Prospect Resources starts copper drilling at Mumbezhi Project

Prospect Resources has started drilling for copper at its Mumbezhi project. Pic: Getty Images

- Prospect Resources starts drilling to define and extend copper mineralisation at its Mumbezhi Project in Zambia

- Drilling will focus on the Nyungu Central deposit and will also test opportunities to broaden mineralisation along strike and at depth

- Diamond holes will recover material for metallurgical test work

Special Report: Prospect Resources has started maiden drilling to define resources and test extensional opportunities at its recently acquired Mumbezhi copper project in Zambia.

Mumbezhi covers 356km2 of ground within the Zambian Copper Belt, one of the most prolific and prospective copper mining regions globally.

This area is close to several major mines hosted in similar geological settings and is prospective for large tonnage, low to medium grade copper deposits.

Prospect Resources (ASX:PSC) acquired an 85% stake in the project for US$6.5m ($9.61m) in cash and scrip in May this year.

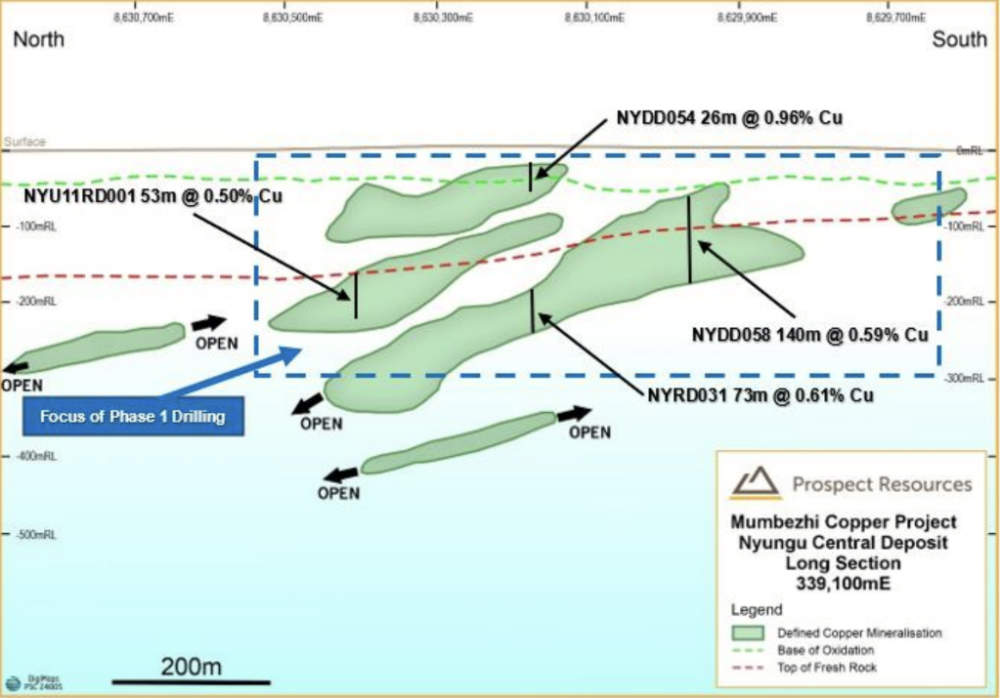

Recently validated data from historical drilling at the Nyungu Central deposit produced top assays of 140m at 0.59% copper from 51m and 32m at 0.87% copper from 353m.

There is considerable potential for repetitions of the folded depositional style of mineralisation evident at Nyungu Central over >1km, at depth, laterally and along strike in the existing licence holding.

Drill Programme

PSC will kick off a drill programme of 30 reverse circulation and diamond holes totalling 7,000m over a 1km strike at the Nyungu Central deposit.

It will initially seek to better define resources before moving on to testing opportunities to extend the copper mineralisation.

Part of the diamond drilling is also designed to supply materials for comprehensive metallurgical studies as well as supporting comminution and flotation test work.

This will enable initial variability testing to directly inform a proposed scoping study for Mumbezhi and support the future economic evaluation of an open-pit mining operation.

“The commencement of Prospect’s maiden exploration drilling at Mumbezhi is an important milestone for our team, which now has boots firmly on the ground in Zambia,” Managing Director Sam Hosack said.

“Our fully resourced exploration team will undertake an RC and diamond programme targeting Mineral Resource definition and drilling activities at the large Nyungu Central deposit initially, which demonstrates clear strike and wide extensional opportunities, with exploratory work in other areas of the licence.

“Following an extensive review of all historical drill data purchased from Orpheus, we have validated several highly prospective drill targets at the Nyungu series of deposits and across the broader Mumbezhi licence.

“Given the scale potential we are boldly and systematically targeting these prospects with ongoing results to be incorporated into our rapidly developing resource modelling.”

Other Activity

Besides drilling, PSC has also started 3D modelling and interpretation of the Nyungu deposits in the southwest corner of the licence.

This will focus initially on the north-northeast trending strike and width extensions.

Environmental and Social Impact Assessment reporting is also underway.

Prospect previously stunned the market by establishing and selling its Arcadia lithium project in Zimbabwe to China’s Huayou Cobalt, funding a near $450m distribution of dividends to shareholders in 2022 in one of the battery metals boom’s unsung success stories.

In Zambia it is chasing similar riches in one of the world’s top growing copper belts, where western giants Barrick Gold and First Quantum are expanding production at the large and long-life Lumwana, Sentinel and Kansanshi mines and overall output could hit 1Mtpa by 2026, up from ~700,000t in 2023.

This article was developed in collaboration with Prospect Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.