Panther snares another battery metals opportunity

Pic: Getty Images

Panther Metals has expanded its battery metals portfolio with the addition of two new exploration licences prospective for nickel sulphides just 10km northeast of its flagship Coglia nickel-cobalt project.

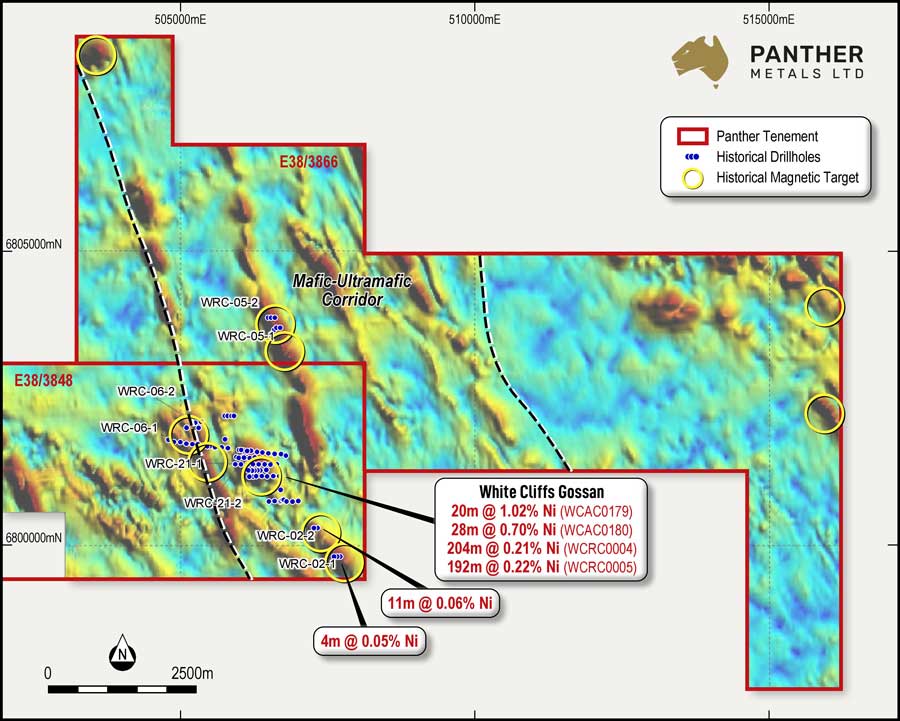

Panther Metals (ASX:PNT) saw an opportunity to peg 84sq.km in the mineral-rich Laverton region of Western Australia that covers a prospective mafic-ultramafic corridor, including the historic White Cliffs Gossan, and where previous drilling intersected high-grade nickel.

The company is particularly interested in 11 magnetic targets within the project area, five of which have had surface sampling carried out over them, with the other six having been lightly tested mostly via aircore drilling.

This earlier drilling intersected near-surface nickel mineralisation, which was evident in hits like 20m at 1.02% nickel from 12m and 28m at 0.7% nickel from 8m.

“We are very pleased to further expand our Western Australian battery metals portfolio with the low-cost addition of the Marlin nickel project through opportunistic pegging,” managing director Daniel Tuffin said.

“The potential for the Marlin nickel project to host nickel sulphide mineralisation is well documented and diversifies the company from its current focus on the nearby laterite-hosted Coglia nickel-cobalt deposit.

“The substantial amount of historic exploration by well-respected industry peers gives us a solid foundation to generate targets for drilling and exploration at Marlin. We look forward to getting on the ground once tenure is granted.”

Best of both nickel worlds

With the rapid rise in the electrification of the globe, which has driven the massive increase in demand for nickel in batteries for electric vehicles, the sector will require all types of the metal to meet forecast demand.

While nickel laterites tend to be large, low cost and make up the larger share of the world’s resources, production from sulphides boasts fast processing times, a higher concentration in orebodies and hits ESG markers through its less intense energy requirements.

If Marlin delivers on its nickel sulphide potential, that gives Panther exposure to both types of nickel and the best of both worlds.

The company has already demonstrated high nickel recoveries of over 92% from its Flagship Coglia Nickel-Cobalt project, which sits just 10km from the new Marlin project, using a high-pressure acid leach (HPAL) process.

HPAL, which has been in use since 1961 and is increasing in use, is the process used to extract nickel and cobalt from laterite ore bodies.

The process can quickly leach nickel and cobalt from laterite ores compared to traditional leaching methods, which are more time-intensive and result in lower recoveries.

Marlin’s exploration past

The project occurs along the eastern edge of the Laverton Greenstone Belt, however, due to the absence of outcrop and a blanket of recent cover, the presence of mafic-ultramafic lithologies in the area was not widely recognised until mapping and sampling by White Cliff Minerals circa 2006.

The focus of exploration was initially the White Cliffs Gossan. Further light exploration of the greater project package was carried out between 2007 and 2012; the intrigue of what this area could host attracted a Korean consortium as the funding partner in a joint venture.

Exploration comprised surface sampling, airborne magnetic surveys, multiple campaigns of ground EM surveying, aircore, and RC drilling.

This wealth of historical data sets Panther up to immediately implement a series of high impact exploration programs as soon as the licences are granted.

This story was developed in collaboration with Panther Metals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.