Pathfinder boss plots course for success, shares head north

Pic: Tyler Stableford / Stone via Getty Images

Special Report: Experienced mining executive Shannon Green is two for two when it comes to successfully recapitalising junior ASX-listed explorers and resetting them back on the path to success.

Having previously been brought in to help revitalise Africa-focused bauxite and gold explorer Lindian Resources (ASX:LIN), Green is now off to a good start with rebranded and relisted gold and iron ore junior Pathfinder Resources (ASX:PF1).

He was appointed to the role of executive chairman of Winmar Resources (ASX:WFE) in March this year to turn the company’s fortunes around.

And Green and his team did exactly that, with the successful raising of the maximum $6m the company was chasing in its IPO and completion of the acquisition of the high-grade King Tut gold and cobalt project in Argentina.

Winmar, starting its new life as Pathfinder Resources, lit up the ASX boards in early November and hasn’t looked back.

Since its debut Pathfinder has climbed 37.5 per cent, hitting 27.5c this week.

Pathfinder Resources (ASX:PF1) share price chart:

Green, who was recently appointed managing director of Pathfinder, has amassed over two decades of experience in resource development and mining operations having managed several major resource project developments and mines, including a number of Australia’s largest iron ore operations.

He has worked for some big names like Western Mining, Rio Tinto (ASX:RIO), Mineral Resources (ASX:MIN)and South Africa-headquartered Gold Fields.

Green’s extensive experience includes having taken several projects from feasibility through development, commissioning and into operation.

Not afraid of a challenge

Green has spent a great deal of his mining career in western and central Africa.

“I’m not shy of going into some of these more challenging jurisdictions,” he recently told veteran mining journalist and Stockhead Garimpeiro columnist Barry FitzGerald.

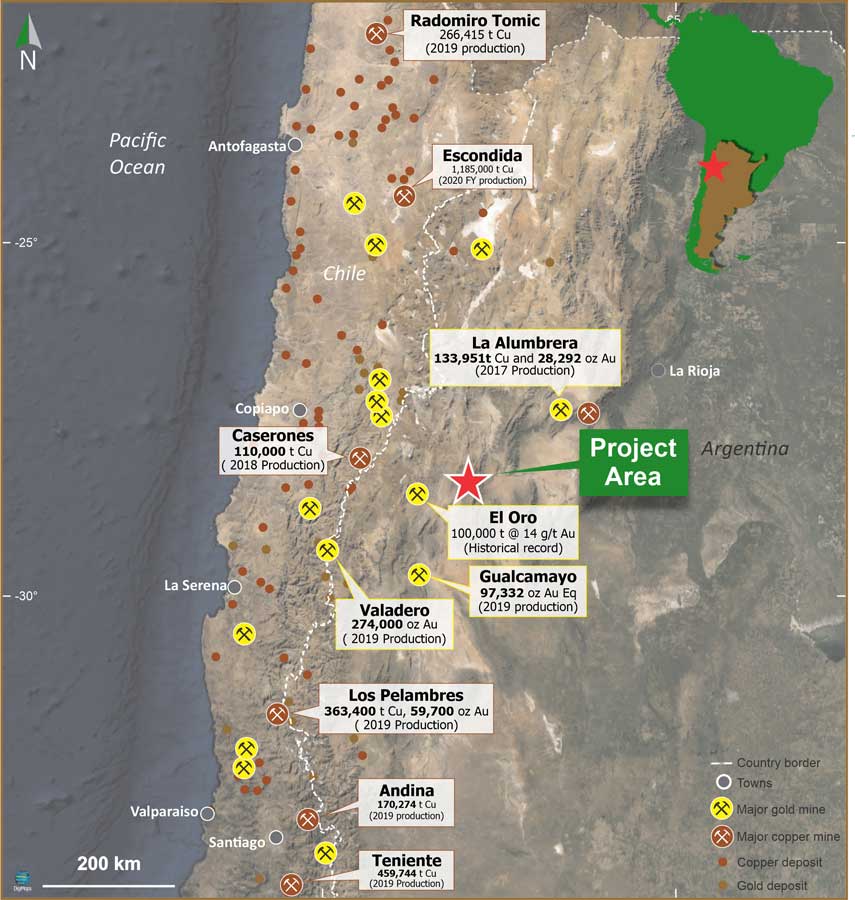

So it is only fitting that Green’s new venture is zeroing in on high-grade gold in Argentina — a very underexplored, but highly prospective country.

Argentina is geologically similar to Chile, where mining is a major driver of the economy, but Argentina – which spans 2.8 million square kilometres, making it the second largest country in South America – has witnessed significantly less exploration than its coastal neighbour.

The Argentine government wants to change that and has been proactively promoting the country as a favourable mining jurisdiction to foreign investors.

Pathfinder’s King Tut project is located in a region well known for its gold mining and sits not far from Barrick Gold’s Veladero mine, which produced 550,000oz of gold in 2019.

The Gualcamayo mine, which is owned by Colombian company Mineros S.A. and regularly produces more than 100,000oz of gold a year, lies to the south, while across the Chilean border to the north-west lies the Cerro Castle project, which contains 23 million oz of gold in reserves.

The historic King Tut mine produced gold and cobalt at grades of up to 28 grams per tonne (g/t) gold and 2.85 per cent cobalt from both surface and underground workings.

Samples collected from the project area in 2018 and 2019 confirmed the significant historic grades, with assays returning up to 37.03g/t gold and 2.56 per cent cobalt from mineralised veins and historic stockpiles.

Pathfinder has started field work following the recent appointment of Argentina-based contractor Condor Prospecting to undertake the initial geological and exploration program.

The goal of the current program is to identify along strike extensions and other mineral occurrences near the King Tut workings through detailed geological mapping and surface sampling.

With Pathfinder’s focus firmly on advancing the King Tut project, it has mapped out a busy 12 months as it works as quickly as possible to define a JORC-compliant resource.

The company is aiming to start drilling in the first quarter of next year, subject to COVID restrictions in South America, to deliver a resource within its first year.

Iron ore definitely not forgotten

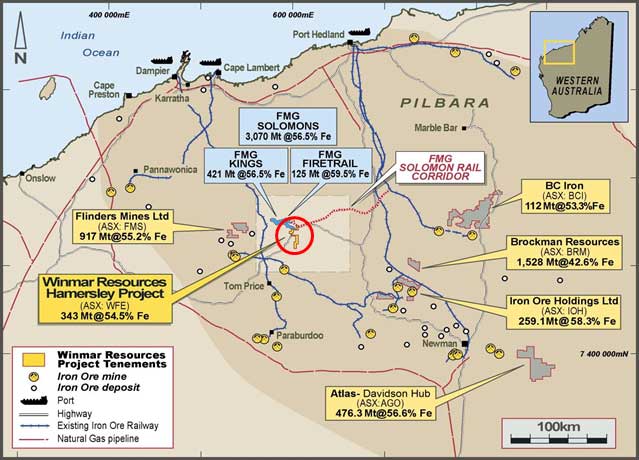

Even with its new start in Argentina gold, Pathfinder is still hanging onto its advanced Hamersley iron ore joint venture with Cazaly Resources (ASX:CAZ) in WA.

And what better location to have an iron ore project than in the heart of the state’s highly fertile Pilbara region, surrounded by operating mines and critical infrastructure.

The Hamersley project, which is 70 per cent owned by Pathfinder, sits 50km northeast of the mining town of Tom Price, immediately south of Fortescue Metals Group’s (ASX:FMG) Solomon project and north of Rio Tinto’s (ASX:RIO) rail network.

Now is a great time to be advancing an iron ore project, with prices this week closing in on an eight-year high of $US150 ($202) a tonne.

The continued run in iron ore prices has been driven by China’s infrastructure-led recovery and rapidly declining stockpiles at Chinese ports.

Pathfinder’s Hamersley is an advanced project that already has an indicated and inferred resource of 343.2 million tonnes at 54.5 per cent iron.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

By moving resources into the indicated category, it means a company has sufficient information on geology and grade continuity to support mine planning.

Hamersley sits on a granted mining lease and has in place heritage agreements and completed baseline environmental studies.

Around 20,000m of drilling has been undertaken, but there is still plenty of exploration upside with the potential for additional resource tonnes with further drilling.

Pathfinder is also investigating its options for a higher grade, direct shipping ore (DSO) project.

DSO refers to minerals that require only minimal processing such as crushing before they are exported, which keeps costs low. These iron ore products also fetch a premium price on market.

This article was developed in collaboration with Pathfinder Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.