Q+A: With Rio literally knocking the door down, here’s CZR’s Stefan Murphy on why they can go it alone

CZR managing director Stefan Murphy.

Resurgent Mark Creasy-controlled iron ore play CZR Resources (ASX:CZR) is at an exciting juncture.

Its flagship ‘Robe Mesa’ project sits in the shadow of the Rio Tinto-led 30Mtpa Robe Valley mining joint venture, stoking speculation that it may be a takeover target for the mining behemoth.

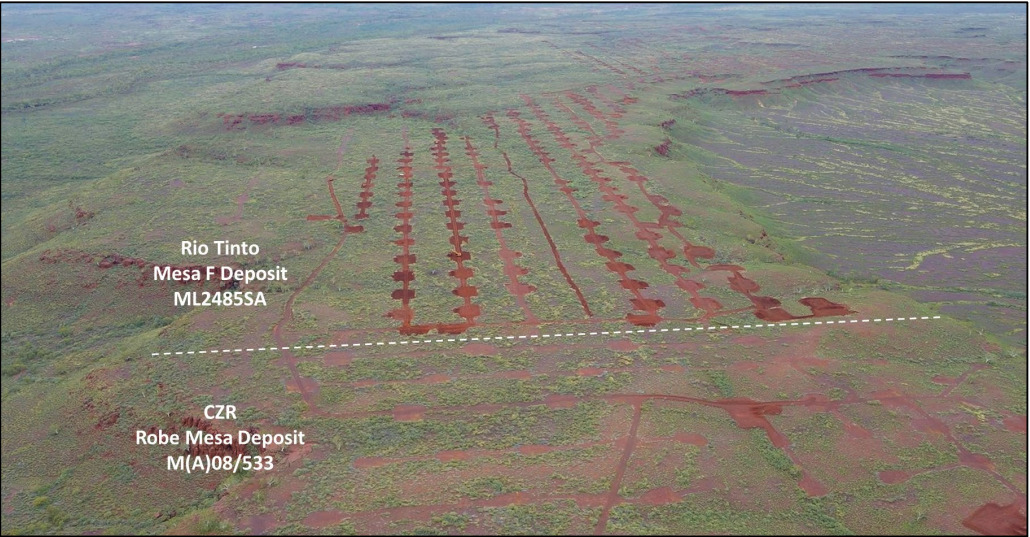

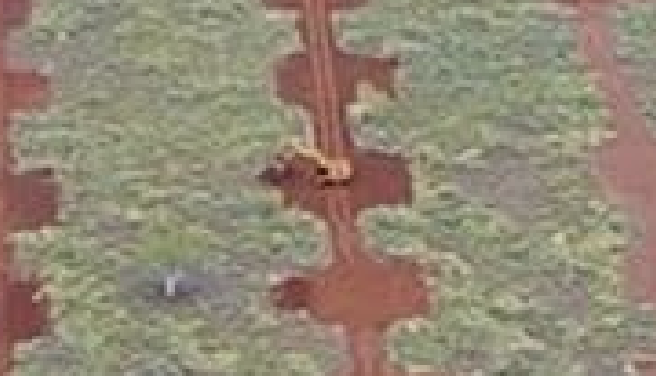

Adding fuel to the fire is a current drilling program by the JV, which has gone right up to the project boundary.

Literally.

The JV are spending billions developing their side of the Mesa, with 11 rigs currently spinning.

But CZR doesn’t need a takeover offer, it says. Led by iron ore veteran Stefan Murphy, the company has the chops to progress this project to production on its own.

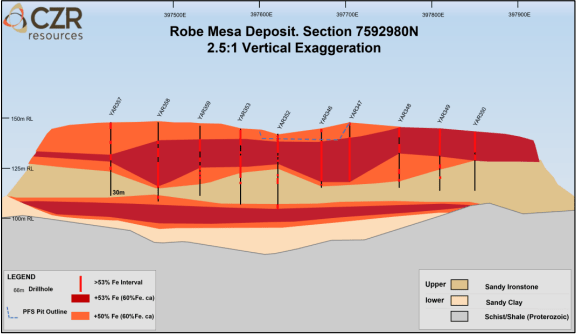

CZR’s current focus is drilling to grow and increase confidence in the 37.5Mt at 56% Fe (62.6% Fe calcined, 55% Fe cut-off grade) Robe Mesa resource to allow for a bigger, longer life 3Mtpa operation.

Murphy chats with Stockhead about Rio, the upcoming feasibility study, and the importance of building an iron ore mine that can operate through the price cycle.

That image is excellent. Rio are drilling less than 50m from the boundary?

“It’s probably within about 20m, if that. Maybe 10m?” Murphy says.

“Rio, Nippon and Mitsui have pumped $1.7 billion into the Robe Valley JV, and they have developed up a couple more deposits.

“But one of the things they are chasing is ore that sits above the water table. That is what has been giving them problems, from all accounts.

“Our whole deposit is within 60m of surface, and all the ore is above the water table.

“For a long time, they didn’t pay much attention to ‘Mesa F’, right next door to us. It was sitting out the back, most distant in their mine plan.

“But now they have something like 11 rigs out there doing reserve drilling, 50 x 50 or 40 x 40.

“That’s very, very tight.”

What do you think Rio’s plans are if they are doing reserve drilling right up to your boundary?

“Complete speculation of course, but my gut feel is that they don’t know what they have on the boundary. It has most likely historically been a lot further out in their production plans,” Murphy says.

“They have huge deposits, and haven’t really needed to worry about it, but certainly the results we have been getting near Mesa F are representative of the high-quality iron ore that they sell.

“That has potentially changed their views on things, and that’s why it appears they are out there doing a heap of work.

“They are spending a lot of money on Mesa F.”

So, a takeover or project buyout is a real possibility, but you are quite happy progressing this project on your own?

“Definitely. The feasibility study is coming along very nicely,” Murphy says.

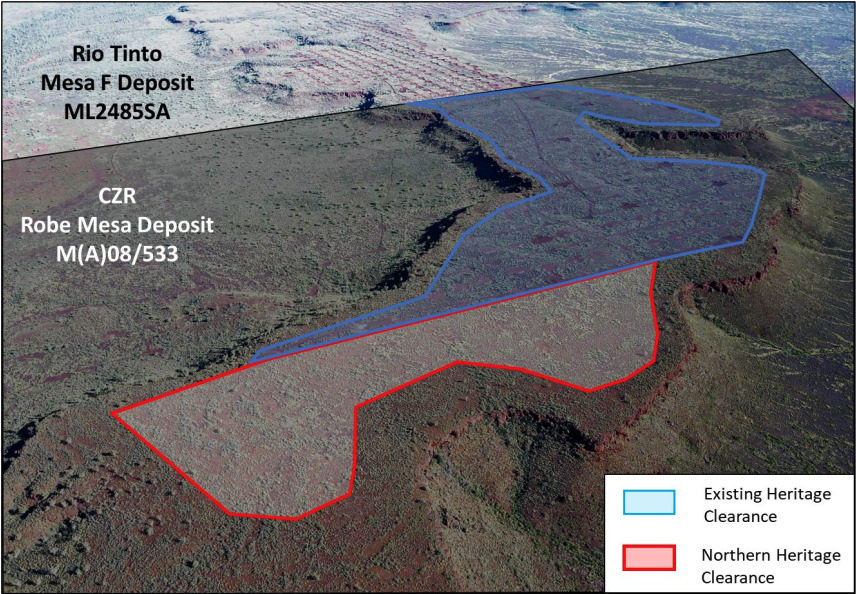

“[Last week] we announced that we have an extension to the north of the deposit that will add another 10-15% to the project as well.

“We want to take this to a +7-year mine life proposition at 3Mtpa. That’s what our focus is on.”

You’ve have had a fair bit of experience in iron ore and building mines. What makes this project stand out?

“[The deposit] is super shallow, and simple to mine,” Murphy says.

“The first 15m-20m is pure ore so when we look at scheduling, for the first few years there is almost no waste to mine.

“We have a low operating cost model to get it to market.

“The other beautiful thing is that the product itself has been sold by Rio from Robe Valley for decades.

“In my previous role we had to create a new market for our product, and we had to go through all that work with steel mills and the like.

“Here, we are effectively a substitute for what Rio are already selling.

“We are still doing all the detailed testwork but you know that the customers will accept it at the end of the day.”

When is the DFS coming out?

“We are hoping for the end of this year,” Murphy says.

How will the DFS improve on the 2021 PFS?

[Miners undertake up to four different types of studies to determine whether a resource can be mined economically. These are – in order of detail — scoping, preliminary feasibility (PFS), definitive feasibility (DFS)/bankable feasibility (BFS).]

“The key areas will be driving down that opex [operational expenditure] significantly by looking at closer port options, and by increasing the production rate from 2Mtpa to 3Mtpa,” Murphy says.

“And then having a significant, material increase to our 8Mt reserve base, so increasing the mine life as well.

“The PFS only looked at this upper ore unit, whereas we are now also looking the lower ore unit, which is still only 60m below surface.”

What is the market price like for your 56% fines?

“It calcines to 62.5%, so it has really low contaminates,” Murphy says.

“It is basically the same stuff that Rio sells, which trades in the market at about a 20% discount to the 62% benchmark price.

“At the moment the discount is only 13%, but it has been higher, so we are using a mid-point of a 20% discount.

“That’s what it averages over the last 5+ years.”

Famous prospector Mark Creasy dominates the CZR register (55% ownership). His investments have been paying off big time lately — is that a tick of approval for you guys?

“I hope so. The share price has doubled over the past six months, so we have been doing OK. It was higher but like everyone else we have been getting sold off,” Murphy says.

“Mark has had a lot of very good quality assets for a long time, which are starting to get pushed by very specific management teams through discovery and development.

“We have been seeing that for the last decade, really.”

Besides the DFS what major milestones have you got coming up?

“The big one for us is going to be the updated resource/reserve. I think we are trading at about $5 per tonne of reserve,” Murphy says.

“By increasing those reserves substantially, we hopefully see a rerate.

“That will be coming out over the next couple of months.”

You obviously want to be a producer that can operate through the cycle. Are you confident you have a project that can do that?

“Definitely. Everything we are working on is designed to drive down that FOB opex down to low $50s Aussie a tonne,” Murphy says.

“At that level it rides the cycles.

“At that level we believe we can weather those dips, but we can also make a great return when times are good.”

To summarise – why should investors take a closer look at CZR?

“In the next six months the company and the project are going to look vastly different to what they look like today,” Murphy says.

“The project is getting bigger and better, and there are strategic players in the area with an interest in our patch of dirt.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.