Q+A: Toubani’s Mark Strizek on building West Africa’s next 150-200,000ozpa gold mine

Pic: Via Getty

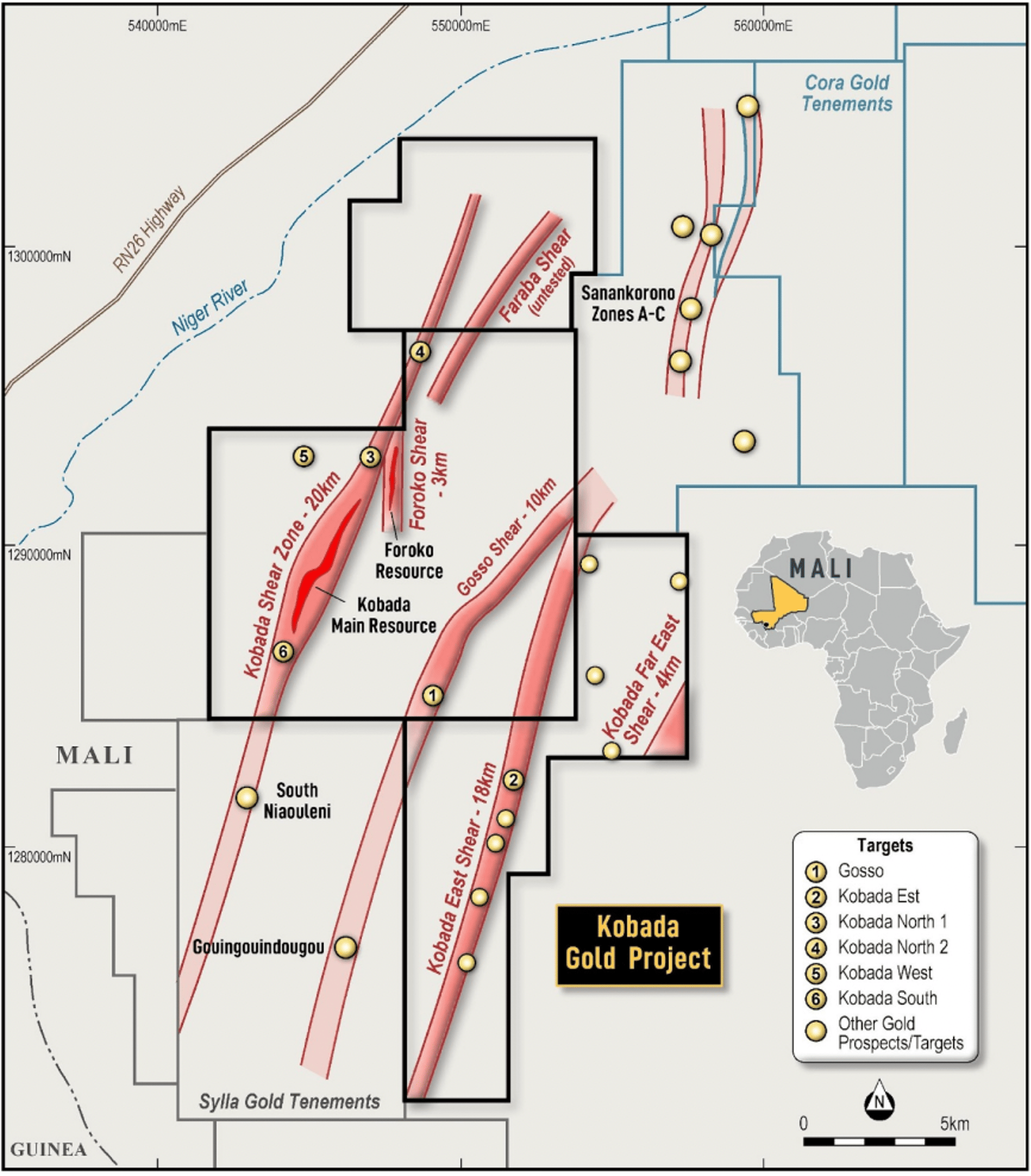

Canadian explorer Toubani Resources (ASX:TRE) jumped ship to the ASX late November last year with the advanced 3.1Moz Kobada gold project in Mali.

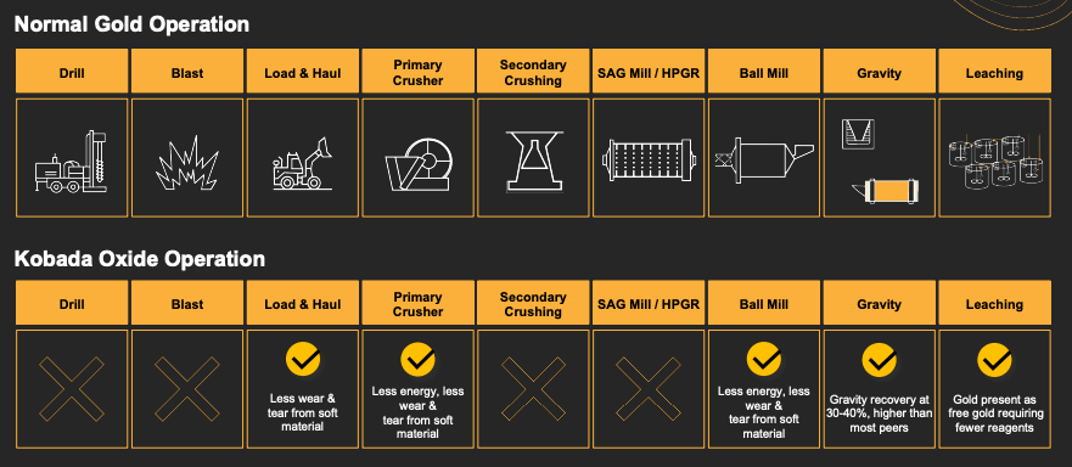

This 4.5km-long resource ticks some important boxes; it is shallow, oxide dominant (softer ore), free-milling and potentially just one of multiple discoveries to be made at the project.

With ~$110m already spent on exploration and studies no significant resource drill-out programs are required ahead of a final investment decision, pencilled in for 1H 2025.

TRE is currently updating a 2021 feasibility study which outlined a +100,000oz per annum operation at US$972/oz AISC over the first 10 years, delivering a pre-tax NPV of $US506m and an IRR of 45%.

The $10-15m capped stock reckons it is undervalued compared to its peers:

We sat down for a chat with new non-exec director Mark Strizek, whose most recent gig was guiding ASX-listed Tietto Minerals (ASX:TIE) from IPO to first gold at the 200,000ozpa Abujar gold project in Côte d’Ivoire.

You left Tietto on a high. Does this project have Abujar vibes about it?

“It’s very rare you get to go all the way through from exploration to building a mine. What is it, 1 in 100?” Strizek says.

“I really see Kobada as West Africa’s next gold mine.”

Just on face value the project looks good: shallow, oxide dominant, free-milling. You’ve already got 3.1Moz, with potentially other discoveries to be made.

“It’s a really simple story,” Strizek says.

“The money has been sunk, and the good thing for a new investor is it takes out so much risk. We already have 3.1Moz, and that’s oxide dominant.

“It’s like going back to Kalgoorlie in the ’80s – you don’t need drill and blast. Essentially you just go in there with an excavator and dig it up, put it in a truck and then it goes into the mill.

“The recoveries are great at between 94-96%.

“We’ve done test work and got up to 80% recovery on gravity, albeit getting down to quite fine sizes, but what that means is that the reagent usage is going to be really, really low.

“The grade is only ~1g/t, but our strip ratio life of mine is only 3.5:1.

“We already have a mining licence and environmental approval for an oxide project.

“And because all the work, so far, has gone into defining and de-risking Kobada the exploration upside is incredible.

“There’s a small 200,000oz contribution in the DFS from the fresh sulphide resource underneath, and the recoveries on that are good, about 94-96%.

“But that 200,000oz is a bit of a taster. The potential is there at depth — its untapped, its unknown, how big could it be?

“What is really getting us excited is going ‘OK, instead of having a 16-year project how do we right size it? Make it 200,000ozpa for 10 years.

“Can we define a 2Moz ore reserve? I think looking at the acreage the company has there’s a good chance. It just about putting the work into the ground.

“Right now, it’s a great project but it really has the potential to be an incredible project.”

Is that what you’re aiming for in updating the old DFS? A move from 100,000ozpa to 200,000ozpa?

“At the moment the guys are talking about 150,000ozpa. We have a good resource base to work with, and there may be opportunity to defer the fresh material and focus on the oxide,” Strizek says.

“The mantra at the moment is ‘keep it simple stupid’. Focus on the oxide, and just try and optimise that plant size.

“I think Tietto has demonstrated you can build a mine cost-effectively in West Africa.”

Tietto’s ramp up at Abujar was relatively trouble-free. West African Resources (ASX:WAF) has performed well over a long period, as has Perseus Mining (ASX:PRU). Maybe the discount for West Africa projects is unwarranted?

“Absolutely right. The smart money is already here,” Strizek says.

“Now it’s just educating the investing public in going ‘look, despite what you think about it, West Africa has a great track record’.

“Perseus and West African are some of the lowest cost producers [on the ASX].

“Then you have TSX listed Endeavour, which has grown into a bit of a gorilla in West Africa. They are knocking on the door of 1Moz of annual production.

“The key is that despite what seems to happen politically – the countries have had issues, there’s no doubt – the mines and mills keep running.

“The governments can’t run their own mines, they need that expertise so they leave you alone; they support you.

“What is more attractive about this project is it has a three-year tax-free holiday. This is real value for shareholders.

“In that important time when you are starting, essentially mining the best grades of the project, we can maximise the value.

“I think it adds considerably to the appeal of Kobada.”

There’s a lot of M&A happening in the gold space at present. Is there a chance you could be bought out cheaply?

“It is true that the best defence is a high share price,” Strizek says.

“That’s the job of the board and the executive led by Phil Russo to drive the work program forward and educate investors about what is on offer here.

“It is stupid cheap, really.

“We have already gone from about 4.5km of known strike that was making up the resource model to around 11km of strike via a modest program of ~5000m.

“There is still another +45km [of strike] identified.”

At Stockhead, we tell it like it is. While Toubani Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.