QMines on the road to the ASX with $10m IPO

Pic: John W Banagan / Stone via Getty Images

Following a recent successful seed capital raising, Queensland’s next copper and gold developer has set its course for the ASX with the launch of a $10m+ IPO.

The company has 100 per cent ownership of four advanced copper-gold projects spanning 978sqkm which includes the historic Mt Chalmers copper-gold mine. It will be one of only a handful of listed copper companies on the ASX with a brownfield copper asset in a Tier 1 jurisdiction like Australia.

Mt Chalmers VMS deposit was mined sporadically between 1898 and 1982, producing 1.24 million tonnes at 2 per cent copper, 3.6 grams per tonne (g/t) gold and 19g/t silver. No mining has been undertaken since 1982, but there’s still plenty of exploration upside.

QMines has already delivered an initial JORC 2012-compliant Inferred Resource of 3.9 million tonnes at 1.15 per cent copper, 0.81g/t gold and 8.4g/t silver (which combined is 1.87 per cent copper equivalent). With a copper grade over 1.87 per cent, interest in the outcome of the company’s ambitious drill program to increase tonnage is likely to be high.

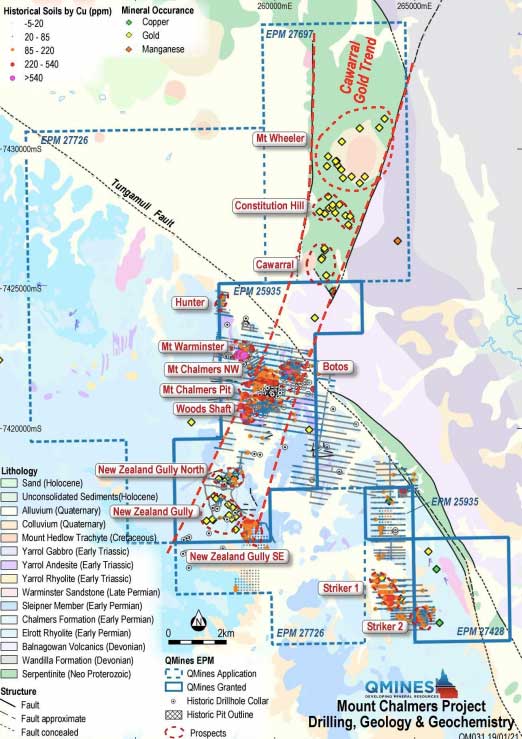

Since acquiring the projects, management has collated and digitised 48,786m of drilling data from 591 historic holes and 168,599 soil samples.

This has led the company to identify three exploration targets and 12 priority drill targets within the Mt Chalmers project area, demonstrating the growth potential. The three exploration targets are in very close proximity to the Mt Chalmers pit and with VMS ore bodies generally found in clusters, management is optimistic on finding more copper.

QMines says the mineralisation at Mt Chalmers is near-surface, relatively flat-lying and open in all directions.

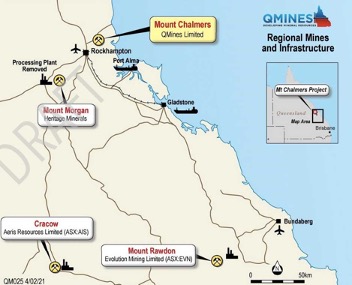

Mt Chalmers is located in the same region as significant mines including Heritage Minerals Mount Morgan’s historic mine, which produced 8 million oz of gold and 400,000 tonnes of copper, Aeris Resources’ (ASX:AIS) Cracow gold mine, which has produced 1.4 million oz of high-margin gold since 2004, and Evolution Mining’s (ASX:EVN) Mt Rawdon mine, which has produced nearly 2 million oz of gold since it started production in 2001.

Proven track record of delivering

QMines has an experienced management team that has already proven it knows how to deliver for shareholders.

Executive chairman Andrew Sparke has extensive experience managing ASX-listed resources companies, most recently with Alt Resources (ASX:ARS), which was acquired by a large private equity group in September last year.

Sparke, who was also a former chairman of Torian Resources (ASX:TNR), has assisted numerous ASX-listed companies with capital raisings and corporate transactions.

Meanwhile, managing director Daniel Lanskey, who has 20 years of experience in the resources, oil and gas and cannabis industries, was the founder of Austex Oil (ASX:AOK), which grew from start-up to generating $US30m in revenue, prior to leaving the company in 2015.

Mammoth drilling blitz

QMines has a big couple of years planned following its ASX debut. The cash raised from the IPO will be used to expand the resource and assess the development potential of Mt Chalmers.

The company has mapped out a large drilling program of 32,000m to 62,000m over the next two years and is expected to kick off the drill campaign immediately.

This article was developed in collaboration with QMines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.