Q+A: Yandal Resources’ Lorry Hughes on being a small cap goldie ‘with a mid-tier miners’ budget’

iStock / Getty Images Plus

‘Drill hard’ has been the approach of busy WA gold explorer Yandal Resources (ASX:YRL) since it listed on the ASX about three years ago. With a backing of a very tightly held and supportive register, YRL is drilling 100,000m for 2021 in the hunt for WA’s next big gold discovery.

That’s right – 100,000m. Next year will be more of the same, it says.

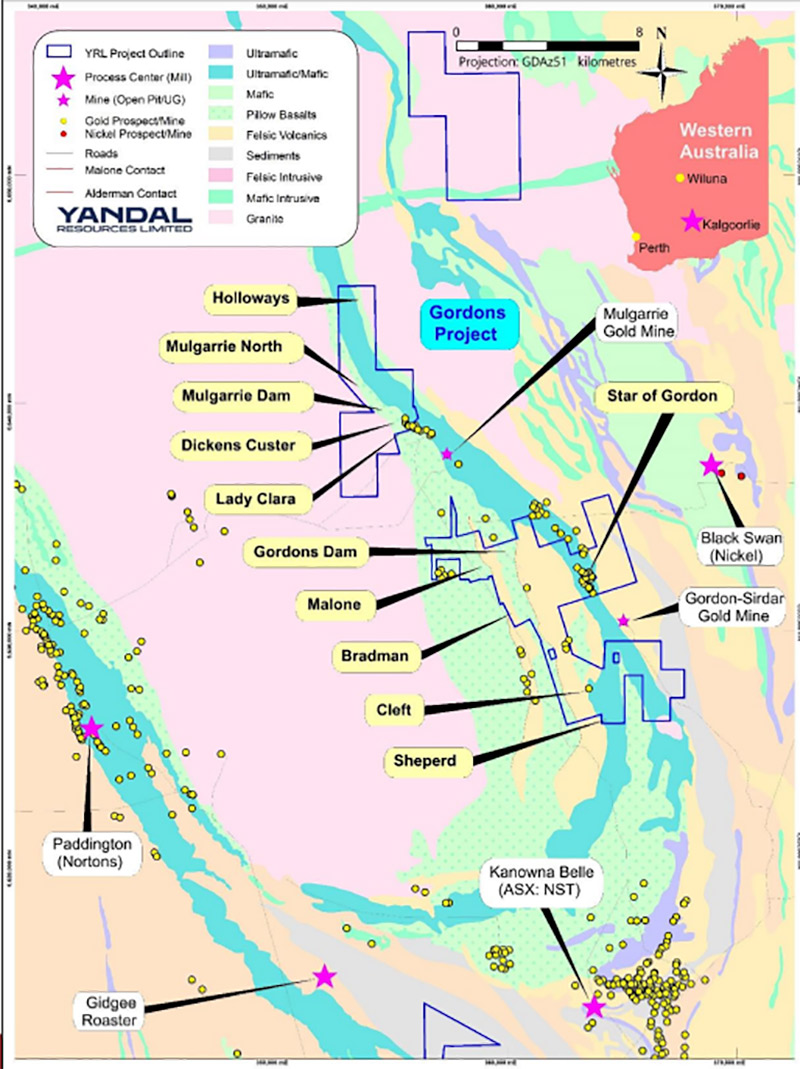

The current focus are the ‘Gordons Dam’, ‘Malone’ and ‘Star of Gordon’ prospects, part of the Gordon’s gold project near Kalgoorlie. Malone and Star of Gordon are fresh discoveries, made only this year. Mineralisation remains open in all directions.

Recently, DGO Gold (ASX:DGO) – known for making substantial investments in De Grey Mining (ASX:DEG) before it hit the motherlode at Hemi – increased its stake in YRL from 14.26% to 19.9%.

Stockhead caught up with YRL managing director Lorry Hughes at Vertical Events’ recent South-West Connect Investment Showcase to talk about being “a small company with a mid-tier miners’ budget”.

You have DGO on the register, which has a history of picking winners.

“DGO bought half [Northern Star’s (ASX:NST)] stake, to increase their stake to ~20%,” Hughes says.

“The other half of Northern Star’s stake was purchased by Regal Funds. Now we have financially based investors who want to see returns on the share price.

“DGO invested in De Grey, which has been highly successful. Then they had an investment in NTM Gold which got taken over by Dacian Gold (ASX:DCN). Now DGO is a major investor in Dacian Gold.

“We are one of their other investments – Yandal, a fledgling explorer.

“Our focus hasn’t changed. We haven’t been buying new projects, we are happy with the projects we have, and so are our investors. They invest in us for our projects.

“They know the ground that we are operating in very well. They see that it is unloved, and it is brownfields.

“Think about where the next gold discovery is coming from. Sure, it might come from the boonies [greenfields] but that is risky; less risky is right next door to well-known deposits [brownfields].

“That where we are with our Kalgoorlie and our Yandal projects.”

Which of the projects/prospects are you most excited about in terms of potential scale?

“It is a little bit early, because they all meet our criteria for million-ounce plus deposits,” Hughes says.

How much gold do you have in resources at the moment?

“We only have a JORC resource at one prospect, which is Flushing Meadows at 260,000oz, predominantly oxide,” Hughes says.

“We are working through mining approvals there in the background.

“We are of the view that we can start the mining approvals process, but the main focus is to find more ounces. We aren’t interested in 250,000oz — we want 2.5Moz in one spot.”

So, mining the smallish resources isn’t a focus?

“We believe that defining ounces, making discoveries is going to be much better for us than talking about mining. We are still getting the mining ready because that takes time, with the approvals and so forth,” Hughes says.

“The primary focus for us is discovery.

“If we find one of the deposits is a bit small, we’ve given it a good crack and it is only 200,000oz, we can look to monetise it.

“Maybe do a production joint venture, where we can potentially self-fund further exploration for something bigger.”

Do you think you are on a multi-million-ounce deposit at Gordons? You are pulling up some impressive intersections.

“We took the decision at the Gordons project to go hard,” Hughes says.

“Four rigs turning, to find out sooner rather than later if we have a multi-million-ounce potential here.

“We have done a lot of drilling and are waiting on a lot of results.

“With gold, you do have to do a lot of drilling to know what you have. Particularly in the complex porphyry hosted system, such as the 10Moz Kanowna Belle, which is an example of the kind of deposit we want to find.

“The resource there extends to 2km depth.

“Right now, we are just scratching the surface of a porphyry system [at Gordons Dam]. It’s relatively still early days.

“We are also onto something brand new only 3km away, Star of Gordon, which is a different system again. At Star of Gordon there are a lot of historic shafts around the area from the early 1900s. Only superficial prospecting activity around that though, nothing major.

“It is mind-boggling that it hasn’t been well drilled. It is 2km directly along strike from an existing mine.

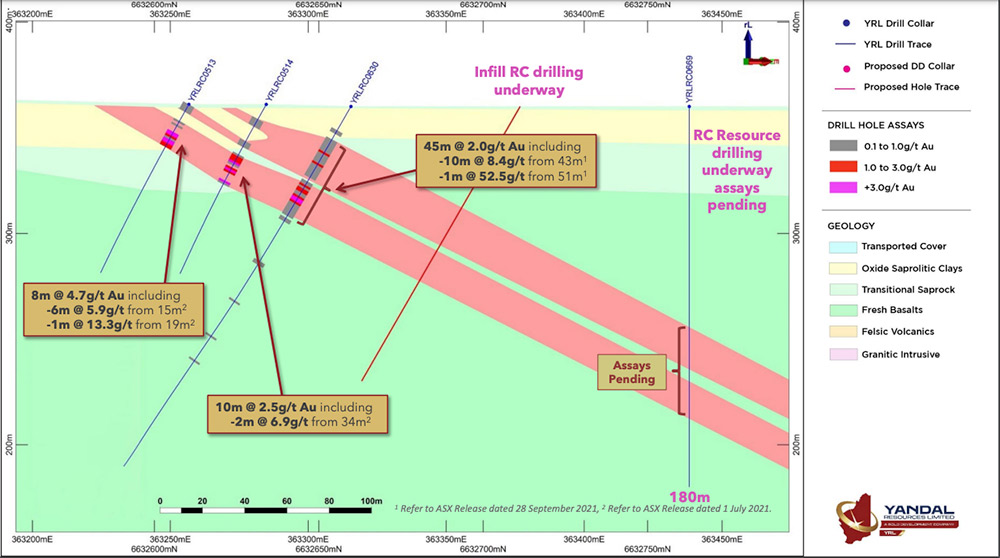

“We recently announced a brand-new intercept of 45m at 2g/t – including 10m at 8.4g/t — from 43m down in bedrock. That’s really exciting.

“I don’t think the market really picked up on the significance of that, those intercepts that we pulled out with very limited drilling so far.

“That 10m at 8g/t automatically looks like a mineable intercept.

“And then we’ve said, ‘right let’s step out’, so we could get some understanding of the potential size of this thing for future targeting. That’s hole YRLRC0669:

“We are waiting on that one [to come back from the lab].

“If that comes in at something like the original hole, then suddenly you have mineralisation 250m down dip which could seriously add some ounces.

“The drill rig is just tidying up a small resource area around Gordons Dam, and then it is going back up to pump more holes into Star of Gordon.”

How many explorers are drilling 100,000m a year?

“Probably only the mid-tier. I’ve said to a few other people that we are a small company with a mid-tier miners’ budget and desire to drill,” Hughes says.

“We are brownfields, so imagine if someone like Ramelius Resources (ASX:RMS) had our ground — what would they be doing? They would be drilling the bejesus out of it.

“Our drilling is continuous. It might stop a bit over Christmas, but it is essentially continuous drilling, continuous news flow.”

It must be nice to have the cash to do that sort of thing. A lot of small caps don’t.

“And importantly the backing. Shareholder are telling us ‘Yep, we want ounces.’ And the only way to find ounces is to drill,” Hughes says.

“You can’t be sitting on your hands. We are not that company. If you look back through three years of announcements, we have been flooding investors with news, and most of it is drilling.

“We will keep going until we really find something special – and then anything can happen with the share price.

What will something special look like to you?

“It will be whole bunch of drilling hits that people will automatically see ‘+1Moz discovery’,” Hughes says.

“You know those hits, you read them in the news – headline hits at like 20m at 10g/t. You just know it is going to be a mine.”

Where do you want to be after this year’s drilling program?

“We will have good idea of what we are dealing with,” Hughes says.

“This year we have made two genuine discoveries we did not know about the year before – the whole Malone contact where we have bedrock hits at 20g/t, and Star of Gordon.

“100,000m of drilling sounds like a lot, but we are talking about finding multiple deposits and growing multiple resources.

“My view is that next year we will be backing it up. We want to do another 100,000m of drilling to build on the discoveries that we have already made.”

To summarise – why should investors take a closer look at the company?

“We are very active, and we have very prospective projects,” Hughes says.

“Importantly, they are all brownfields. We are not a grassroots explorer taking huge risks out in the boonies. We are in proven gold areas, close to existing mines and infrastructure.

“We think our chances of discovery are much higher.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.