Pantera expands Superbird lithium project in the prolific Smackover region by a further 16.6%

Pantera is snapping up more acreage to add to its Superbird project. Pic via Getty Images.

- Superbird project increases 16.6% to 12,103 acres

- Pantera’s acquisition of Daytona has received 100% approval from Daytona shareholders

- A lithium exploration target for Superbird is in progress

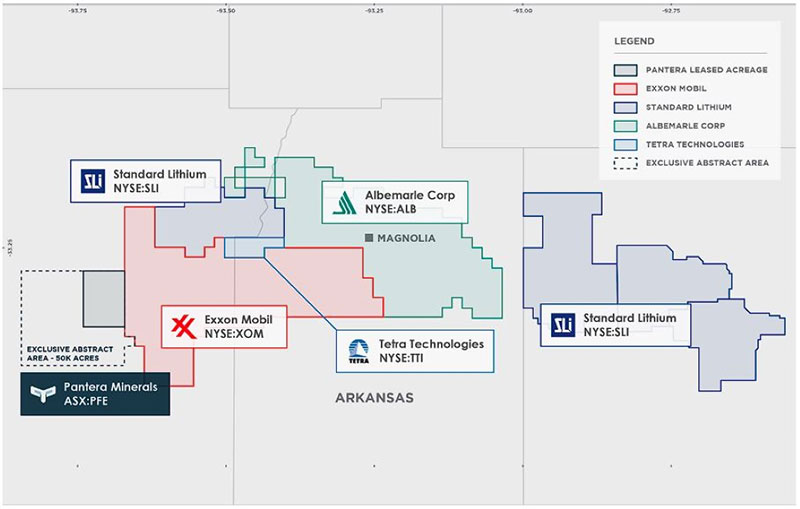

Special Report: Pantera Minerals adds 1,724 more acres adjacent and along trend to ExxonMobil’s lithium brine project, at its Superbird lithium project in the prolific Smackover Formation, which is progressing to become one of North America’s most prolific lithium brine precincts.

Within Smackover, Pantera Minerals’ (ASX:PFE) is forging ahead its Superbird flagship lithium brine project, where resources majors are descending upon to develop projects for our clean energy transition.

Superbird directly abuts ExxonMobil’s (NYSE:XON) 120,000 acre lithium brine project and is along trend from other big players Standard Lithium (NYSE:SLI), Tetra Technologies’ (NYSE:TTI) and Albemarle Corporation (NYSE:ALB).

Exxon itself is targeting 75,000-100,000 tpa of lithium carbonate equivalent (LCE), while Standard Lithium expects first production in 2025 for an average of 5,400 tpa LCE over a minimum 25-year operating life.

Standard meanwhile recently released a definitive feasibility study for its 150,000 acre, 208,000t LCE @ 217 mg/L Lanxess project and project economics include an after-tax NPV of US$550m and an IRR of 24%.

Tetra currently produces bromine out of its Magnolia project and is investing US$540m to build a DLE test facility in the region, as well as recently exercising an option agreement with SLI for lithium rights within Standard Lithium’s South-West Arkansas project.

Support from the top

The Smackover region has government support too, with Arkansas Governor Sarah Huckabee recently throwing state support behind the development of the region as a critical minerals hub and is moving at “breakneck speed” to become the lithium capital of America.

“For over 100 years, the Smackover Formation in Southern-USA has played an important role in America’s conventional energy economy, moreover, its well-known geology, straightforward permitting and existing infrastructure make it a prime area for Pantera to develop its lithium brine project,” PFE CEO Matt Hansen says.

Superbird acreage increase

Since Pantera’s initial investment in Daytona Lithium and subsequent move to acquire the company, the project’s land position has increased by 127% from 5,325 to 12,103 acres, with a further 9,000 acres currently under negotiation.

The company entered into the Smackover Formation in August last year when it acquired a 35% interest in Daytona Lithium and has subsequently made great strides to explore and increase the size of Superbird.

PFE is in continuing discussions with two direct lithium extraction (DLE) technology providers for the most robust methods of lithium from brine extraction from its tenure.

“In a competitive leasing environment, the leasing approach of the Superbird project continues to remain effective, now surpassing 12,000 acres,” Hansen says.

“Adding another 1,724 acres is a positive step for the project, leveraging the project’s exclusive 50,000-acre abstract agreement.”

What’s next for Pantera?

PFE is working towards the release of a lithium exploration target at Superbird and will commit resources to the re-entry of an already identified well to test brine grade, permeability and porosity, as well as DLE testing by two highly-regarded tech providers.

It will also acquire existing 2D Seismic data to facilitate subsurface modelling of the Superbird project’s area of interest.

This modelling, Pantera says, will provide it with clear drilling locations for the first resource definition wells as it continues acquiring additional project acreage.

“In the near-term we look forward to drilling wells and gathering samples to produce a resource and develop our knowledge of the extensive, porous, and permeable limestone aquifer, which is host to the lithium rich brine,” Hansen says.

“Longer term, the company has access to the technology that can extract lithium with fewer carbon emissions forming part of the industry that will strengthen supply security for the companies investing in EV and battery manufacturing facilities in North America.”

Up next

The acquisition of Daytona now rests on Pantera shareholder approval and is expected mid-February.

The explorer is also working up to the release of a lithium exploration target at Superbird and is testing brine grades and DLE extraction tech at an identified well within the project area.

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.