‘Plenty of upside’: Rimfire’s David Hutton says FY24 is just the start of its exploration story

Rimfire, Rio and Sunrise are looking at NSW as a potential world supplier of scandium. Pic via Getty Images

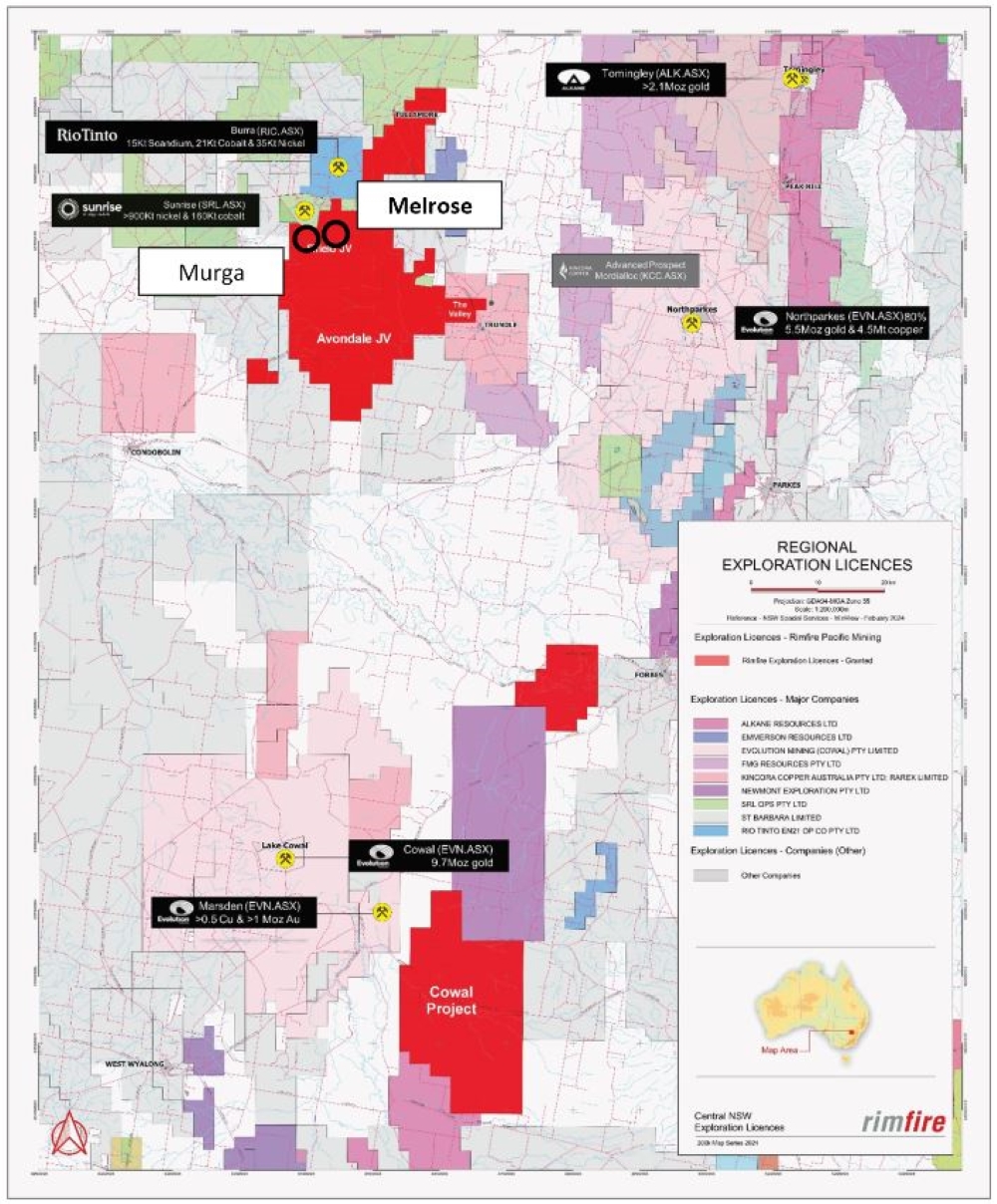

- Rimfire has eyes on scandium, cobalt and copper across its NSW projects

- The FY24 top performer has kicked off drilling at Broken Hill

- Fifield’s scandium can fill an Australian production gap

Rimfire Pacific Mining was FY24’s top small cap gainer, so we spoke to its chief, David Hutton, about investor interest, scandium and cobalt, and why its stock has risen 700% over the past 12 months and how that’s helped exploration efforts across the company’s project portfolio.

“About two and a half years ago Rimfire Pacific Mining (ASX:RIM) pivoted to critical minerals while looking for platinum group elements, concentrating on cobalt, scandium and copper in NSW’s East Lachlan Ford Belt,” RIM CEO David Hutton told Stockhead.

“We started to understand we were sitting on some special ‘Alaskan-style’ ultramafic rocks, which we found had several advantages as a source rock for historical alluvial platinum deposits.

“When those rocks weather, you get strong concentrations of laterite-hosted nickel and cobalt mineralisation – but you also get strong, up to 5-10x the average concentrations of scandium elsewhere.”

READ MORE: FY24 Resources Winners: REEs, niobium and gold explorers vie for the podium

Scandium supply

Scandium has unique properties that increase the strength of aluminium – intrinsic to the next generation of products such as aircraft, military applications and new and upcoming tech.

“The biggest problem with scandium is that supply is constrained by geopolitics,” Hutton said.

“The West is extremely reliant on the East for production and our belief is that if we can generate a long-term, secure supply of scandium it will unlock the constraints and growth of its use in the market.

“While it’s found as a by-product, there’s no single, standalone production of it in the world and anything above 100ppm Sc is considered to be globally significant… our grades at Fifield are typically around the 300-500ppm at Melrose alone.”

There’s a growing recognition of scandium. In fact, Rio Tinto (ASX:RIO) set up a dedicated scandium division about 12 months ago and purchased a scandium-laden deposit from Platina Resources (ASX:PGM) just last year, with Sunrise Energy Metals (ASX:SRL) looking to its own scandium endowment.

“It’s literally at our back fence and we’re now busy drilling and proving up a maiden JORC resource at our own tenure as we speak,” Hutton said.

“It’s just the beginning.”

A maiden resource is due to be revealed this quarter for both the Murga and Melrose prospects.

That’s because Murga appears to be different from other scandium occurrences in the district, which, Rimfire says, are “intimately associated with nickel and cobalt mineralisation”.

“While we remain firmly focused on delivering a maiden scandium resource at Fifield and Avondale, we are also keen to advance our highly prospective Broken Hill project, especially the Bald Hill prospect,” Hutton said.

Bald Hill’s cobalt

While the scandium is getting a lot of interest, Rimfire is also going gangbusters at its Bald Hill cobalt play, part of its Broken Hill project. And while the explorer admits prices are depressed, the long-term view is that the cobalt mineralisation can add significant value to its portfolio.

Rimfire’s Broken Hill project lies within same geological domain as Havilah Resources’ (ASX:HAV) 191Kt copper, 20Kt cobalt and 86Koz gold Mutooroo deposit and Cobalt Blue Holdings’ (ASX:COB) 87Koz Broken Hill cobalt project.

A 1000m diamond drill campaign is ongoing at Bald Hill, testing for extensions to high-grade intercepts it discovered in September last year that showed best hits of 33m at 0.11% Co from 58m in FI2469, including 4m at 0.23% Co.

“Given the existing drill intercepts coincide with an outstanding magnetic anomaly along strike and with all targets lying within a favourable geological setting, we think that Bald Hill is an exciting opportunity to discover a significant cobalt and copper deposit,” Hutton said.

At time of writing, Rimfire announced it hit into similar sulphides at Bald Hill, with two out of six diamond holes now completed.

They’ve been identified in the first two holes of the current campaign, about 100-200m away from previous high-grade cobalt intercepts and show some major, visible signs that the company has the potential to unlock more mineralisation.

“The Bald Hill prospect continues to grow with broad zones of great-looking sulphides intersected in the latest step out holes,” Hutton said.

“The diamond drilling is helping our geologists build a detailed model for the prospect and we look forward to seeing what the rest of the program delivers.”

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.