Q+A: We need more zinc. Rumble Resources’ Earaheedy project could boast supergiant potential

Could Rumble's Earaheedy become a zinc supergiant? Pic: Grandeduc/iStock

- Four of the world’s 10 biggest zinc producers have less than a decade of mine life

- Used in wind turbines and solar panels, mined supply of zinc is short as the energy transition progresses

- Shane Sikora from Rumble Resources believes its Earaheedy discovery in WA can grow into a supergiant deposit after this month’s maiden resource

After more than a year of warfare, inflation, rate rises, bank collapses and commodity price volatility, 2021 seems so long ago.

It was also the last year when Australia’s mining sector saw major greenfields discoveries, as capital flooded into the industry as cash ran hot in the stimulus-heady early days of the Covid recovery.

One of those discoveries was made north of Wiluna in central WA’s Earaheedy Basin, where junior explorer Rumble Resources (ASX:RTR) went prospecting in search of a zinc and lead find that had eluded explorers for decades.

In April, 2021, the explorer hit the mark, announcing a major discovry of 34m at 4.22% zinc and lead from just 66m deep at the Chinook prospect.

The initial reaction bore similarities to the excitement around other, larger finds of the era like De Grey’s (ASX:DEG) Hemi gold discovery and Chalice Mining’s (ASX:CHN) Gonneville nickel and PGE find a year earlier.

Rumble shares surged in days to 74c and the junior raised $40 million to bankroll a major expansion in exploration at the project, the bulk of which is owned in a 75-25 JV with Zenith Minerals (ASX:ZNC).

It even sparked a run on ground and exploration in the vicinity, with additional discoveries at Tonka and Navajoh, and nearby finds by companies like neighbouring Strickland Metals (ASX:STK), which hit zinc and lead mineralisation at its Iroquois prospect.

Despite continued exploration success at the Mississippi Valley Type project heat came out of the market and RTR shares have trended down by almost 42% over the past 12 months amid a weakening outlook for the global economy and by proxy base metals like zinc and lead.

But, with a weakening supply profile in the coming years and massive uplift in demand from the battery and renewable sectors, zinc remains a hot commodity.

Despite its status as one of the few metals where recycled material fills a large chunk of demand, the International Zinc Association still says mined supply will need to rise from 12Mt in 2020 to 17-22Mt by 2050.

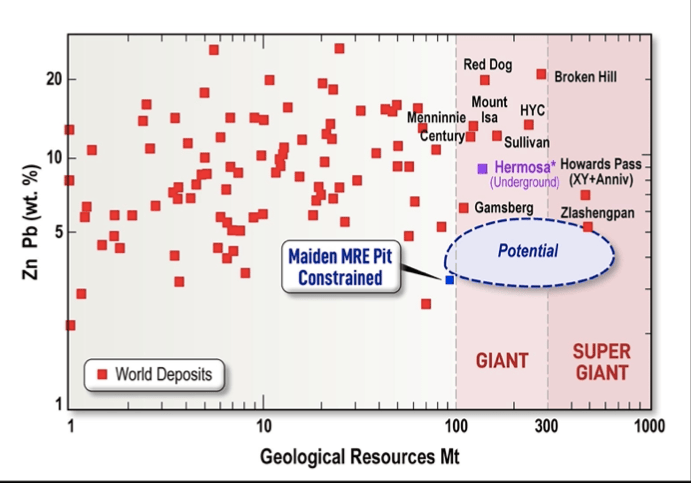

This month’s delivery of the maiden inferred Earaheedy resource shone a spotlight back on the $130m capped Rumble, with the inventory of 94Mt at 3.1% Zn+Pb and 4.1g/t silver for 2.2Mt zinc, 600,000t lead and 12.6Moz silver announcing it as the owner of one of the largest shallow zinc sulphide discoveries globally in a decade.

With less than 35% of a 45km long shallow and flat-lying unit tested by drilling, Rumble remains confident it can continue to grow the resource and lift it to giant and supergiant status.

We spoke to Rumble MD Shane Sikora about the future for zinc, the poor outlook for the world’s biggest producers and Rumble’s capacity to expand what could grow into a world class resource.

After two years of drilling and the heat coming out of the company a little bit from that phase when you made the initial discovery, what has the reception been like so far since you released the resource?

“I think it’s been a phenomenal response, to be honest, I think people will recognise it is one of the largest undeveloped zinc deposits globally and I think the markets weren’t kind to anyone in the last nine to 10 months, really, for a number of factors. I feel like this is a great line in the sand moment to give this project really good intrinsic value and you can start to see what this thing can be worth.

“There’s never been a better time to find zinc. It’s gonna be critical to that renewable energy push moving forward, because they play a key role in wind farms and solar panels. And right now if you look at the forecast for zinc, there’s a massive deficit coming in the next 10-20 years, with four of the 10 major producers running out of ore in the next 10 years.

“You factor in climate change scenarios – the world’s crying out for zinc mines and deposits. And it’s difficult to find there’s not many around. The last one of this sort of scale was the Hermosa deposit, which was bought by S32 for $2 billion Australian only sort of four years ago.

“We’re sitting now at about 140-150 mil market cap and we think there’s significant potential to grow our share price and market cap based on this resource, but we’re really just at the tip of the iceberg.

“We’ve only really tested 35% of our strike, which hosted mineralisation, all the resources are open in all directions. And we’ve also got the potential to find high grade underground below our mineralised envelope. It’s a pretty incredible start.”

If we just look at the comparison from yourselves at Earaheedy to some of the other deposits around. You’re pushing on that 100 million tonne mark but the grade is quite a bit lower than mines, like Hermosa, Mt Isa, Broken Hill. Is there an opportunity to increase the grade of that material?

“I think you’ve got to note though, a lot of those are underground. So when you have an underground mining scenario, you have much higher mining costs.

“92% of zinc mines are underground globally. Only 8% are open pit which have a much lower mining cost scenario. If you can imagine an underground, you’re going to have limitations to the size of your machinery and you also have to get that ore to the surface.

“When you’re talking open pit, your mining costs are significantly lower and you’ve got a lot of optionality because you can use big mining equipment. So that’s the difference.

“So if you think about 94 million tonnes at 3.1% zinc-lead, it is equivalent to a 94 million tonne 1% copper deposit (in an) open pit. Typically, a lot of mines in the copper space that are mined as an open pit are going 0.4-0.5% copper.

“And when you also look at our resource, there is a smaller tonnage, higher grade portion of that as well, which gives you the potential to mine that higher grade potentially earlier on to pay back the capex.

“We’ve also got a much larger volume of metal — that’s 460 million tonnes — which could potentially be beneficiated.

“So you talk about elevating grades, we would look to do potentially DMS or ore sorting, which is a cheap effective way of sorting the waste to the ore.

“Some of the examples we’ve given in the presentation around the style of mineralisation, these MVTs typically work very well with beneficiation and you’re seeing upgrades of head grade from four times to eight times and you’re rejecting up to 80% of the waste.

“What that means is if you had one and a half per cent (zinc-lead) and you’ve got four times upgrade, all of a sudden you’re talking … about five or 6%.”

The style of deposit and I guess the discovery itself is something that doesn’t seem to be that common in this part of the world. What was it that tipped Rumble off to the zinc and lead potential in the Earaheedy Basin?

“Our head of technical Brett Keilor — twice Prospector of the Year, one for Tropicana and one for Plutonic — he’s had seven deposits that have turned into mines and a whole series of other discoveries.

“He’s one of the best discoverers globally, we believe. And one of the things he looks at is for projects that have significant metal content, which could mean a large system.

“So when we first reviewed the Earaheedy project, there was about 30km of mineralisation, very sporadic. And historically, a lot of the drilling that we reviewed only sort of hit 1m into any of those mineralisation zones.

“They didn’t push through to understand what was actually there. They had difficulties with drilling. Having that big metal budget there, suggested to Brett that there could be a big system, and then it was all about then trying to analytically or systematically explore the region to see what would be uncovered.

“We spent about three-four months trying to understand how to get the drilling right, we eventually perfected the method. We noticed that the mineralisation was flatlying in the middle of the project, and Brett suggested if we could follow that mineralisation to near surface, we could have open pitable depth discoveries, and that’s exactly what happened.

“I’ll say one thing too, zinc doesn’t conduct. You couldn’t do ground EM looking for conductors. And above the mineralisation there’s no method to soil sample either. So it was a blind deposit that just needed some good geological targeting work and it had to be the drill bit to find it.”

I guess that points to one of the reasons why it’s so hard to actually make new zinc discoveries and why so many of the existing producers are running short.

“That was part of the point of showcasing those deposits in the presentation. There’s not many of them, really, because they are hard to find.

“People were looking in this space, because the basins globally is where you target the large scale sedexes or MVTs. That’s why they were out there looking for it 30 years ago or so. But fortuitously Brett used his technical capabilities to make that discovery.”

Along that note, we’ve seen Graham Kerr from South 32 — he’s really pointed out how significant he thinks zinc is to the renewable future and the energy transition. Is that something that you think is not well understood at the moment by the market?

“I think there’s a lot of focus on your battery metals. But you know, you’re seeing globally, a lot of countries and continents are actually wanting to focus on renewable energy.

“And I guess the key thing is to say that the galvanising of these wind farms and solar panels are important for longevity of those renewable energy sources. It’s not great if you actually go and build all these big wind farms and solar panels, and you have to keep replacing them every three to four years. It’s not very environmentally friendly.

“So there’s a massive requirement for that, globally and as you said, S32 and Teck and other groups that are in the zinc space are really excited about that.”

You’ve got the 25% holding in the project there with Zenith Minerals. Are there any plans to consolidate them or buy them out as you start the scoping study and potentially seek a project partner out?

“I just think we’ve got good joint venture partners at the moment. There’s nothing really to say more than that at this point in time.

“We’ve got a very big land package that is contiguous to the joint venture ground, which is 100% owned by Rumble. And already 20% of the resources are on those tenements.

“What we will be focused on is we’ve targeted the Navajoh South East trend, which is 9km of strike to the south of the joint venture, which we believe we can see the these feeders in gravity lows. That will be a focus for us, to grow the resources into the new 100% ground.”

Is it yourselves or someone else who has hits at Iroquois?

“So what we’ve got is you’ve got the mineralisation coming up from depth, it’s passing through these feeders.

“It goes through the Iroquois covenant member. Then there’s the purple shale and the Navajoh unconformity is nearer the surface.

“Above that’s the iron oxide sequence. So when you’re near those feeders, you’re getting big widths of mineralisation at a much higher grade. And as it gets further away they decrease but we’ve got a whole series of these feeders and they join up like a coal seam.

“So what Strickland (Strickland Metals) did is drill down into the Iroquois, which is two units below ours and hit significant mineralisation. So what that says is that that horizon is fertile as well.

“We haven’t even started to test that below our mineralisation where we are. But, if you can imagine, the geological units get deeper to the east and they’re shallow to the west. That Iroquois unit daylights out onto the our western block, and that caters for about 85% of our project area.

“There has always been historic drillholes to suggest that we could have near surface Iroquois deposits there as well. Not just on those historic hits, but if you factor in Strickland’s drilling it showcases there’s a big possibility there as well.”

You’ve got the scoping studies commencing this year. How much are you spending on drilling and how much drilling do you have planned in 2023, and when do you expect to have some of those studies coming out?

“I don’t have a figure. We haven’t announced to the market yet in regards to the metres or the spend but it will be a significant campaign, one, targeting those new feeders structures.

“I should say… it’s been difficult to locate the mineralisation. Late last year, we started applying other geophysical methods, so we’ve applied magnetics and passive seismic, which didn’t work very well.

“But what we did see and I think I mentioned before, above the mineralisation, if you soil sample there, the mineralisation doesn’t come to surface because of the iron oxide sequence. But where it potentially daylights to the west, it does show a good signature of mineralisation in the up dip position.

“So what it says to us is, if you get a certain tenor in the soil sample it suggests that the mineralisation down at depth could be significant. And that’s proven to be the case at Tonka and Navajoh.

“We then flew airborne gravity and the gravity lows are showcasing where those feeders sit perfectly. So our template is, if you’ve got good soils on the up dip position, and you’ve got gravity lows, there’s a good chance you’re going to have feeders.

“We’ve done that work at the Navajoh South East trend, and we found what looks like another nine feeders, and that whole section has never been drill tested. So that’ll be a big focus of our drilling early on, where we think we can make new discoveries.

“Also to the west of Chinook we’ve got another 12km called the Sweetwater trend, which has potential for a whole series of new discoveries. The drilling will also focus on expanding known resources because it’s open in all directions as well.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.