Q+A: Everest Metals’ Simon Phillips talks lithium hunting with Rio and finding the next DeGrussa

Pic: Stock, via Getty Images

The stock formerly known as Twenty Seven Co rebranded as Everest Metals (ASX:EMC) in late 2022 with a focus on lithium, gold and base metals in Australia.

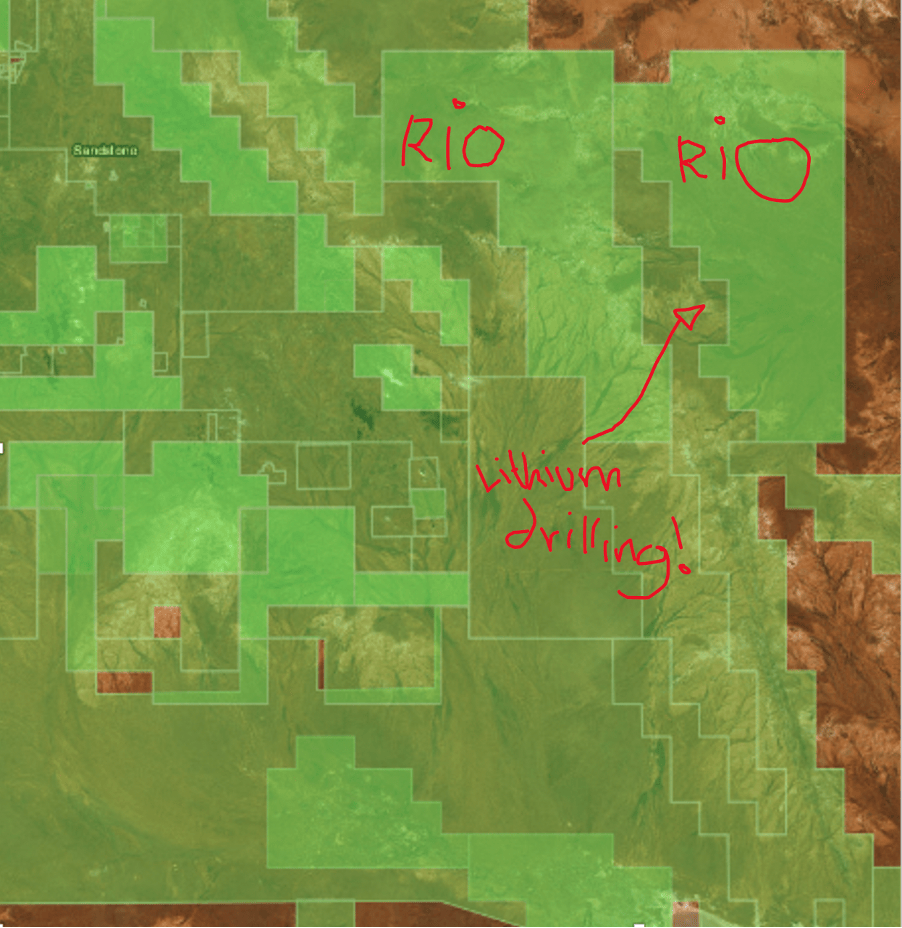

Complementing its Mt Edon (lithium) and Revere (gold, copper) projects are a couple of lithium JVs, most notably with Rio Tinto (ASX:RIO).

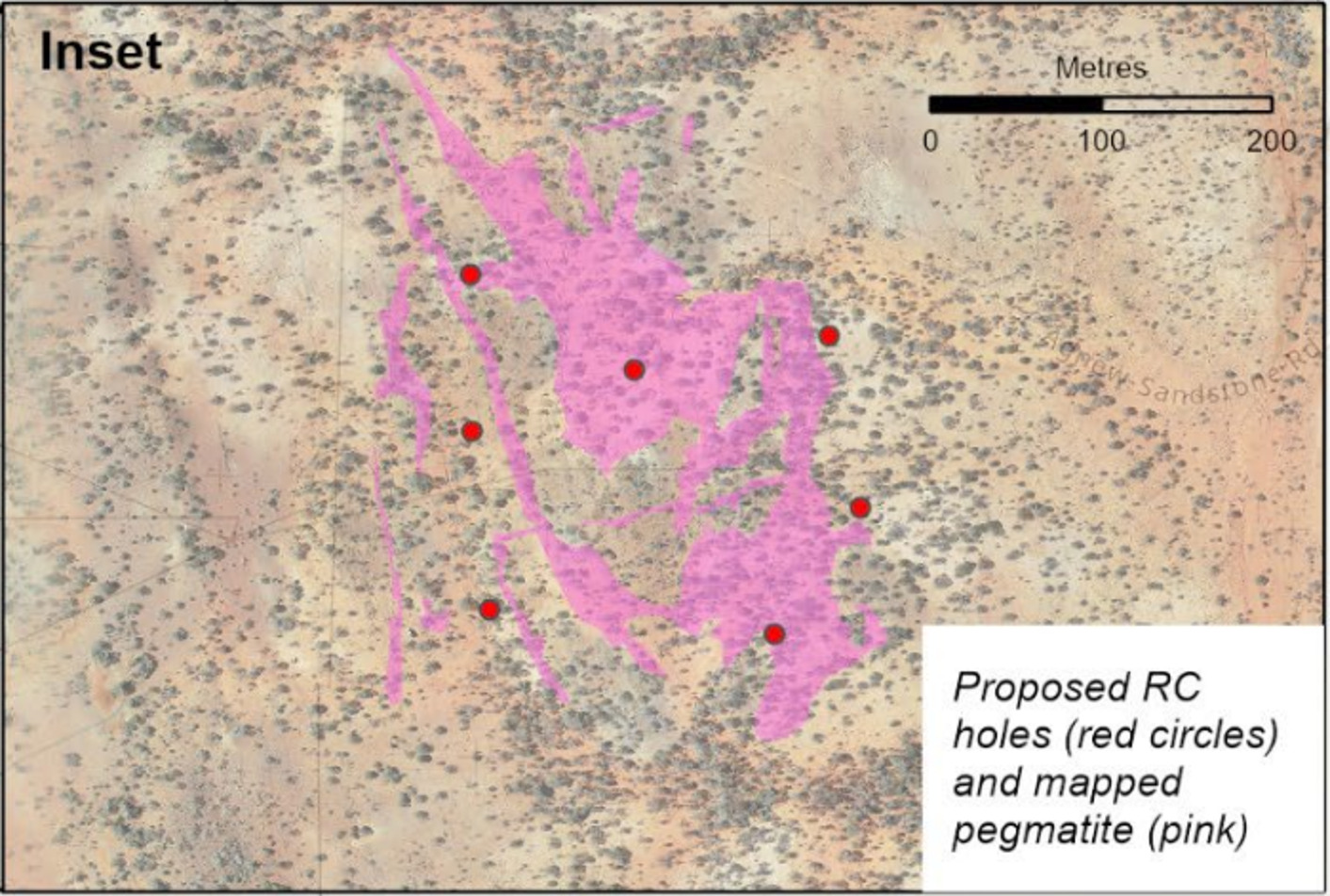

This month the mining major completed a seven-hole, 1400m drill program over the North Rover JV, where it can earn 80% by sole funding $5m of non-gold exploration.

The target is potential pegmatite hosted lithium beneath weathered pegmatite outcrop, EMC says. Results are pending.

Exciting. But that’s not all.

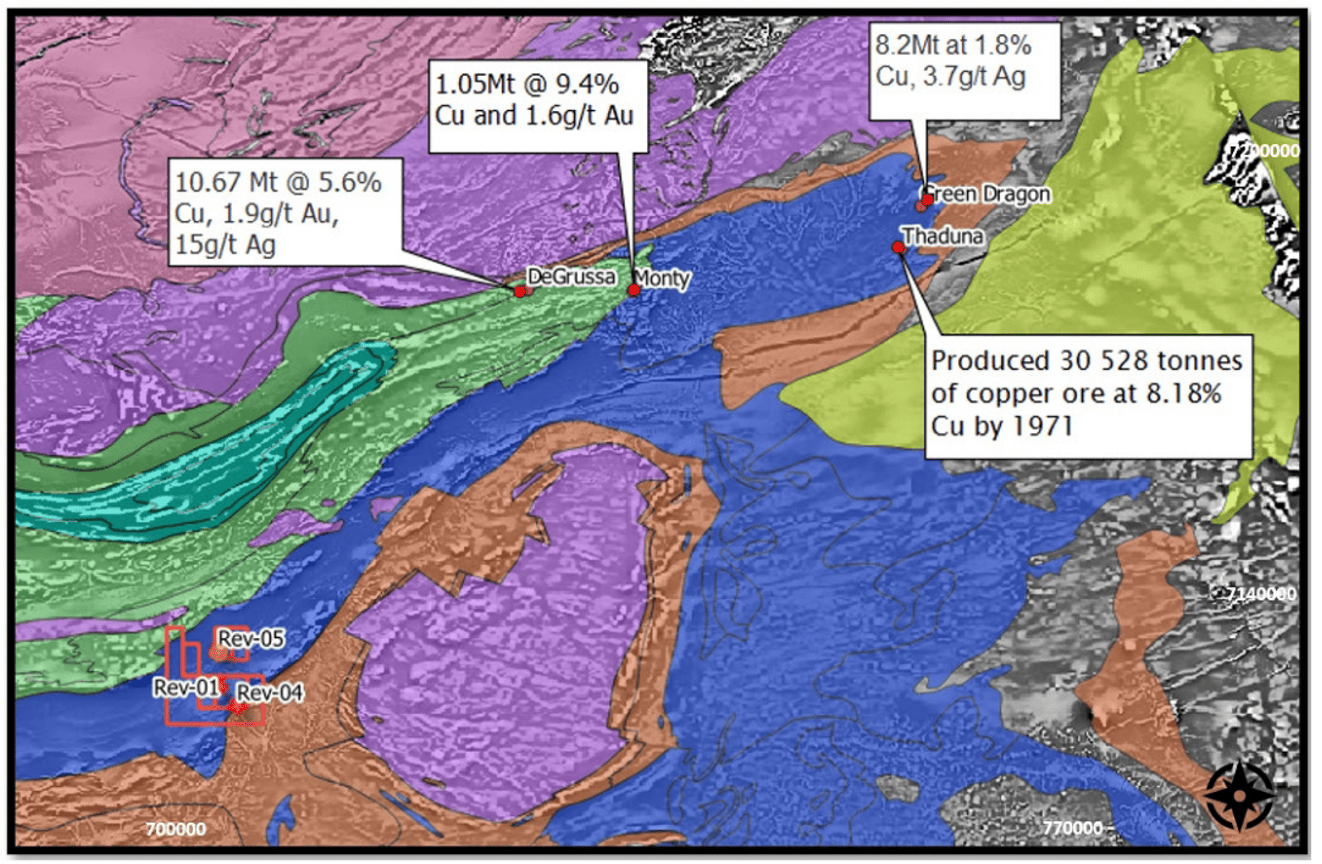

First pass deeper drilling at Revere hit a “DeGrussa style mineralised system”, EMC said earlier this month.

Big if true. In early 2009, struggling explorer Sandfire Resources (ASX:SFR) discovered what would later become the world-class DeGrussa copper-gold mine, rapidly transforming its fortunes from a 4c penny stock into a ~$1bn mining company.

And while punters were disappointed with the results of a small drilling program at the Mt Edon lithium-rubidium project, EMC COO Simon Phillips says the hunt for the source continues. A proposed stage 2 drilling campaign is set to commence in early August.

Where will the Everest rerate come from? We called Simon for a chat.

Rio Tinto have pushed into lithium in quite a big way. How did that deal come about? What did they like about this project?

“Rio contracted me back in October-November 2021 after they had been for a walk over Northern Rover and identified some weathered outcrop they liked,” Phillips says.

“We were committed with other projects and thought the terms they offered on the deal were pretty good. We liked having Rio in there as a potential partner.

“It took some time to get going but here we are – they are drilling for lithium as we speak.”

Have they shown you what the target is?

“They have. The team at [Rio’s exploration arm] RTX are a very modest group and have a natural disposition towards managing expectations,” Phillips says.

“On that basis I am excited they have identified a target good enough to drill, because they do have an exhaustive process to go through before they decide to drill.

“That tells me enough. Very exciting.”

I noticed that Rio recently picked up the two tenements either side of you up there.

“They have. Again, very telling,” Phillips says.

“They have been very active, also adding massive tracts of ground to the east of our Revere gold project up north.

“I think they felt they fell behind a little in the lithium hunt.”

Now onto Mt Edon. Those lithium drilling results probably weren’t as good as you wanted them to be. What’s the next step there?

“It was only a small program, and the rock chip samples that we got the big hits out of, that got everyone excited, had to come from somewhere,” Phillips says.

“Our geological team are that keen to follow up that program that they are up there [right now] mapping the new hole locations.

“We think these new holes will bear some fruit — the kind the market was expecting in the first [program].

“In saying that, we are not disappointed with 40m of pretty high-grade rubidium in a stage 1 drilling program of just 440m.”

Revere is an interesting one. No one has found another DeGrussa yet, though no lack of trying.

“Along strike along that Doolgunna fault our project is the only area [Sandfire] never had a chance to get into,” Phillips says.

“It hasn’t been through lack of trying with us, but our chairman has never really been interested.”

What do the initial results tell you about what you’re dealing with at depth at Revere?

“Visually it tells us we are on a mineralised system. Somewhere within that system will be an orebody,” Phillips says.

“The geology is identical [to Monty and DeGrussa]. It’s very encouraging.

“But as people having discovered finding another DeGrussa can be a needle-in-a-haystack situation. We will be methodical.”

Then you have potential near term cashflow from the gold at Revere.

“We have high grade gold from surface, and the ability to mine it,” Phillips says.

“The Revere reef system is not a traditional type of gold deposit. That’s why a proposed 36,000t bulk sampling program is so important for us.

“The bulk sampling will give us a resource; we have an internal resource target of 200,000oz.

“Our aim is to be in production this year.”

Why the bulk sampling? Is the deposit not amendable to closed space drilling?

“Being a reef system, if you hit the reef, you get elevated grades, and not a lot in between,” Phillips says.

“The bulk sampling program will allow us the extrapolate the data to get a resource. We also aim to produce some revenue out of that program. There is a lot of high-grade dirt in that 36,000t.

And the met work looks excellent. Would you get a mobile plant on site or toll treat?

“We have access to a plant, and we are in negotiations to lease or purchase outright the plant,” Phillips says.

Gold isn’t on the nose, but it isn’t flying either. Still, you’d have to be happy with a +$2900/oz Aussie gold price.

“That’s a very healthy Australian dollar gold price, isn’t it? Gold equities are probably some of the cheapest assets globally at the moment,” Phillips says.

“For some of the better placed producers you almost get the gold in the ground for free. It’s remarkable.”

Where would Everest like to be by the end of the year?

“We’d like to have a lithium-rubidium discovery at Mt Edon, and copper underneath all our gold at Revere,” Phillips says.

“I think if we were to achieve any of those targets, as well as a resource and production out of Revere, we would be rerated.

“And that doesn’t even include what is happening with Rio.

“In each of these activities there is a rerate for us.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.