Q&A: With Craig Moulton, MD of newly listed Ravensthorpe nearology play NickelSearch

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

NickelSearch (ASX:NIS) listed yesterday, IPOing at $7 million via the issue of 35,000,000 shares at $0.20 each, and the share price jumped almost 10%.

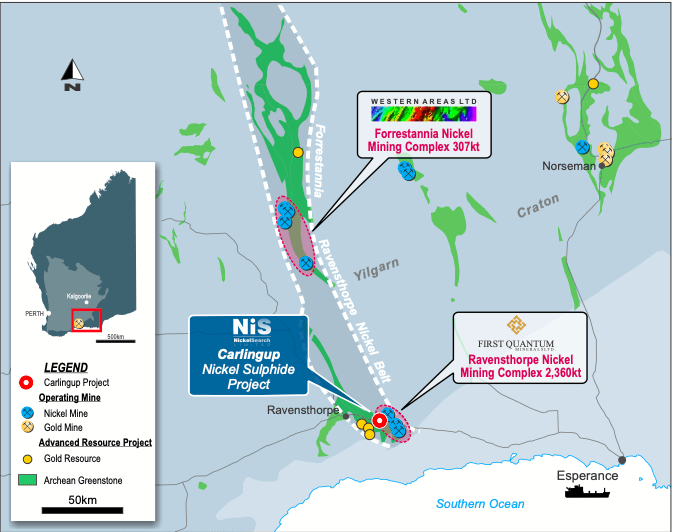

Speaking with Stockhead, managing director Craig Moulton said the company isn’t wasting any time, with exploration ready to kick off at the Carlingup nickel project near Ravensthorpe in the southwest of WA.

NickelSearch is freshly listed, what’s the next step for the company?

“It’s a very exciting time for us. We have the Carlingup nickel project, which post-IPO, comprises of eight mining licences and seven exploration licences which pretty much cover all the ultramafic, which is the host rocks for the nickel sulphides in the Ravensthorpe Greenstone belt.

“It’s adjacent to First Quantum’s Ravensthorpe nickel operations and basically consists of all those ultramafic that isn’t covered by First Quantum’s mining leases.

“So, between the two of us, we pretty much have all of that ground covered, but they’re only focused on nickel laterites (the gravels), whereas we’re focused on high grade nickel sulphide exploration.

“Our land has the historic RAV8 mine that was mined by Tectonic Resources from 2000 to 2007 and produced around about 16,100 tonnes of nickel at about 3.45%, which really demonstrates this is a very high tenor system for nickel sulphites.

“Our fundamental focus is to find multiple RAV8-style ore bodies in the tenement, plus, potentially looking for extensions below RAV8, and we already have a resource around 75,100 tonnes in JORC 2012.

“By our heap leach process, we believe we’ve got a demonstrable pathway to processing that material into mixed hydroxide product (MHPs) which flows into the battery cathode market.”

When do you plan to kick off exploration?

“We have a very dominant land position where there’s been very limited expression for nickel sulphides even though the rocks are highly prospective for that.

“The reason being is that area has really been the focus for laterite exploration, the surface stuff, and nobody has had all these tenements as one package historically – and that’s another advantage.

“When you start exploring for nickel sulphides, you want to work through it systematically from the shallow mineralisation and follow it down at depth.

“It you look at deposits like Black Mountain Metals and their Lanfranchi deposit, or Panoramic (ASX:PAN) with their deposits, these things go down to about a kilometre. Even the old RAV8 mine was only drilled and mined to about 300m, so it’s quite feasible that this mineralisation will go much deeper.

“On top of that, we have several advanced deposits, RAV1, RAV4, RAV4 West and RAV5. We’ve got walk-up drill targets at RAV5, at RAV1, RAV4 and RAV4 West we already have a JORC resource around 5,000 tonnes of nickel. Bringing it into JORC 2012 resource standards will be one of our tasks going forwards.

“We’re already doing surface sampling and we expect to be drilling before the end of the month with an RC drilling program.”

What makes NickelSearch stand apart from its peers?

“The obvious thing is that given we have 179 kilo tonnes of JORC 2012 resource, and listing with a market cap of $20.8 million, we feel we’re very good value for money at the moment.

“But you don’t invest in a company like us just because we’re relatively cheap compared to our resource base; you invest in companies like NickelSearch because we have multiple growth opportunities.

“We have significant potential in terms of our greenfields exploration potential, we’ve got advanced deposits that we’ll be working to bring to resource, we have the historic RAV8 mine site which has the associated plant capital, and then we’ll have that material around RAV8 that we’re focused on developing this heap bio leach to actually go into production.

“On top of that, we have the John Ellis laterite nickel deposit which we own directly, plus we have royalties on the First Quantum laterites in our ground.

“There are just multiple facets to this company and so we’ve got multiple growth options and products, and that’s where I believe we’ll deliver the value to our shareholders.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.