Poseidon attracts higher valuation on maiden Golden Swan resource, Silver Swan exploration upside

Pic: Getty

Research firm MST Access has raised its valuation on Poseidon Nickel after the emerging nickel producer released a promising maiden resource for the Golden Swan deposit.

MST Access analyst Michael Bentley believes Poseidon Nickel (ASX:POS) should be trading at 22c a share, valuing the company at around $650m, based on its recently released maiden Golden Swan resource and the exploration upside at Silver Swan.

While this is only a slight increase on Bentley’s previous valuation, it’s still more than double Poseidon’s current market valuation of 9c per share, or $270m.

Poseidon Nickel (ASX:POS) share price chart

In late October, Poseidon revealed it had added significant nickel tonnes to the high-grade inventory at its Black Swan project in WA with the completion of a maiden indicated and inferred resource for Golden Swan (GS) of 160,000 tonnes at 3.9% nickel for 6,250 tonnes of contained nickel.

This boosted the high-grade indicated resources at Black Swan to 219,000 tonnes at 7% nickel for 15,330 tonnes of contained nickel.

“GS has added 50% to the high-grade indicated resource and is only 120m from the drill drive POS completed last year and so will be easily mineable,” Bentley said in a recent research report update.

“The high-grade resource is an important part of the Black Swan restart strategy as it can be blended with the low-grade Black Swan material to enhance quality, increase recovered nickel tonnes and lower unit costs.”

Golden Swan was discovered in March 2020 after the first two holes hit high-grade massive nickel sulphides. Since then, drilling has confirmed the continuity of high-grade mineralisation at the discovery.

Bentley believes there is additional exploration upside within the Silver Swan (SS) Channel and around the Southern Terrace structure.

“We see further upside from SS resource infill and extensions as well as a revised Southern Terrace program,” he said.

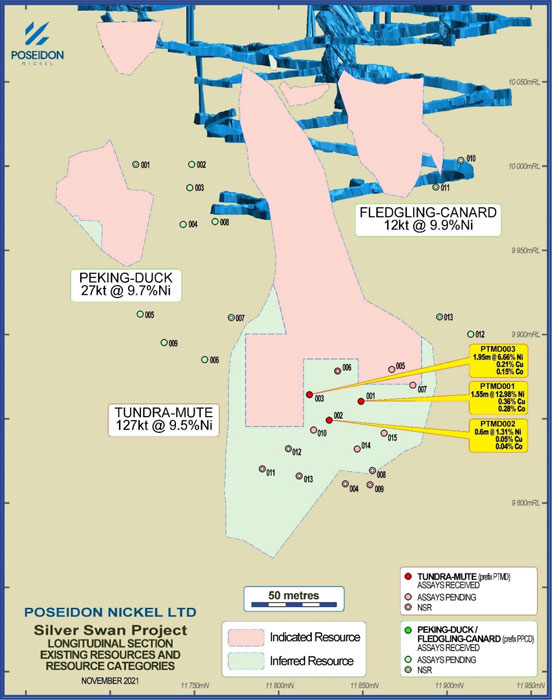

On Tuesday, Poseidon announced more high-grade intersections from resource extension and infill drilling at Silver Swan.

Significant intersections of massive and stringer nickel and copper sulphides have been logged, with assays pending.

“We are pleased to see some good hits within the Tundra Mute resource,” Managing Director Peter Harold said.

Poseidon is drilling at Silver Swan to increase the confidence in the resource, by converting existing resources from inferred to indicated, and to potentially find high-grade mineralisation outside the current resources.

Harold said these latest holes should assist in increasing the amount of material in the indicated resource category.

“We are also about to drill a couple of deeper EM holes and look forward to seeing whether the EM surveys detect any EM plates beyond the current extent of the known mineralisation.”

EM surveys will be conducted in holes already drilled at the Peking Duck and Fledgling Canard resources.

Once the current resource infill drilling program is completed at Tundra Mute, Poseidon plans to drill at least two deeper holes that will be used as EM platform holes.

Black Swan, which Poseidon bought from Norilsk Nickel at the end of 2014, already has a 2.2-million-tonne-per-annum processing plant in good condition.

In early September, a scoping study showed the most economically attractive option for a production restart at Black Swan was to refurbish the 2.2Mtpa processing circuit, derated to 1.1Mtpa and fill that plant to maximise nickel concentrate production.

Black Swan is on track for commissioning in December 2022.

This article was developed in collaboration with Poseidon Nickel, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.