Q+A: Why it’s the perfect time for Marmota to return to its uranium roots

Pic via Getty Images/ Stockhead

The nuclear renaissance is shining ever brighter as spot prices touch US$80/lb.

For uranium explorers like Marmota (ASX:MEU), the prolonged downturn following the Fukushima incident necessitated a shift to commodities like gold, which led to the Aurora Tank discovery in South Australia’s Gawler Craton.

Aurora Tank is a prize in its own right, with extensional drilling yielding multiple close to surface super high-grade intercepts over 100g/t.

MEU believes the deposit lends itself to simple low-cost, low capex, open pit heap-leach mining – great news in a time of record gold prices.

However, it has been uranium’s comeback that is recently rejuvenating the explorer.

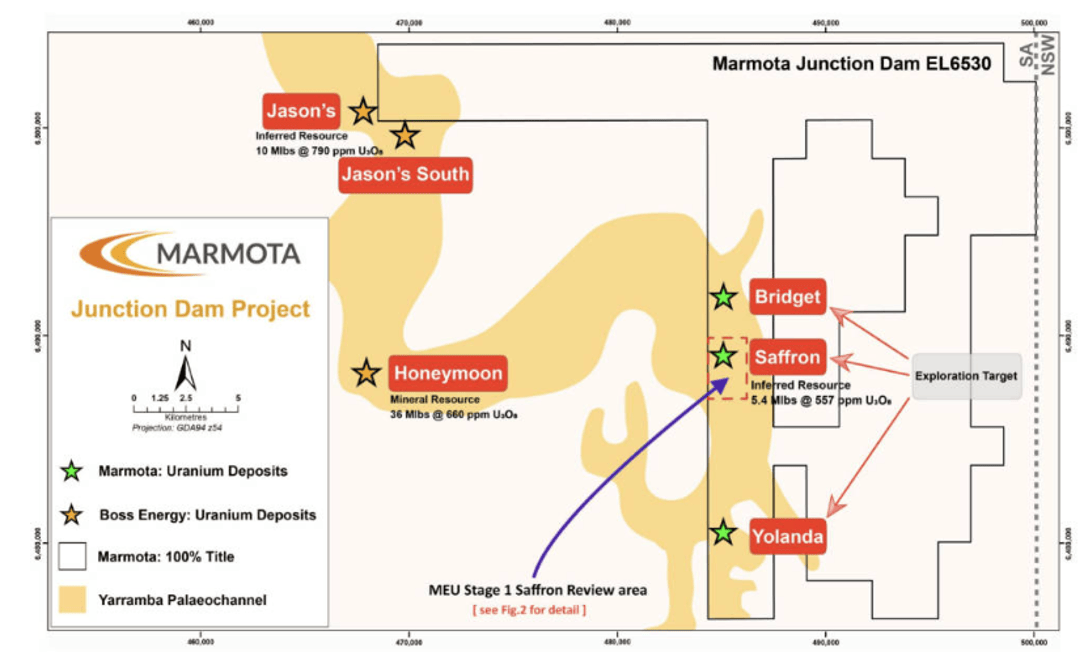

The company is restarting its Junction Dam uranium project which already has a 5.4Mlbs (U308) JORC resource at 557ppm, in the premier uranium jurisdiction of South Australia.

MEU’s goal is to first grow the uranium resource at the existing Junction Dam resource area (called Saffron), and then expand it further by bringing in the Bridget and Yolanda prospects, which have not been included in the project’s resource.

Along with the Saffron deposit, these prospects have an existing exploration target of between 22Mlbs and 33Mlbs U3O8 at a grade range of 400-700ppmm, which is similar to Boss Energy’s (ASX:BOE) Honeymoon uranium mine, only 18km to the west.

Honeymoon, one of just four permitted uranium mines in Australia, has commenced mining operations with first production expected this quarter.

Stockhead sat down with Marmota’s head of exploration Aaron Brown, executive chairman Colin Rose and engaged uranium expert Mark Couzens to get the lowdown on Junction Dam.

How did you come across the project?

“The same paleochannel [hosting] Boss’ Honeymoon starts off by first flowing through the Junction Dam tenement, so the potential of Junction Dam was always clear,” executive chairman Colin Rose says.

“Marmota owned another tenement slightly to the east but soon realised that the real prize was on the Junction Dam tenement (which we did not own) and was at the time owned by the huge multinational Teck, together with two smaller parties.

“We then entered into a JV with Teck (and the other two owners) which led to Marmota earning 100% of the uranium rights to Junction Dam.”

What influenced your decision to move to acquire the tenement in 2021?

“The decision to secure 100% ownership of the tenement in 2021 was really all about giving us the flexibility to make decisions ourselves, to move rapidly, and to be masters of our own destiny in the uranium space,” Rose says.

“Prior to acquiring ownership of the tenement, Marmota owned 100% of the uranium rights but the tenement was owned by a consortium of three companies.

“It’s like the difference between owning a house and wanting to make it bigger … versus renting an apartment (and wanting to do the same thing).

“As an owner, everything is easier and faster, and does not require getting three signatures from three different parties anymore… it was a very important change for us.”

In what ways is your Junction Dam uranium project analogous to Boss’ adjacent Honeymoon uranium mine?

“The geology at Junction Dam and at the Honeymoon Uranium mine are very similar,” head of exploration Aaron Brown says.

“Both are located within the same Yarramba Paleochannel.

“The resource grades are similar, the depth of mineralisation is similar and the uranium mineralisation is found primarily within the Eyre Formation at both projects.”

What other benefits does the proximity to the Honeymoon mine provide?

“From a regulatory point of view, approvals already exist in the area and there are no known issues,” Rose says.

“The potential for substantial resource growth next to one of the four permitted uranium mines in Australia provides a significant advantage looking down the road towards production.

“According to their own feasibility studies, Boss themselves need a larger resource to achieve economies of scale to lower cost of production and to extend mine life through development of satellite resources.

“In fact, they just started drilling a few days ago at Jasons (right next door to Marmota’s Junction Dam tenement).

“It also provides us with optionality.

“With Honeymoon already having processing facilities established for uranium mining, there is the added optionality that uranium mined at Junction Dam could be connected by a trunkline to Honeymoon, which would dramatically reduce capex and upfront processing costs.

“Alternatively, depending on how large Junction Dam grows, Junction Dam could develop into a local hub of uranium mines, which has its own benefits of shared knowledge and expertise, particularly when somebody else has already had to work out how to optimise the production process,” he says.

“That’s a huge advantage.”

You’ve got a uranium resource outlined at the project already. What are your immediate next steps and what do you intend to achieve in 2024?

“Marmota contracted uranium specialist Mark Couzens to assist in reviewing all the available drilling data as well as creating a revised stratigraphic model for the mineralisation at Junction Dam with the aim to substantially grow the uranium resource at Saffron,” Rose says.

“This work has already led to the identification of four new exploration targets at the Saffron uranium deposit with the aim for drill testing in early 2024.

“Mark has also started reviewing the Bridget and Yolanda prospects which currently form part of the substantially larger exploration target, and our intention is to substantially grow the resource model by building them into the model, with additional growth zones and new drill targets.”

Has the turning point finally come for uranium stocks?

“Sentiment across uranium explorers worldwide at the moment is the most positive it has been in the last 10 years,” uranium expert Couzens says.

“The uranium spot price continues to grow and the worldwide demand for uranium appears to be under-supplied indicating that more uranium mines will be needed to meet the needs of the world.”

“There are two other factors I would add to that,” Rose says.

“The first is that uranium is now perceived as green, as a path to clean energy, and as a saviour from the potentially catastrophic problems of global warming and climate change.

“That is very, very different from just 10 years ago. And those climate problems are not going away.

“Second, the uranium market is very different from other minerals such as lithium.

“It is much more difficult for supply in the uranium sector to respond quickly to increasing demand (particularly with regulatory/licensing issues), so when demand increases (which has been forecast for years and is happening now), it appears likely to be here to stay.”

Marmota’s share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.