PhosCo eyes scoping study for Chaketma Phosphate project as prices hit US$320/t

A mineral resource upgrade and scoping study for the project are expected to be released in the near-term. Pic: Aaron Horowitz / The Image Bank via Getty Images.

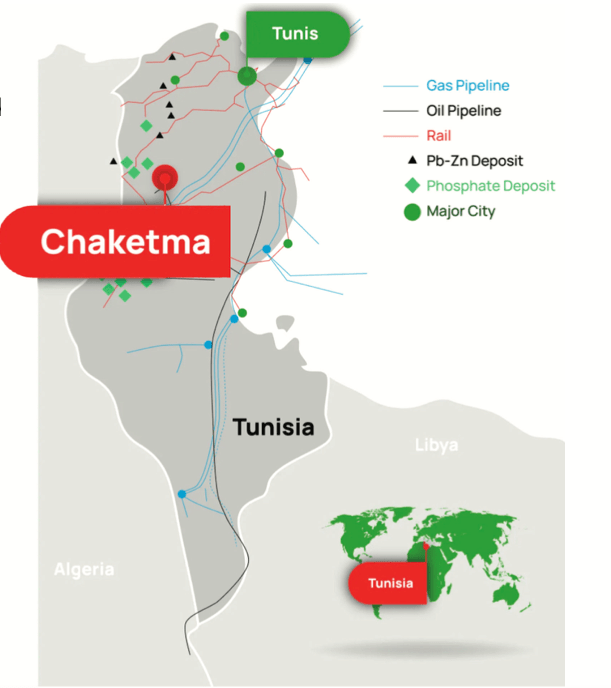

PhosCo has its sights set on releasing an updated scoping study for its Chaketma Phosphate Project in Tunisia in the coming weeks.

Just last week the company lodged the economic and financial study to develop the Project with the Tunisian Government, which demonstrates the financial capability to finance the project and represents the final element of an application for the Chaketma Mining Concession.

And the timing couldn’t be better. Phosphate is a critical fertilizer that underpins the world’s food supply, and with growing demand for food globally, the price has risen from US$88/t in February 2021 to US$320/t.

Chaketma contains JORC compliant Resource of 148Mt at 20.6% P₂O₅, defined from drilling at only two of the project’s six prospects – and a significant amount of drilling and technical work has been completed since this Resource was defined.

PhosCo (ASX:PHO) is planning to release a Mineral Resource Upgrade at the GK prospect, which will inform the scoping study – which will also determine the work required to complete a BFS for Chaketma ahead of securing development funding.

Soaring demand for rock phosphate

The demand for phosphate is so extreme that the European Union has even declared phosphate a critically strategic commodity.

This is also due to the conflict in Ukraine, which has further exacerbated the crisis, as both Ukraine and Russia are key players in the fertilizer market.

Phosco says record prices combined with positive early engagement with both the Tunisian Government and investment banks, provide an exciting backdrop for the company as its development plans gain momentum in country.

On the doorstep of Europe

Not to mention, Chaketma is located in Tunisia, the northern most country of Africa, making it close to key export markets with Europe right on its doorstep.

The capital of Tunis is 210km away by sealed road and the nearest railhead is just 35km away offering a connection to two ports.

Gas and power are nearby, and various research organisations have been engaged to consider wind, solar and treatment routes as a part of the company’s ESG strategy.

This article was developed in collaboration with PhosCo Ltd, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.