PNX gains back Pine Creek uranium rights as clean energy takes centre stage

Pic: Getty Images

- Uranium rights over NT tenure returned to PNX after expiry of 10-year agreement

- Numerous previous drill hits of over 1% uranium

- Uranium prices reaching levels strong enough to incentivise new sources of supply

Special Report: PNX Metals is bolstering its portfolio with the return of the uranium rights over a large part of its landholding in the Pine Creek region of the Northern Territory – one of the world’s largest and richest uranium provinces.

PNX Metals (ASX:PNX) has received back the uranium rights over a substantial portion of its Pine Creek tenure in the Northern Territory with the expiration of a 10-year historic third-party agreement with Oz Uranium, a subsidiary of Rockland Resources.

The Pine Creek region is renowned as one of the world’s most prolific uranium provinces, hosting the Alligator River, Rum Jungle, and South Alligator Valley uranium fields.

The resurgence of uranium interest has been spurred by the global push towards clean energy and decarbonisation, and PNX’s strategic move to regain control of its uranium assets couldn’t have come at a better time.

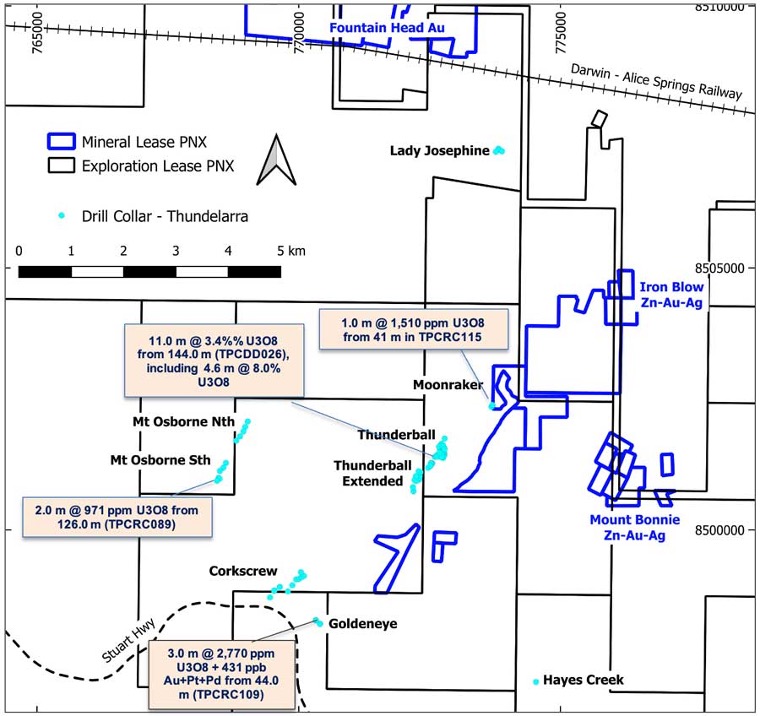

The Hayes Creek uranium tenure, which includes the Thunderball uranium deposit, as well as several nearby uranium prospects adjacent to PNX’s Hayes Creek zinc-gold-silver and Fountain Head gold projects, is now firmly back under PNX’s control.

“The return of uranium rights over PNX’s approximate 1,500 sq.km of exploration tenure in the Pine Creek region of the NT is well timed with recent increased interest in uranium and its role in energy decarbonisation,” managing director James Fox said.

“Previous explorer Thundelarra discovered the near-surface Thunderball uranium deposit, and advanced other greenfield uranium discoveries directly adjacent to PNX’s Hayes Creek zinc-gold-silver project.”

Thundelarra discovered numerous uranium prospects at Hayes Creek, with Thunderball being the most prominent, delivering thick and high-grade intervals from drilling like 15m at 1.5% U3O8 from 139m, including 1m at an impressive 20.3% U3O8.

“At the time of reporting in 2009, the exceptional uranium grades achieved at Thunderball were amongst the highest ever reported in Australia and highlight the significance of these returned rights to PNX and the pre-eminence of the Pine Creek uranium province,” Fox said.

Drilling at Thunderball culminated in the delineation of two discrete sub-parallel dipping uranium lodes and the estimation of a pre-JORC 2012 resource, which PNX plans to reassess to bring into JORC 2012 compliance.

Importantly, the deposit remains open down-dip, and no exploration has been conducted beneath the lower lode.

Thundelarra also reported high-grade results at other nearby prospects on PNX’s ground, including the Corkscrew Prospect where surface samples returned grades of up to 17.6% 3.5km to the southwest of Thunderball, demonstrating the vast uranium potential in the Pine Creek region.

PNX is now in possession of all exploration data, drill core samples, and assay pulps.

2008 and 2011 in relation to PNX’s existing projects.

A nuclear boom on the horizon

With uranium prices on the rise and increased global interest in nuclear power as a means to achieve cleaner energy, PNX’s regained control over their uranium assets represents a strategic advantage in a burgeoning market.

This move positions the company to potentially generate significant shareholder value through exploration or commercial transactions.

Uranium spot prices briefly hit decade-long highs of $US63/lb after the Russian invasion of Ukraine sparked fears of a uranium supply crisis in April last year. They’ve since run even further this year to $US74/lb, closing on levels strong enough to incentivise new sources of supply.

And experts think the outlook is brighter than at any time in the past 15 years.

The world has shaken off the funk of Fukushima, and sentiment for uranium is growing, with nuclear reactor lives extended across the West and new builds flourishing in China to help meet Net Zero by 2050 and 2060 deadlines.

But actual replacement contracting from power plant owners is rising, likely to hit double the level of contract signings this year than there were last year.

At the same time, major suppliers in Canada and Kazakhstan are struggling to ramp up production to full levels due to labour shortages, while a coup in Niger has threatened a major yellowcake source to Western Europe, making politically stable Namibia a clear growth region for a blossoming industry.

As the world transitions towards cleaner energy sources, uranium is regaining its status as a critical component of the energy mix. Pine Creek’s re-emergence as a key uranium province, and PNX’s timely reacquisition of its uranium rights, underscores the potential for substantial growth in this sector.

This article was developed in collaboration with PNX Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.