Poseidon Nickel’s new CEO unveils bold strategy to navigate path to production

Pic: via Getty Images

Poseidon Nickel’s new CEO is tackling shareholder concerns head on with a strategy centred on key changes aimed at putting Poseidon in the best possible position for growth and the restart of the Black Swan nickel mine when the time is right.

Poseidon Nickel (ASX:POS) has recently introduced its newly appointed CEO, Craig Jones, and his vision for the company is nothing short of ambitious.

With almost three decades of operational and corporate experience, he brings a wealth of knowledge and a commitment to integrity and respect to the table.

In a letter to shareholders, Jones outlined his threefold strategy for Poseidon’s future, which includes developing a pathway to production, targeted exploration, and exploring new business development opportunities.

“My modus operandi is integrity, credibility and respect and I work hard to build mutually beneficial relationships with employees, business partners, traditional owners, investors and … our shareholders,” Jones said.

Significant progress has been made towards the restart of the Black Swan operations and while a financial investment decision remains on hold for the time being, the management team implemented some proactive initiatives at the corporate and project levels.

In September, the company revealed it had identified around $3m in cost savings annually and that it was making some personnel changes, which included Jones stepping up for the top job.

Addressing shareholder concerns, Poseidon is making changes to its remuneration structure, which Jones says shareholders will be advised of once finalised.

“In addition, the executives and key management personnel had all elected not to accept their STI incentive payments for FY23 in support of the difficult times the company and shareholders are experiencing,” he said.

The decision to forgo STI payments was made back in August.

Developing the path to production

The cornerstone of Poseidon’s strategy lies in gaining a comprehensive understanding of its orebodies at the Black Swan operations, which include Black Swan, Silver Swan, and Golden Swan.

Jones emphasised the critical need to ensure that the Poseidon team could produce on-specification concentrate on time and within budget, a pivotal factor in the success of the operation.

Significant resource definition drilling programs have confirmed the quality and quantity of the ore sources and materially increased the confidence in the resources.

“I am committed to building credibility and to delivering on what we say we will do. I do not intend to see us join the long list of projects in recent years that have struggled during ramp up and mine and process plant commissioning,” Jones explained.

“A supportive team with an educated shareholder base and a strong nickel price environment will give us every chance to succeed when the decision is made to restart.

“Preparing Black Swan for a restart will remain a key focus of mine and the executive team.”

Exploration is another key element of the strategy, and Poseidon sees significant potential for organic resource growth.

The company has identified multiple exploration targets on its tenements and is allocating well-prepared budgets to effectively grow the resource inventory.

“I am excited by what I see in relation to exploration targets and look forward to exploiting these opportunities and delivering value through the drill bit that should grow value and see our market capitalisation increase,” Jones said.

Business development and strategic positioning

Being strategically located within known nickel provinces, Poseidon’s nickel assets provide a unique opportunity for the company to process both its own ore and third-party feeds.

“I will be looking to leverage these assets to bring value to shareholders with potential business partners who can support growth with capital and/or additional feed,” Jones said.

While Poseidon’s primary goal is to position itself for production, it is also acutely aware of the unpredictable nature of the nickel market.

Economic and geopolitical factors can significantly impact nickel prices, making flexibility and adaptability key components of the company’s strategy.

Jones said Poseidon required a strong nickel price to move into production.

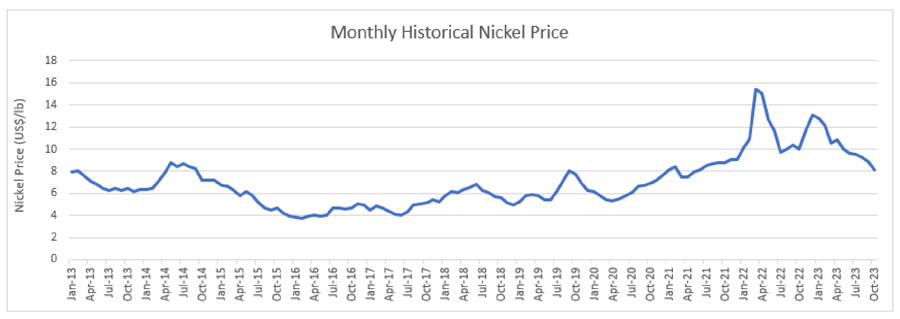

“In January 2013 the nickel price was around $US8/lb (~$12) and for the next eight years, until the start of the COVID19 pandemic in 2020, the price fluctuated between $US4/lb and $US9/lb with an average price over those eight years of around $US6/lb,” Jones explained.

While the nickel price now is around $US8/lb, close to where it was 10 years ago, Jones emphasised that operating costs to extract a unit of nickel continued to rise throughout the period.

This has led to the very high cost, and lack of availability, of labour, consumables and all the other inputs squeezing the margins of all nickel producers in Australia, even with the lower Australian dollar.

But market watchers are anticipating an uptick in the nickel price, with recent global events such as the war in Ukraine and unrest in the Middle East expected to influence the market positively.

Additionally, growing demand for nickel in electric vehicles, the increased scrutiny of Indonesia’s nickel production from an ESG perspective and the impact of the US Inflation Reduction Act add to the positive outlook for the nickel price.

Potentially adding another string to its bow, Poseidon is undertaking an historical assessment of the potential for lithium across its Western Australian tenements.

Validation of database records will be followed up with field reviews and an assessment with an expert in lithium exploration, a step not previously completed by Poseidon.

With metallurgical test work nearing completion, the expansion project test work demonstrating extremely high nickel recoveries of up to 96%, positive exploration results, and other opportunities, Poseidon is navigating the volatile nickel industry with a clear vision and a commitment to building a robust future.

“I am committed to growing Poseidon and will continue to lead the company as a credible and responsible explorer, developer, and ultimately, producer,” Jones said. “I will seek to grow our assets by focusing on value-add initiatives that will build on our strategic pillars.”

This article was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.