Potential abounds in Viking’s golden First Hit homecoming

Pic: Getty Images

Special Report: There are a number of key features which make an acquisition like that of Viking Mines’ First Hit gold project, announced last week, stand out in a crowd.

If you were to post a sign in WA’s mining HQ heart of West Perth which read “Wanted: one gold asset. Must be local, high-grade, historically low cost, house established infrastructure and big exploration potential”, you’d be laughed off the street.

Like orebodies themselves, projects with these attributes are highly sought after and far less easily found.

But at First Hit, via an extensive due diligence process following a search which spanned the globe, Viking Mines (ASX:VKA) has managed to uncover exactly the sort of project companies of its ilk are searching for.

By acquiring Red Dirt Mining in last week’s deal, Viking has picked up a high-grade historic gold project in WA’s Eastern Goldfields – one first mined in 1930 and most recently in 2002 by Barra Resources and Barminco. It hasn’t been touched with drill or shovel since.

Still covered by a mining lease through to 2032, when the project was shut the gold price was around US$325 per ounce. It was uneconomic, even with the owners reporting cash costs of just US$345/oz.

Most importantly, the mineralisation at First Hit remains open above, below and laterally adjacent to the historic resource. Drill results carried out by Barra in the early part of the century returned the following assays.

Below the historic mineral resource:

- 9m at 64.8 grams per tonne gold from 62.1m;

- 7m at 22.2g/t gold from 64.3m;

- 5m at 10g/t gold from 55.8m;

- and 3m at 9.3g/t gold from 273m.

Laterally adjacent to the historic mineral resource:

- 3m at 77.6g/t gold from 224m;

- 1m at 66.7g/t gold from 164m;

- and 1m at 15.4g/t gold from 255m.

Above the mined workings:

- 4m at 26.1g/t gold from 58m in an un-stoped area;

- 2m at 13.1g/t gold from 27m above the highest level mined;

- 2m at 5.1g/t gold from 18m near surface splay;

- and 4m at 2.3g/t gold from 38m near surface splay.

The project was only historically mined to around 220m.

A dormant development

Speaking to Stockhead on the day of the acquisition announcement, Viking director Charles Thomas said First Hit went untouched for nearly two decades as the market focused its attention elsewhere.

“I think going back to the early 2000s, and even into the mid-to-late 2000s, the gold price was substantially lower than what it is today,” he said.

“A lot of the WA companies, as Viking was, were off in Africa chasing big elephant deposits above a million ounces, because that’s what the market and the people were demanding in terms of the listed environment for resource companies.”

For its part, Viking did prove up and sell an “almost-million-ounce” deposit over that time in Ghana, where it is still concurrently searching for gold.

But the pull of the home jurisdiction was strong, and First Hit offers Viking an in to a field where it will be in good company.

“The reason this is still sitting there, I think, is traditionally 100,000oz or 200,000oz is not considered a large, company-making deposit,” Thomas said.

“A lot of the guys operating locally were your Northern Stars, your Saracens – bigger companies that this didn’t move the needle for.

“For a company like Viking, this can significantly move the needle. It may have been overlooked in the past but things have changed, the gold price has gone up significantly, all the low-hanging high-grade fruit is pretty much gone.

“Fortunately for us, this one has sat there dormant for almost 20 years.”

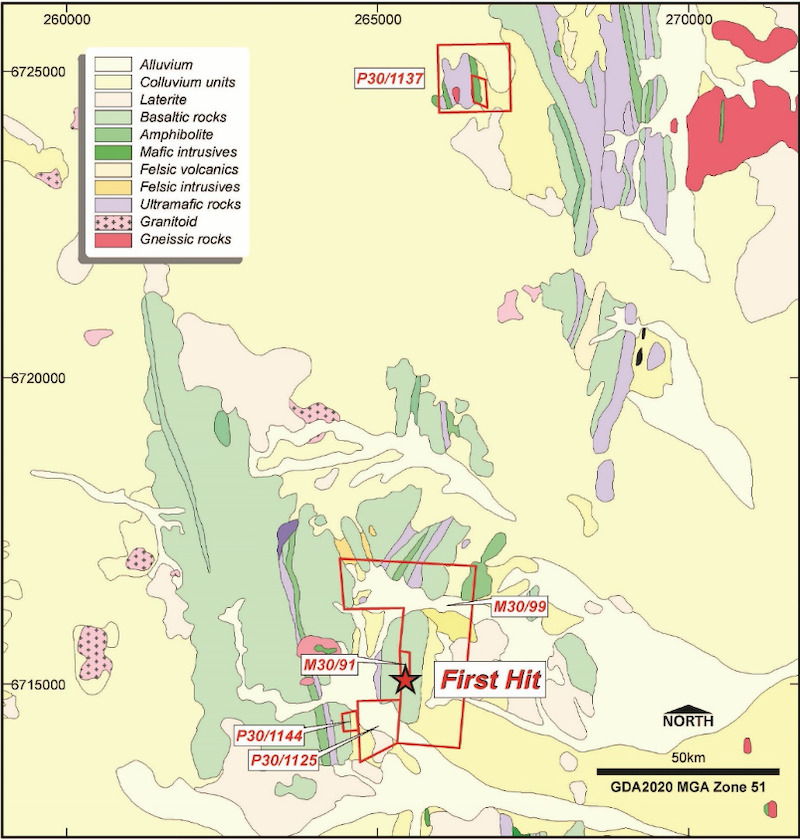

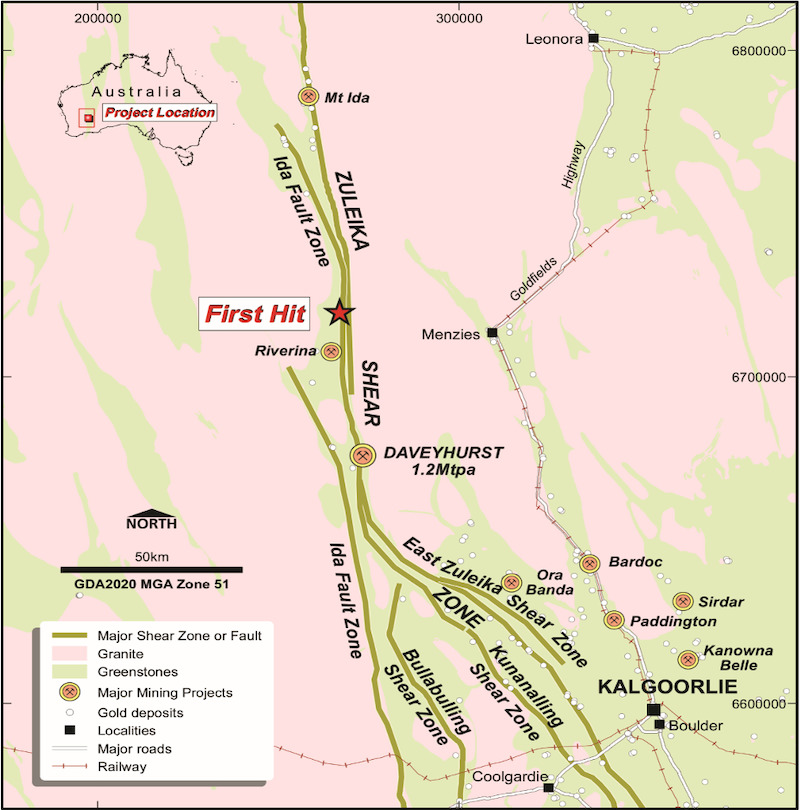

First Hit is not just a historic mine. Located at the northern end of the strike-extensive Ida fault, the project comes with five advanced exploration targets, each of which are untested using modern exploration techniques. Viking believes these have the potential to replicate the mineralisation on show at First Hit.

According to Thomas, first priority will be geochemical work and then drilling in the coming months to grow and bring the mineral resource up to JORC 2012 standards.

“We’re hoping to increase the resource up to 150,000-200,000oz before we think about going back into production,” he said.

Historically an underground project, Thomas said Viking was open to other means of mining as well.

“I think the main thing we’ll focus on first off is the open cut potential, which hasn’t been explored before,” he said.

Prominent postcode

Whatever development does take place, Viking will be helped along the path thanks to retained historic infrastructure which should help keep upfront costs down compared against a greenfields project.

“In historical terms it’s had about $15 million spent on infrastructure to get it to production and that’s still sitting there,” Thomas said.

“There’s a box cut, drives, waste dumps, roads, and actual camp facilities as well – it’s all in good order.”

The project has some significant neighbours too. Around 45km from Menzies, First Hit sits 50km from Ora Banda Mining’s Davyhurst mill and in relative proximity to six mills in all.

The Ida fault on which the project is located is host to a number of significant deposits, including the Bullabulling and Mt Ida gold mines, and the Davyhurst Mining Centre which incorporates the Mullaline and Riverina mines.

“For Viking shareholders this represents a rare opportunity to get into a local, high-grade gold opportunity at a relatively cheap price,” Thomas said.

“I think there’s plenty of upside for Viking going forward.”

This article was developed in collaboration with Viking Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.