Promise of porphyry riches opens FMG’s purse for Myall JV with Magmatic

Fortescue has committed to a $3.5m exploration spend in FY26 at Magmatic's Myall project. Pic: Getty Images

- Fortescue commits $3.5m to FY2026 exploration budget at Magmatic’s Myall project

- Expenditure fulfils minimum obligation iron ore major needs to meet for first stage of JV deal

- Myall sits within porphyry hot spot and is showing positive signs

In a ‘blink and you might miss it’ moment, junior explorer Magmatic Resources (ASX:MAG) has received a shot in the arm with its senior JV partner Fortescue agreeing on a $3.5m FY2026 exploration budget for the Myall project in New South Wales.

While the expernditure is barely a blip in the iron ore giant’s books – for now – it represents a strong show of confidence in the project, which is an emerging porphyry system in a region known for top tier discoveries of that nature.

The funds will be used for a significant aircore and diamond drilling program that will fulfil the minimum obligation that Fortescue needs to meet under the first stage of the JV agreement.

This requires Fortescue to spend at least $3m and carry out at least 3000m of drilling within the first two years. Should it then spend a further $3m of expenditure within the first four years of the agreement, it will earn an initial 51% interest in Myall.

Fortescue, which also subscribed for 75.9 million shares worth $3.71m to give it a 19.9% stake in Magmatic at the time the agreement was signed, can increase its share to 75% by spending another $8m over the subsequent two years.

Magmatic Resources (ASX:MAG) also gets a kicker here by drawing an operator’s fee during the initial earn-in period.

But just what is it about Myall that led Fortescue to sign up in the first place?

A porphyry hotbed

To get a handle on its reasons, we first need to understand the geology of the East Lachlan Belt and take a little trip down memory lane.

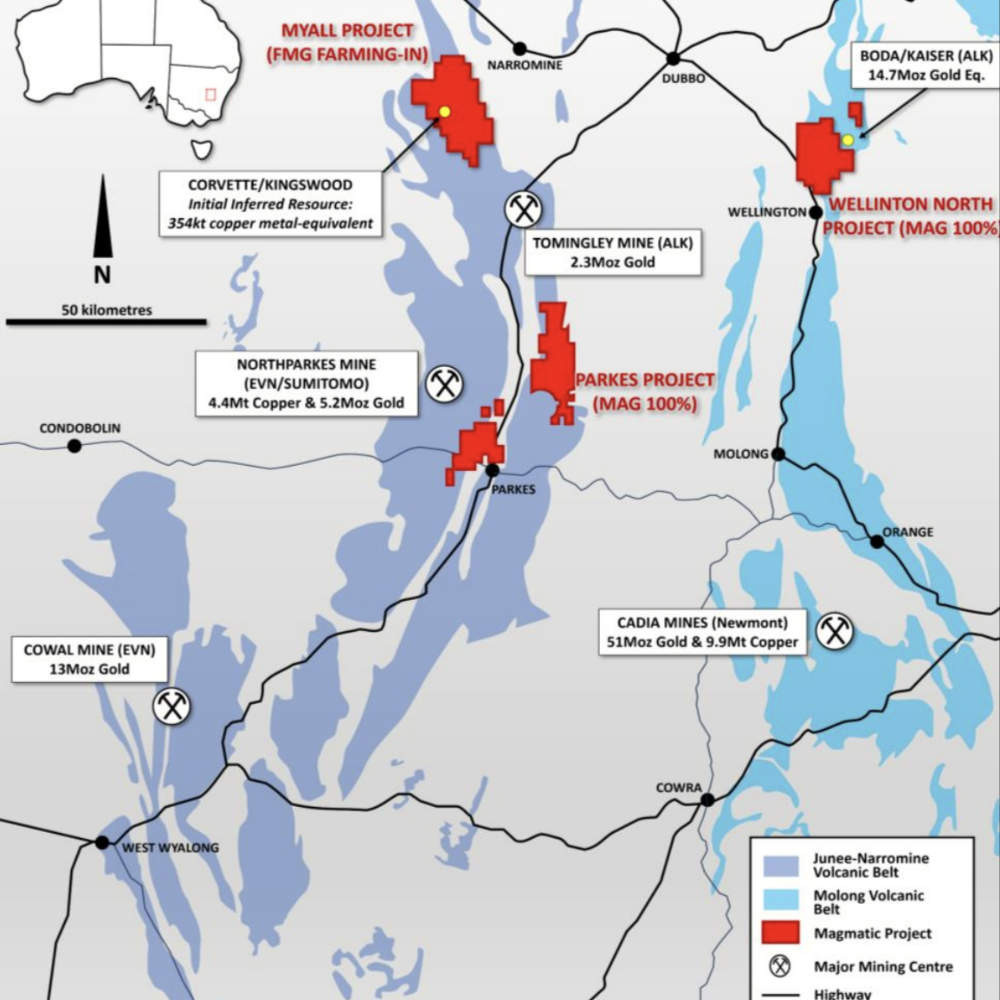

Sitting down with Stockhead, Magmatic managing director David Richardson noted the East Lachlan is the centre of Australia’s gold-copper or copper-gold porphyry resources that are centred around either the Molong or Junee-Narromine volcanic belts.

“It’s known that if you want mineralisation, you have to be on one of the volcanic belts.”

For example, Cadia Valley – Australia’s largest or second largest gold mine depending on the year with its monstrous contained resource of 51Moz gold and 9.9Mt copper – sits within the Molong belt.

Junee-Narromine is no slouch either, hosting the Cowal gold mine to the south and also Northparkes, which is Australia’s largest copper-gold porphyry mine.

Take into account more recent discoveries like Alkane Resources’ (ASX:ALK) Boda-Kaiser porphyry and you can see why the region is known as elephant country. It’s not a one trick pony either, with plenty of orogenic, near surface quartz vein-type gold mines such as Alkane’s Tomingley project.

“Post the GFC, a lot of the majors stopped greenfield exploration and also consolidated regionally and with a focus on mines and extension of mine life,” Richardson said.

“Barrick sold a number of gold mines in Western Australia to Goldfields and Goldfields decided to exit greenfield exploration in New South Wales and East Lachlan.”

This led to the precursor to Magmatic picking up four projects from Gold Fields, which fulfilled the key criteria of being in Australia’s East Lachlan, had strong potential for tier-1 mineralisation and had come out of a major that had spent $14m on geophysics, geochemistry and target generation.

“We inherited a portfolio of close to 100 targets though Gold Fields. Being a gold company (it) had largely ignored polymetallic results at that time,” Richardson added.

“We then listed off these assets (in mid-2017) and Gold Fields held 20% of us then because they thought the projects could be done better in a junior explorer.”

An advanced porphyry project

While each of the four projects is prospective in its own right, it didn’t take long for the company to realise that it wouldn’t be able to do justice to all of them.

This led to the 2021 demerger of the Moorefield gold project in the Girilambone area between East Lachlan and Cobar into Australian Gold and Copper (ASX:AGC) .

“It was a small near-surface gold quartz vein type project and we thought that was best outside Magmatic,” Richardson said.

Doing so allowed Magmatic to focus on its remaining three projects in the East Lachlan, the most advanced of which is Myall.

“Geologically, when you look on the Junee-Narromine volcanic belt, the two of the three features that are important for these mines are that you need to be on the volcanic belt and you need to be on an intrusive,” Richardson noted.

“Then when you look at the specific features of Northparkes and Cowal, they are both on a magnetic high and a gravity low. “

These features appear as a yellow circle on geophysics and the only other area on the belt with a similar feature is at Myall.

Adding further interest, Myall shares the same rocks and geology as Northparkes and, once drilling started, it was also found to have similar porphyry mineralisation.

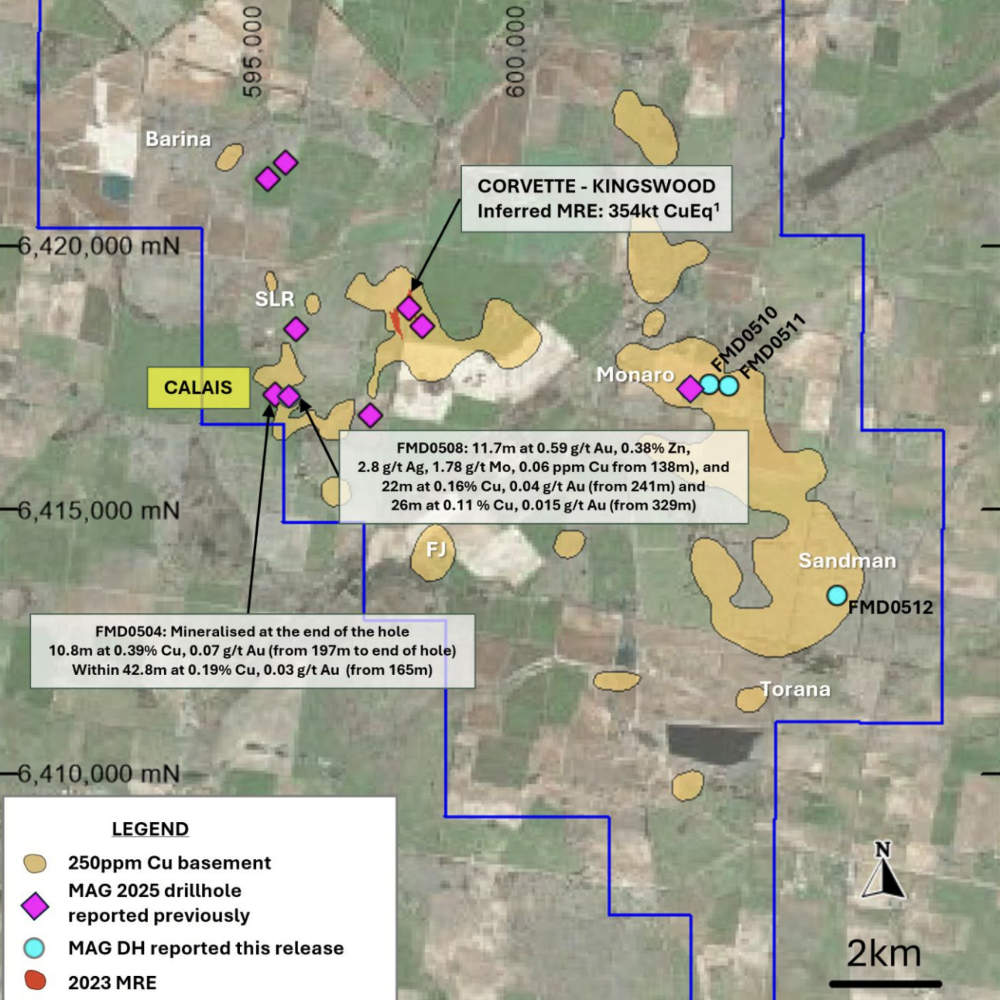

This led to the definition of a large resource of 110Mt grading 0.33% copper equivalent, or a contained mineral inventory of 293,000t copper, 237,000oz gold and 2.8Moz silver at the Corvette and Kingswood prospects.

Like any porphyry resource, Myall has massive tonnage but low grades, though this does not distract from their prospectivity given that porphyries collectively supply some 80% of the world’s copper.

Despite this, Magmatic’s successes at Myall failed to move the market, with Richardson saying that Australian investors did not really understand porphyries. But the need to secure a bigger partner was always in the foreground.

“We always knew when we bought the portfolio that to truly advance them, at some stage we would need to attract a partner with the ability to actually develop them,” he added.

This is particularly true given that porphyries globally, but specifically in the East Lachlan, tend to occur in clusters.

“Northparkes has over 20 deposits while Cadia has five mines. These occur in clusters, so if you’ve got one, there’s a good chance you’ve got another deposit nearby,” Richardson said.

“That means you’ve got to drill it, and it’s hard for junior explorers to be drilling lots of 1km diamond holes.”

Top tier partner

Magmatic subsequently carried out an expression of interest that was won by Fortescue.

The pull of making a significant discovery at Myall and diversifying from iron ore into copper were attractive for the Andrew Forrest-led mining giant.

During the first 12 months since the agreement was signed in March 2024, the two companies carried out a lot of preparatory work such as geophysics, geochemical relogging and examining old core.

Taking Northparkes as an example, where most deposits occur within 2km of each other, the first drill program was aimed at finding other potential porphyry deposits outside of Corvette and Kingswood.

This drilled and identified what could be a potential discovery at Calais, a vote of confidence to expand regional drilling.

“We recently announced our 2025-26 budget is $3.5 million. So that’s $3.5m going into the ground, and we’re already in August, so really in the next 10 months we are going to be very busy,” Richardson said.

“They’ll just about reach the joint venture stage in these next 12 months.”

Copper is, of course, critical to electrification. And with a potential shortfall looming, the market is starting to reward miners.

This interest hasn’t passed on to the explorers as yet, but Richardson is hopeful the tail will “begin to wag” in the next 12 months.

“There’s a whole lot of consolidation but you can only do so much M&A. At some stage, you have to come down the value chain,” he said.

Magmatic’s has a big opportunity to capitalise when that starts, especially if the Fortescue earn-in delivers more significant results and the major commits to move onto the next stage.

At Stockhead, we tell it like it is. While Magmatic Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.