Potato monitor Croplogic jumps aboard the hemp hype train

Pic: Schroptschop / E+ via Getty Images

Potato monitor Croplogic has jumped on the hemp hype train by appointing two advisors to tell it where the money is in Oregon.

The company (ASX:CLI) hired Green Rush Advisory Group and Green Light Law Group to outline the “current state of, and opportunities within, the industrial hemp market in Oregon”.

Industrial hemp, which contains low levels of THC and slightly higher levels of cannabidiol (CDB), is due to be legalised in the US once the 2018 Farm Bill is passed, a piece of legislation that is being held up due to non-hemp related factors.

The Bill will likely make hemp-derived CBD legal. CBD is a major component of medical-oriented cannabis products.

Croplogic chief James Cooper-Jones said they were looking for “crops with high performance, growth trajectory and market share potential”.

Struggle-town

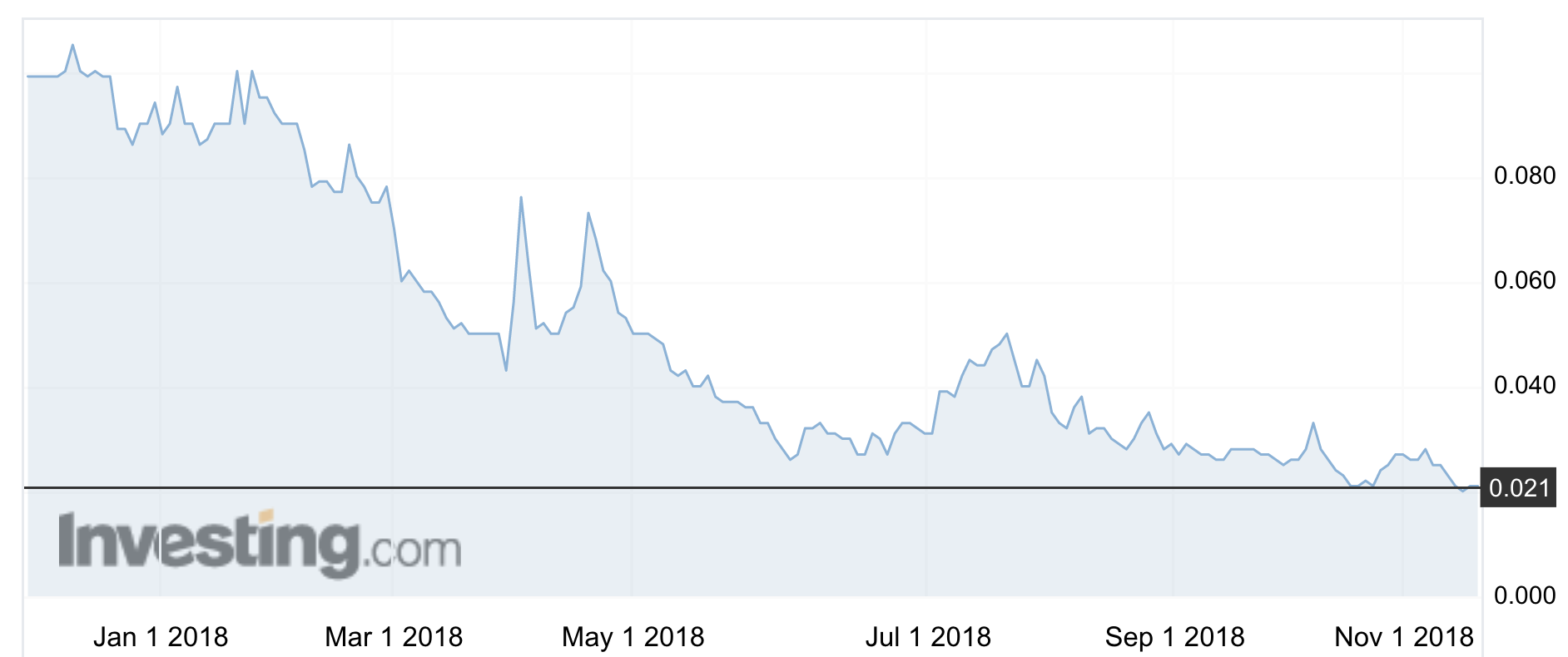

Croplogic debuted New Zealand government-backed agriculture technology on the ASX in late 2017, listing shares at 20c each but promptly dropping 23 per cent on day one.

Their crop production technology, sensors monitor the water, soil, plant, pest and weeds from their mobile app and decreases the necessity for agronomists to make site visits.

At the time, investors spoken to by Stockhead blamed an expensive ‘growth by acquisitions’ strategy and said the $23.9m valuation was too high.

The stock has never recovered. It opened on Monday at 2.1c.

By April, CEO Jamie Cairns had quit and the company was on track for a strategic about-face: they began the process of moving the company’s base from New Zealand to Australia, but nixed a big deal that was supposed to be their big entree there.

The original plan was to expand as an agronomist in Washington State, US, focusing initially on potatoes, but the company is aiming to attract growers of a variety of above-ground crops such as grapes and nuts, in Mildura.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Investors are yet to buy the promises of growth.

The company is, however, beginning to make money.

It has gone from taking cash receipts in the March quarter of just $98,000, to $510,000 the following period and $1.016m in the most recent quarter.

It has slashed cash burn, and while by the end of September it only had $1.5m left in the kitty with an anticipated spend for this quarter of $1.6m, it secured $2.6m from institutional investors last week.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.