Producing battery materials in the DRC could lower supply-chain emissions, BNEF says

Charging of an electric car. Pic: Getty

A new study by BloombergNEF (BNEF) on a unified African supply chain has identified The Democratic of Congo (DRC) as a favourable destination for the manufacturing of sustainable battery materials used in high-nickel batteries.

It says the DRC can leverage its abundant cobalt resources and hydroelectric power to become a “low cost and low emissions producer of lithium-ion battery cathode precursor materials.”

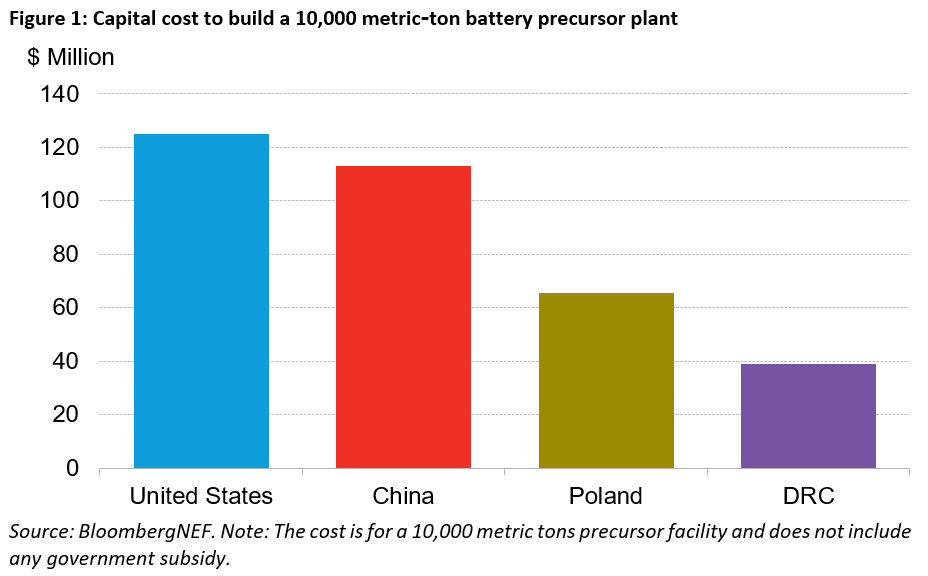

BNEF estimates that it would cost $39 million to build a 10,000 metric-ton cathode precursor plant in the DRC, which is “three times cheaper than what a similar plant in the US would cost,” it says.

A similar plant in China and Poland would cost an estimated $112 million and $65 million, respectively.

The report, titled “The Cost of Producing Battery Precursors in the DRC” goes on to say that the emissions associated with battery production could be cut by 30% compared with the existing supply chain that runs through China, if cathode precursor materials (such as NCA and NMC) were produced in the DRC, with Poland handling the production of cathode materials and cells, and Germany the final pack assembly.

The DRC’s cost competitiveness comes from its relatively cheap access to land and low engineering, procurement and construction or EPC cost compared to the US, Poland, and China, the lead author of the report and BNEF’s head of metals and mining Kwasi Ampofo said.

“European cell manufacturers currently rely heavily on China for battery precursors,” Ampofo said.

“However, the raw materials for batteries are, in most cases, imported into China from Africa and refined before being exported to Europe.

“Automakers in Europe can lower their emissions by shortening the transport distance and capitalising on the DRC’s hydroelectric powered grid and proximity to raw materials.”

The sheer scale of growth expected in the coming decades means that there is inherent uncertainty over which companies and countries may come to dominate this new value chain, he said.

“African countries could play a major role in the lithium-ion battery supply chain by taking advantage of their abundant natural resources and onshoring more of the value chain.”

Capitalising on natural resources to build a global electric vehicle hub

The African Continental Free Trade Area (AfCFTA) is a free trade area covering 54 African Union nations, which came into force on 30 May 2019 and effectively went operational on 1 January 2021.

BNEF says the AfCFTA agreement has the potential to create the largest free trade area in the world and if approached correctly, African countries could capitalise on their abundant natural resources, growing demand for vehicles, and rapid urbanisation to build a global hub to produce electric vehicles.

James Firth, head of energy storage at BNEF, says for regions to to attract battery component or cell manufacturing they need to have either a supply of key materials or local demand for batteries.

“If they have access to raw materials, they can use this supply to attract downstream manufacturers,” he said.

“If they have local demand for batteries, cell manufacturers will move to the region to be close to their customers, particularly in the automotive industry.

“Africa has a wealth of critical battery raw materials and is in a position to use these to attract more value-add in downstream processing and manufacturing.”

End-users looking to diversify supply away from the DRC

But Minelife founder and senior resources analyst Gavin Wendt says while it is true that the DRC has enormous mineral wealth, hosting world-class deposits of copper and cobalt – both crucial elements in the move towards new energy technologies, end-users have been looking to diversify supply away from the DRC for some years now.

“This is particularly the case with cobalt, where the DRC dominates worldwide supply,” he said.

“End-users don’t want to leave themselves exposed to relying on one major supply source.

“This is due to the fact that the DRC ranks highly in political risk terms, and working conditions for many artisanal miners are questionable to say the least.

“In a world that is focusing more on high ESG standards, the DRC will have to raise its game significantly if it wants to remain a player.

“Countries like Australia therefore will be even better placed, given the certainty that we can offer customers in terms of our ESG credentials and low sovereign risk factors.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.