QMines builds Queensland copper potential on multiple fronts

QMines is growing its resource base from multiple angles. Pic: Getty Images

- QMines returns more high-grade copper intercepts from Develin Creek

- Resource updates now planned for two deposits, Scorpion and Window

- Project expected to add mine life to nearby Mt Chalmers copper-gold operation

Special Report: QMines has logged another batch of high-grade copper intercepts as it looks toward a double Develin Creek resource update in the Sunshine State.

The latest QMines (ASX:QML) results were headlined by a 20m at 2.94% Cu, 0.42g/t Au, 20g/t Ag and 1.4% Zn strike from the Scorpion deposit.

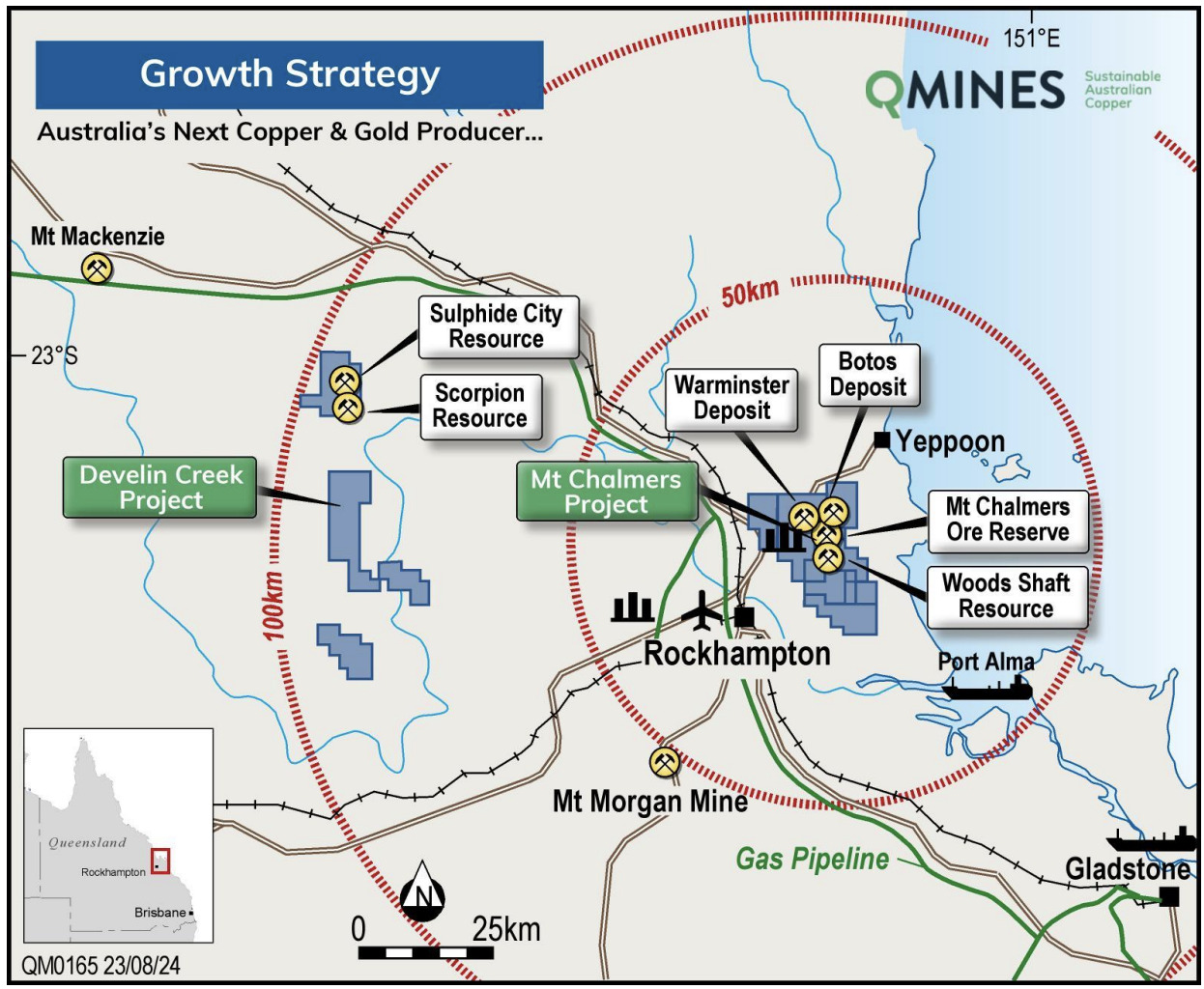

They come off the back of results which already validated a shallow, high-grade copper and zinc deposit with potential to add mine life to its proposed Mt Chalmers copper-gold operation, just 90km away.

A 43-hole, 5,043m maiden campaign over Develin Creek is now officially in the books, with more results due ahead of a planned resource update for two deposits.

“The program consistently intersected wide high-grade intersections at the Scorpion and Window deposits,” QMines executive chairman Andrew Sparke said.

“This is an excellent start to the new year which will be followed up shortly by further drilling results and an updated mineral resource estimate at each of these deposits.”

Significant new results from the Scorpion deposit encompass:

- 20m at 2.94% Cu, 0.42g/t Au, 20g/t Ag and 1.4% Zn from 46m; including 6m at 4.16% Cu from 57m

- 30m at 1.58% Cu, 0.45g/t Au, 23g/t Ag and 2.82% Zn from 61m; including 5m at 3.63% Cu from 68m

- 17m at 2.15% Cu, 0.42g/t Au, 20g/t Ag and 2.18% Zn from 102m; and

- 15m at 2.54% Cu, 0.45g/t Au, 18.3g/t Ag and 1.54% Zn from 83m; including 8m at 3.87% Cu from 86m.

Scaling up Mt Chalmers

QML acquired Develin Creek from Zenith Minerals (ASX:ZNC) with the objective of building scale for the company’s ambitions to become Australia’s next copper-gold producer.

Develin Creek currently holds a 3.2Mt at 1.61% CuEq resource, serving as a satellite to the main 11.3Mt at 0.75% Cu, 0.42g/t Au, 0.23% Zn and 4.6% Ag resource at Mt Chalmers.

That resource was the subject of an attractive pre-feasibility study, which outlined a decade-plus mine development with cashflow of $636m to power a respective NPV and IRR of $373m and 54%.

Develin Creek could enhance those numbers from several volcanic hosted massive sulphide deposits, but broad hydrothermal alteration now identified beneath Window offers QML the excitement of a potential new deposit style with significant upside.

Plan of attack

With the full acquisition of Develin Creek now complete, QMines sees several more historical base metal and gold intercepts at depth around its deposits as demanding a taste of the drill.

But those will likely have to wait through a busy period for the company, which is looking to add value with more drill results, updated resources, geotechnical and metallurgical diamond drilling, and an updated open pit optimisation and mine design in the first quarter of 2025.

Those works will be followed by regional mapping and ranking of priority regional targets ahead of RC drilling at the flagship Mt Chalmers project in Q2 as QML attempts to bridge the gap from exploration to production.

This article was developed in collaboration with QMines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.