Poseidon positioning itself perfectly for new nickel boom

Pic: Getty

Poseidon Nickel looks to be timing its run to restart its West Australian nickel operations to perfection as the price of the base metal hits seven-year highs and big miners point to the huge amount of additional supply that will be required to meet forecast demand over coming years.

Managing director Peter Harold told the RIU Explorers conference in Fremantle last week that Poseidon (ASX: POS) is working towards making a final investment decision on bringing the Black Swan nickel project 50km north-east of Kalgoorlie back into production at around the end of 2021.

A day earlier, in handing down its half-year results for the six months to 31 December, BHP said it was now expecting nickel demand to quadruple by 2050 on the back of global decarbonisation efforts. Glencore’s forecast, delivered the same day Zurich time along with its full year results, is for a 3.7x increase in demand over the same period.

And on Friday, as other base metals leveraged to the electric vehicle thematic such as tin and copper performed strongly, the nickel price surged 2.4% to close at US$19,565 a tonne, its highest level since 2014.

“When I started in nickel 30 years ago, it was all about stainless steel and stainless steel had a compound annual growth rate of about 5% per annum since 1970,” Harold, who headed up another well-known ASX nickel play Panoramic Resources prior to joining Poseidon in November 2019, told the conference.

“Now you’re going to see this massive uptick and you’re going to see the nickel market go to 3 million tonnes (a year) very quickly and that’s off the back of continued demand for stainless steel but also this massive ramp-up in demand for nickel in batteries.

“It’s a great story and it’s great to be in nickel at this point in the cycle.”

While there is work to be done by Poseidon before a restart is confirmed, it would take someone with strong conviction to bet against the company arriving at a positive decision come the end of the year.

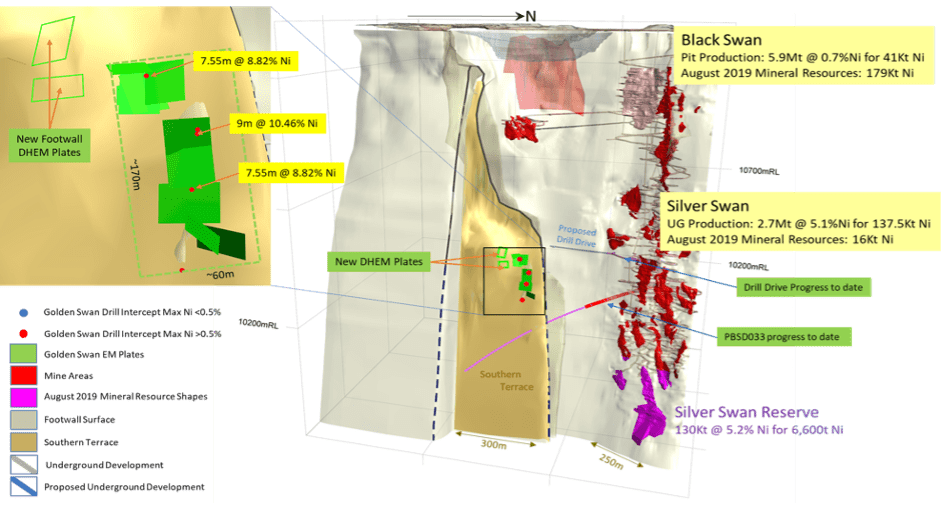

Black Swan, which Poseidon bought from Norilsk Nickel at the end of 2014, already has a 2.2Mtpa processing plant in good condition and contains 195,000 tonnes of nickel in resources including 16,000 tonnes grading 9.5% nickel at the Silver Swan underground and 179,000 tonnes in lower grade open pit and stockpiled material.

That resource figure looks set to grow materially following the discovery of a new zone of high-grade sulphide mineralisation, Golden Swan, at the project last year.

An initial intercept of 23.1m at 4.0% nickel and 0.4% copper from Golden Swan barely registered with the market as it was announced just as the COVID-19 pandemic hit and investors were still getting their heads around the likely impacts.

But follow-up holes producing intercepts of 9.0m at 10.46% nickel and 6.4m at 9.60% nickel were met with greater recognition and in combination with a rising nickel price, helped drive a solid appreciation in Poseidon stock through the back half of last year.

Those three intercepts were enough for the company to commit to developing a 440m drive from the Silver Swan decline across to Golden Swan to assist with the drill-out of a resource and to allow for further exploration of the Southern Terrace below Golden Swan.

The drive is expected to be completed at the end of March, at which time two rigs will start drilling. Poseidon anticipates publishing a maiden resource early in the September quarter, to be followed shortly thereafter by mine planning and reserve calculation.

Downhole EM surveying, a geophysical technique used to great effect to identify sulphide mineralisation, has shown up several additional conductors at Golden Swan that will also be tested in upcoming drilling.

“The Peppermint Grove of exploration”

As Harold explained in his conference presentation, Poseidon non-executive director and nickel expert Peter Muccilli has dubbed the Southern Terrace the “Peppermint Grove of exploration”, a reference to the riverside suburb that hosts some of Perth’s most expensive homes.

Stockbroker Morgans shares a similar view, suggesting that Golden Swan can rival Silver Swan in size if mineralisation continues down along the Southern Terrace in the same way as the Silver Swan channel.

“Golden Swan is a high grade >5% nickel orebody that is proximal to previous mine development and infrastructure,” the broker, which supported Poseidon in raising $10 million in December, wrote in a note to clients.

“It has the potential to be rapidly developed and generating $100 million plus in free cashflow in 12 months and to ultimately grow to a similar size as the world class Silver Swan orebody (150kt nickel).”

Poseidon plans to undertake an options study looking at either direct shipping ore from Black Swan to one of several nearby processing plants or restarting the Black Swan concentrator.

The company also intends to dust off the feasibility study incorporating the Silver Swan mineralisation and the low grade Black Swan open pit material that was completed in 2018.

“If you add Golden Swan into that feed regime, it creates another interesting opportunity in terms of what the project might look like as a mining and processing operation,” Harold said.

Concentrate from Golden Swan appears likely to find a ready market, with the unusually high iron-to-magnesium oxide (Fe:Mgo) ratio of >50:1 prompting plenty of enquiries when results from early metallurgical testwork were released in late November.

Other assets represent value

While Black Swan – and more specifically Golden Swan – will be the primary focus for Poseidon over the course of the year, the company also owns the Windarra and Lake Johnson nickel projects and Windarra gold tailings project.

Windarra provided the setting for the initial Poseidon stockmarket boom back in the early 1970s and later went on to be mined by WMC Resources. Over its life, the operation has produced 84,000 tonnes of nickel.

These days, it contains a resource of just over 140,000 tonnes spread across two deposits. There are several targets Poseidon would like to follow up along trend, but Windarra is playing second fiddle to Golden Swan in terms of exploration priorities.

Gold was also produced by WMC at Windarra and there remains a resource of 105,000 ounces in tailings on the site that Poseidon is looking to monetise.

In August last year, the company purchased the rights to treat an additional 62,000 ounces in tailings at Lancefield, 17km from Windarra, to beef up the tailings project and is currently completing a definitive feasibility study.

A positive outcome could mean a source of cashflow to fund the nickel restart strategy.

Poseidon is also assessing its options for the Lake Johnston nickel project, which has 52,000 tonnes in resource and a 1.5Mtpa processing plant that has been on care and maintenance since 2013.

The company undertook a restart study on Lake Johnston about five years ago, not long after it was purchased from Norilsk, but the project was put on hold when the nickel price collapsed.

That study has been dusted off recently and using the current nickel price, Harold said the project “looks quite interesting”.

“There’s more work to do there. There’s also quite a few geological targets to test. If you like at the strike length, there’s a number of different targets along 10km of strike that need to be followed up.”

“There is the potential for intrusive Savannah or Nova-style mineralisation and that’s one of the things we’d like to test if we had the time and money. But right at the moment the focus is on Golden Swan.”

Again, Lake Johnston could offer a means of funding a restart at Black Swan depending on the path Poseidon ultimately decides to take with the asset.

“It’s all about taking advantage of the current nickel price and the future nickel price outlook and that really means getting Golden Swan/Black Swan into production as soon as we possibly can,” Harold said.

This story was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.