PhosCo shares keep climbing following major phosphate resource upgrade

Pic:Getty

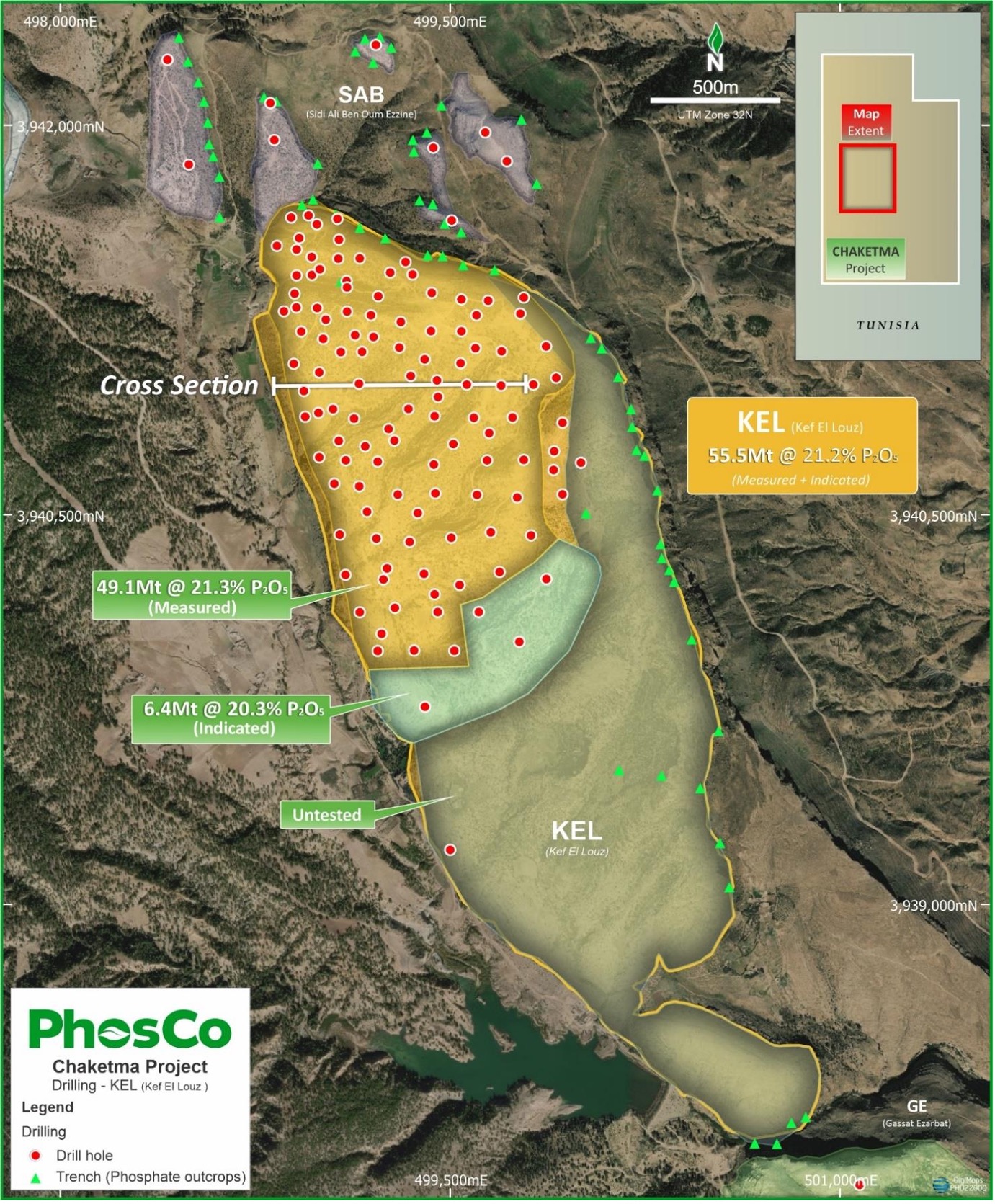

PhosCo has delivered a 50% increase in its KEL mineral resource, in a major step towards the start of feasibility studies at its Chaketma Phosphate Project in Tunisia.

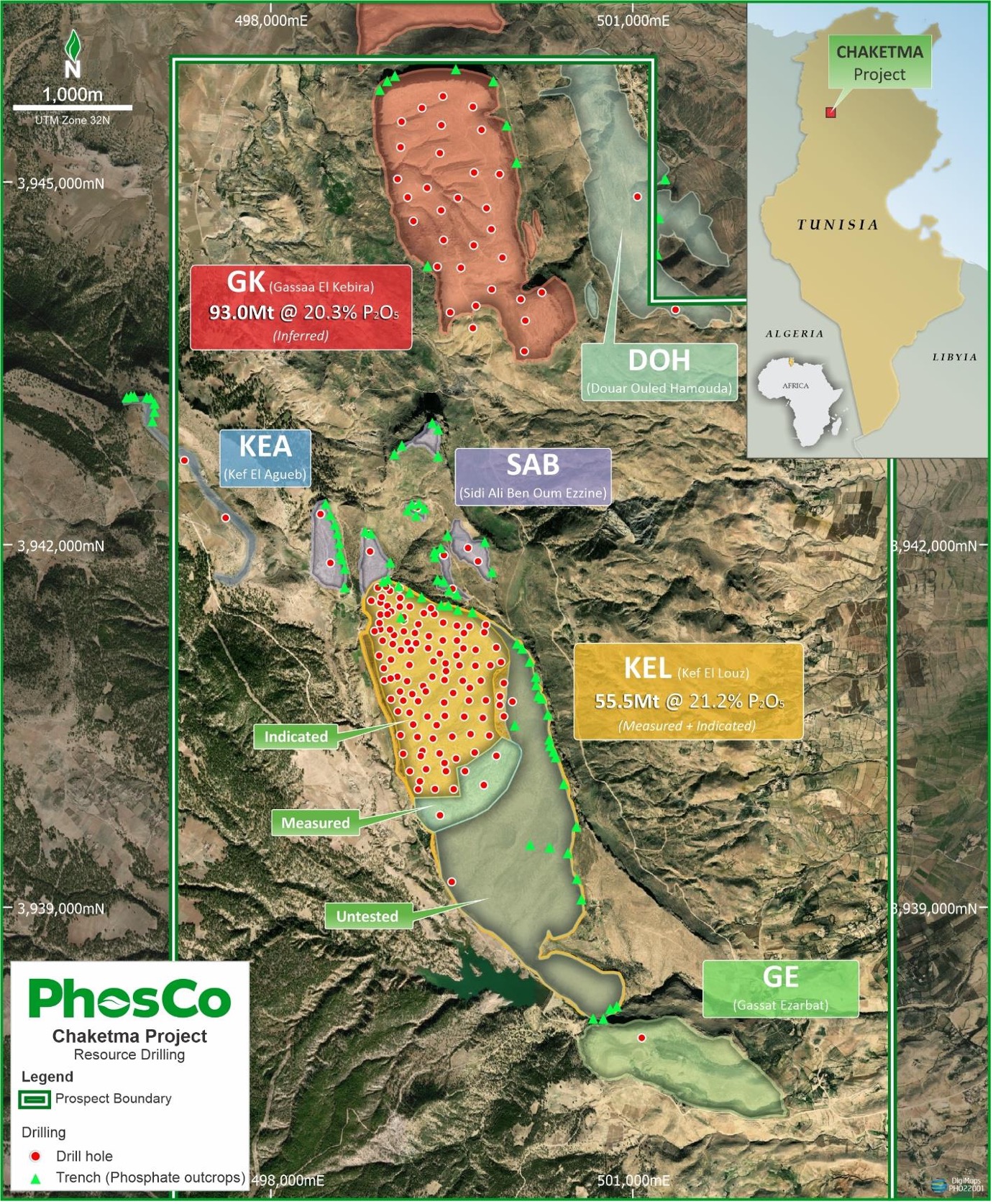

PhosCo (ASX:PHO) is celebrating the material uplift in tonnes to 55.5Mt at 21.2% P2O5 at KEL, one of two major deposits at Chaketma, which now has a total resource of 148.5Mt at 20.6% P2O5.

Not only has the tonnage increased, but the resource has been moved from Inferred to the higher Measured and Indicated categories.

Those resources can be converted to ore reserves, paving the way for mine feasibility work to begin, with a gap analysis on the steps before a BFS can be completed due in the second quarter.

Already PhosCo is talking up the potential of a 30-year mine life at an initial production rate of 1.5Mtpa.

Upside potential

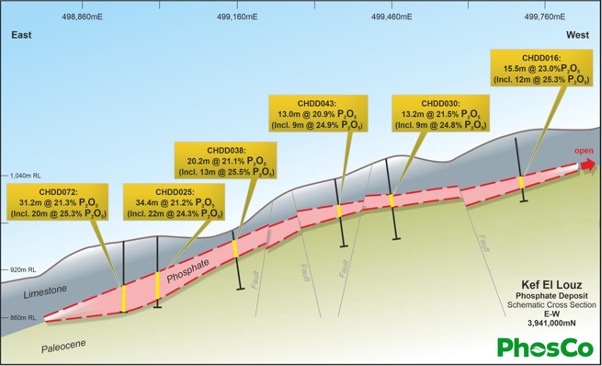

KEL is now a large, shallow and high-confidence resource with simple geology, exposed on all sides due to its flat-topped Mesa-like topography.

Even after the upgrade in the KEL resource size and confidence, just 47% of the surface area of the known KEL mineralisation is covered by drilling, showing there is plenty of upside to come.

An updated mineral resource is also due soon for the even larger GK deposit, which contains an Inferred resource of 93Mt at 20.3% P2O5.

“We’re excited to see such a significant step-change at the KEL phosphate prospect,” PhosCo executive director Taz Aldaoud said.

“Not only has the size of the resource increased substantially, but equally positive is the enhancement in confidence of the resource thanks to a large conversion of tonnes into the Measured & Indicated category.

“There’s plenty of upside at this deposit with drilling to date covering just less than half of the surface area of known KEL mineralisation.

“Work is now underway to deliver an upgrade at the neighbouring GK deposit.”

What’s next?

The end game is to rapidly advance Chaketma towards production, with PhosCo’s location in North Africa setting it up to become a key supplier to Europe’s agricultural market.

90% of the world’s rock phosphate reserves are situated in just five countries, China, Morocco, South Africa, Jordan and the USA.

Export restrictions and tariffs against producers like Morocco and Russia have highlighted the need for more diversity in the supply chain given phosphate’s essential role as a crop fertiliser.

With the expanded resource now in the books, PhosCo has a number of key work programs to progress its plans in 2022.

They include metallurgical test work to optimise recoveries from each layer of its mineral resource, and mining extraction and pit design to move towards the estimation of ore reserves.

Further drilling is also planned over the more than 50% of the KEL prospect not yet included in the resource, with about 130 drill holes believed to be needed to provide a similar drill density.

An exploration target will be considered before drilling begins.

The GK mineral resource update will also be a major step, with an additional 21 holes to be included on top of the 10 used in its last update nine years ago.

This article was developed in collaboration with PhosCo, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.