Peloton says Kaiser’s a compelling buy on Maldon gold potential

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Peloton Capital believes that Kaiser Reef’s (ASX:KAU) recent start of a two-month, in-mine exploration drilling campaign at the Maldon Goldfield is especially compelling.

The private equity firm, which had rated the company as a Buy with a target price of 90c in February, said its belief was because modern exploration concepts that discovered high-grade fields such as Fosterville in the Victorian Goldfields had yet to be applied to the Maldon Goldfield.

Shares in Kaiser are currently trading at 25.5c.

And it is not hard to see why Peloton is excited given that Fosterville produced 640,467 ounces of gold at an astounding average head grade of 33.9 grams per tonne (g/t) for its owner Kirkland Lake (ASX:KLA).

Peloton noted that while localised geology differs somewhat, both projects occur geologically in the Bendigo Zone adjacent to similar structurally important faults extending to the basement.

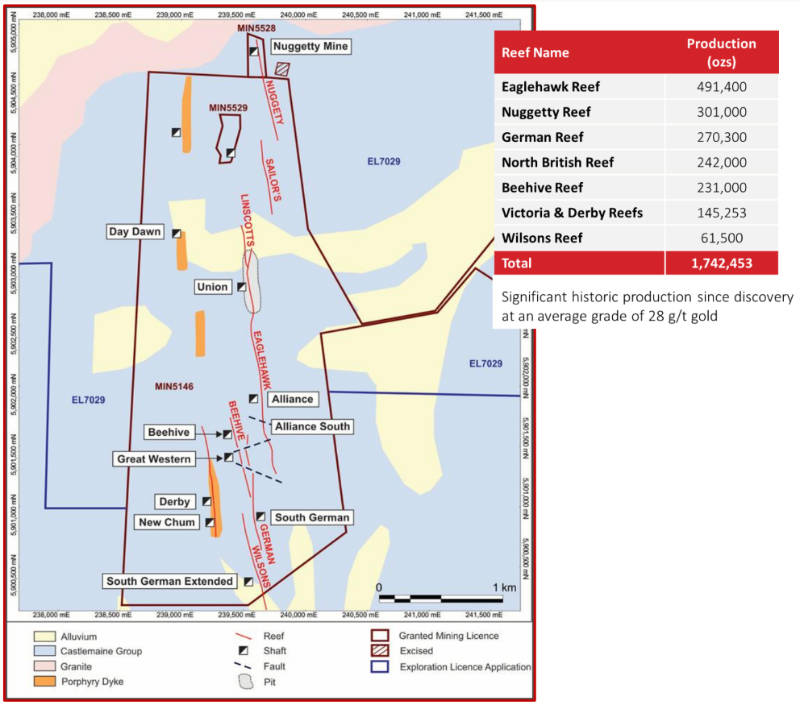

It added that while Maldon had historically produced more than 1.75Moz of gold at nearly 1 ounce per tonne (28g/t) from a series of still open plunging shoots – that were demonstrated by multiple unmined high-grade intercepts – it had not seen any significant production since the mid 1800s.

To top it off, Maldon also contains what is possibly Australia’s highest grade historical gold mine, Nuggety Reef, which produced 301,000oz of gold at 187g/t.

Kaiser also benefits from operating within the modern Union Hill decline that was developed in the 1990s.

This decline provides it with established air, power and water services while allowing drilling to test multiple high grade shoot extensions within close proximity to existing workings.

The company has already flagged that it will drill an initial 20 holes and may extend the program based on its results.

Highly prospective

Peloton had previously applauded Kaiser’s acquisition of the portfolio of assets that include the Maldon Goldfield and processing plant along with the A1 gold mine.

Besides elevating the company straight into the producing ranks, it also included 50sqkm of prospective exploration ground.

The firm noted the acquisition was a “very rare opportunity” and was a near “perfect fit” with substantial upside potential.

It added that its target price did not fully consider all opportunities open to the company over the next 12 months to define resources and increase production.

The Maldon processing plant is also the only licenced operating facility in the area, placing Kaiser in the strong position to either consider approaches from third parties for toll treatment of their ore, or potentially acquiring these ‘stranded’ resources.

Furthermore, its location adjacent to the Union Hill and Nuggety Mines places it in a strategic position to receive any ore mined from these operations in the near to medium term.

Peloton also pointed out that while the plant has official throughput capacity of 150,000 tonnes per annum, current throughput from the A1 mine is far less than that, allowing the company to treat more ore at minimal cost.

Recent developments

Besides the recent start of diamond drilling within the Maldon Goldfield, drilling at the A1 Mine has also returned narrow bonanza grades such as 0.2m at 802.9g/t gold and 0.2m at 105.1g/t gold along with hits such as 2.4m at 33.1g/t gold that have delineated the positions of the currently mined reef systems.

This article was developed in collaboration with Kaiser Reef, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.