Pilbara Minerals to become global hard rock lithium player with $560m buyout of Latin Resources

The potential acquisition of Latin Resources would position Pilbara Minerals as a global lithium producer. Pic via Getty Images.

- Purchase price for 100% of LRS shares at 20c per share for $560m

- Buyout represents 57% premium to LRS’ 10-day VWAP

- Acquisition to provide PLS with exposure to US and European markets

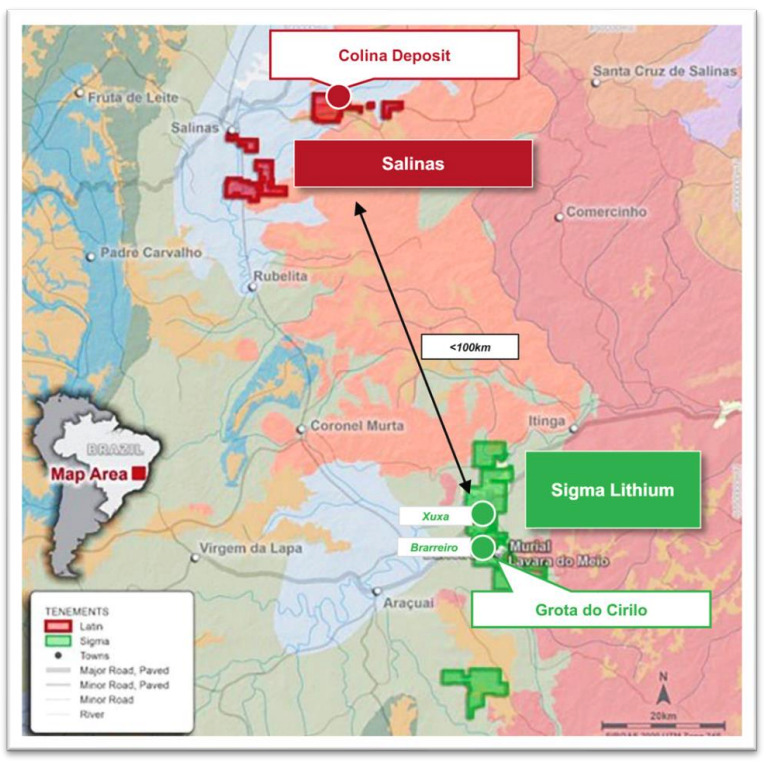

Special Report: WA hard rock lithium miner Pilbara Minerals has stunned the market with the purchase of Latin Resources and its 70Mt Salinas deposit in Brazil for $560m to become a global miner.

Latin Resources (ASX:LRS) flagship Salinas lithium project has the potential to make a significant contribution to Pilbara Minerals (ASX:PLS) by immediately adding ~20% to PLS’ resource base and up to ~30% of production if Salinas fully ramps up to 499,000tpa at 5.2% Li2O over an initial mine life of 11 years.

Running costs of production at Salinas is regarded as on par of that of PLS’ Pilgangoora operation in Western Australia.

PLS says it “will consider any project timing against the prevailing lithium market conditions as undertaken historically with previous production expansions and enables Pilbara Minerals to leverage its strong balance sheet and proven technical expertise to de-risk and further optimise Salinas’ project execution”.

The nitty gritty deal details

LRS shareholders will receive 0.07 new PLS shares for each LRS share held and will own ~6.4% of PLS shares upon implementation of the scheme.

That will give LRS shareholders exposure to a diverse range of benefits, including significantly increased liquidity, enhanced access to capital markets and inclusion in relevant ASX & global indices.

The buyout is based on Pilbara Minerals’ closing price of $2.85 per share on August 14 and the transaction implies a value of ~20c per LRS share.

That represents a 57% premium to LRS’ 10-day volume-weighted average price (VWAP) of 12.7c and a 32% premium to the 30-day VWAP of 15.1c.

“This acquisition is on-strategy, diversifying the business with what we believe is a counter-cyclical, accretive extension that further builds out our position as one of the leading lithium materials suppliers globally,” PLS managing director Dale Henderson says.

“It will deliver our second 100%-owned, Tier 1, hard rock lithium asset, which is expected to be low-cost and accretive for our shareholders.

“It provides us with optionality to sequence new supply and diversify into new growth markets for lithium such as Europe and North America.

“The acquisition follows an extensive period of project assessment globally in which we rank LRS’ Salinas project at the top of our list when benchmarked holistically across a range of key criteria.

“Further, a comprehensive due diligence period has been conducted over the past six months which has built-out our understanding of the asset and the region’s potential.

“Importantly, the acquisition leverages Pilbara Minerals’ capability in hard rock lithium resource delineation, project development, operations and marketing experience.”

The upside for LRS holders

As part of the proposed acquisition, Latin Resources shareholders can expect several benefits as laid out by the boards of the two companies.

Benefits include an “immediate upside” due to the attractive premium seen in Latin’s recent trading prices and the continued exposure to Salinas’ development through being a shareholder of Pilbara Minerals (Latin Resources shareholders will roughly represent 6.4% of the pro-forma entity).

Perhaps most beneficial is Salinas’ funding and development risk can be significantly mitigated due to Pilbara Minerals’ strong balance sheet, cashflow from Pilgangoora and company expertise.

“In addition to delivering an attractive premium, this transaction allows Latin Resources shareholders to retain ongoing, but significantly de-risked, exposure to the development of Salinas as part of a larger, more diversified enterprise with a strong balance sheet, cashflow generation and technical expertise, all of which will support the successful development and operation of Salinas,” Latin Resources managing director Chris Gale said.

“I was very pleased to be asked to commit to continue to work with Pilbara Minerals to advance the Salinas project towards production and I’m excited about the future prospects for our project in Brazil when combined with Pilbara Minerals’ existing asset base.”

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.