Peep This: Latin Resources secures Peep O’Day project to bolster NSW gold portfolio

Latin Resources is getting a bit of local action, securing a solid gold prospect in New South Wales. Pic via Getty Images

Latin Resources is all in on lithium in Brazil, but the emerging explorer has secured a promising gold prospect in New South Wales’ exciting Lachland Fold Belt to bolster its gold portfolio.

Latin (ASX:LRS) will issue 6 million shares to exercise its option with Mining and Energy Group and it’s no surprise to see why.

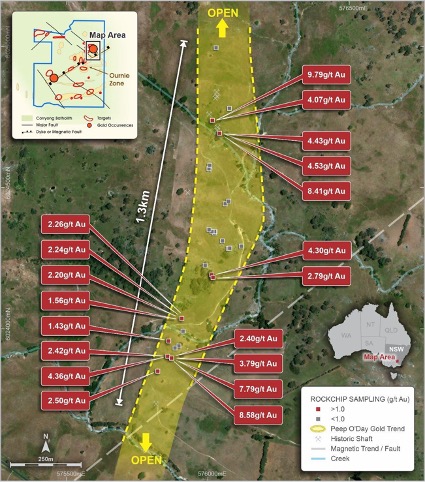

Previous exploration has highlighted the prospectivity of the tenure, confirming a high-grade gold structure over a strike extent of around 1.3km.

Outcrop sampling by Latin at Peep O’Day during its option period has lit the place up like a Christmas Tree – and samples of 9.79g/t, 8.58g/t, 8.41g/t and 7.79g/t gold are nothing to sneeze at.

That early exploration initiative has helped Latin really zero in on the good stuff at Peep O’Day as well. It will only be acquiring the southern portion of the Yarara tenement, where those significant gold grades occurred.

With the less prospective northern portion carved out and returned to the vendor, Latin has less but more fertile ground to manage as it resubmits applications for first pass drill testing with the change of ownership.

Time to focus

It is no secret that Latin’s focus lies outside of gold, with a JORC resource due soon from its Salinas hard rock lithium project in Brazil where it has been drilling an impressive looking pegmatite.

It is also working hard drilling out the world class Cloud Nine halloysite-kaolin deposit in WA, where it already has a JORC 2012 inferred mineral resource of 207Mt of kaolinized granite, including a sub-domain of 50Mt at 6% halloysite making it one of the largest undeveloped deposits of the material in the country.

This latest addition at Peep O’Day is one of five projects Latin controls in the Lachlan Fold Belt, home to some of Australia’s largest gold and copper mines, with the Manildra, Burdett and Boree Creek projects all sitting within an area triangulated by the massive Cadia, Northparkes and Cowal mines.

Latin says Its recognised strike and grade potential has led to discussions around divesting it, and other non-core assets, with a number of third party groups already in talks.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.