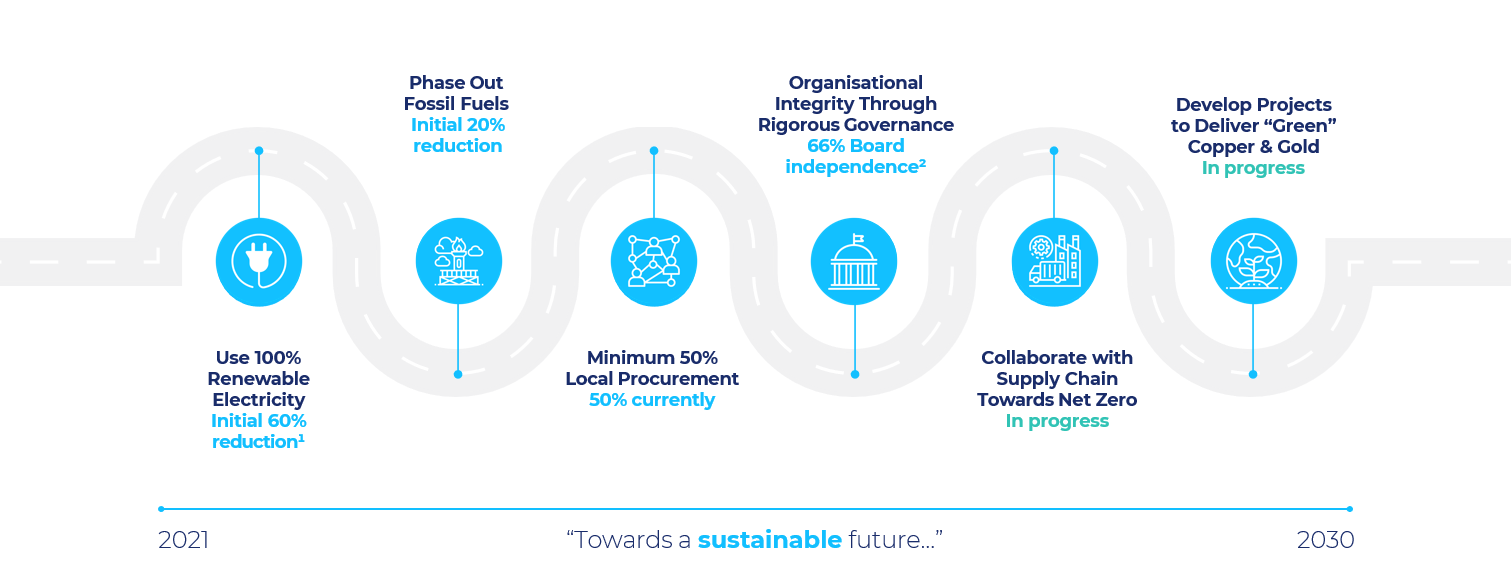

QMines (ASX:QML) has taken several steps to drastically reduce its carbon footprint, including now having signed an agreement with an Australian company for the long-term supply of renewable fuel.

This renewable fuel deal targets an initial 20% reduction in scope 1 diesel emissions from drilling and exploration activities.

The company’s near-term goal is to achieve an initial 60% renewable energy usage as part of its commitment to net zero emissions by 2030.

“Since listing in May 2021, QMines has been diligently working on a number of carbon abatement strategies,” executive chairman Andrew Sparke said.

“Our initial investigations show that diesel usage for exploration drilling and associated activities is expected to be our largest source of carbon emissions.

“The renewable fuel agreement demonstrates QMines’ commitment to decrease scope 1 diesel emissions by an initial 20%, with further reductions expected over time.”

QMines, which has a footprint spanning 1,096km² across four 100% owned copper and gold projects in Queensland, has gone to great lengths to establish exactly how much carbon it is emitting and drastically reduce those emissions.

The company has commenced the Climate Active assessment process and expects to receive certification in the first quarter of 2022.

Climate Active certification is an achievement that currently only around 350+ of over 2.4 million actively trading Australian businesses have managed to attain.

Certification is awarded to businesses and organisations that have credibly reached a state of achieving net zero emissions, otherwise known as carbon neutrality.

This means that the activities associated with running a business or producing a particular product have no net negative impact on the climate.

As a first step, prior to its debut on the ASX, QMines conducted a self-assessment of its greenhouse gas (GHG) emissions over a four-month period in 2020, which resulted in an estimate of 8.14 tonnes of CO₂ emissions.

This review and QMines’ forward projections highlighted that one of the largest future emissions sources in likely to come from professional services, which includes exploration drilling and its diesel usage.

To counter this, the company permanently surrendered 35 tonnes of CO2-e emissions by investing in an Australian Biodiverse Reforestation Carbon Offsets (BRCO) program.

The BRCO project aims to link small patches of remnant vegetation and nature reserves in the Yarra Yarra Biodiversity Corridor by planting mixed native tree and shrub species on degraded ex-agricultural land.

But QMines’ efforts didn’t stop there. Since listing in May this year, the company has scaled up operations as well as its environment, social and governance (ESG) strategy.

Once QMines had a solid understanding of the emissions it was generating, the company engaged leading consultant Tetra Tech Coffey to undertake an environmental audit of its flagship Mount Chalmers copper project, northeast of Rockhampton in Queensland.

The company then implemented renewable energy generation, including a solar and battery back-up system, to establish an “off grid” site office and accommodation facilities, and installed an on-site wastewater treatment system.

The company has since installed an additional 6.6-kilowatt solar system and doubled the capacity of the on-site wastewater management system at Mt Chalmers.

On the governance front, the company has boosted its board independence to 66% with the appointment of Peter Caristo as an independent non-executive director.

QMines has also been proactive on the local procurement, employment and engagement front, implementing initiatives like sponsorship of the Junior Nerimbera Magpie’s Football Club in Rockhampton.

This article was developed in collaboration with QMines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.