Pantera broadens land coverage in Arkansas Smackover lithium brine play

Pantera is the largest acreage holder in the Smackover area outside of the majors. Pic: Getty Images

- Pantera Minerals has added another ~3700 acres to its lithium brine project

- Its total landholding in the Smackover now covers almost 26,000 acres

- The company is preparing for the first re-entry test well

Special report: Pantera Minerals has added an additional ~3700 acres to its lithium brine project in the prolific Smackover Formation, boosting its total landholding to an impressive 25,998 net acres.

Arkansas’s Smackover region has a long history of oil production, which means it hosts many historical producing wells that have been plugged and abandoned after the reservoir or part of the reservoir they serviced became depleted.

For Pantera (ASX:PFE), the only listed junior in the area, these wells represent a massive opportunity to carry out exploration at a much lower cost, compared to other lithium brine areas, as re-entering an existing well can be done quickly and cheaply.

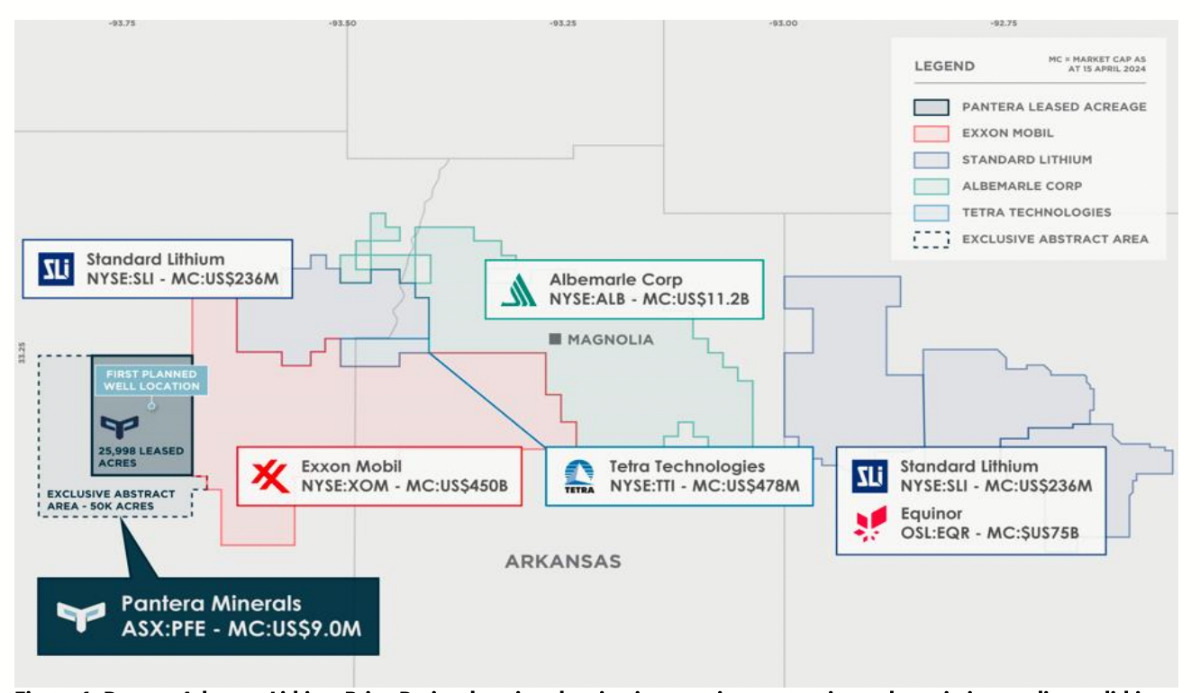

The Smackover’s prospectivity is best demonstrated by the quality of resource majors it has attracted with big names such as ExxonMobil, Albemarle, Standard Lithium and Tetra all developing potentially multi-billion-dollar projects to supply the burgeoning lithium market.

Arkansas itself benefits from a well-established oil and gas industry, exceptional logistics and transportation links, and a proactive, supportive state government.

PFE has been carefully building up its acreage to position the asset as a commercially viable lithium brine project.

Largest acreage holder in the Smackover

PFE is now the largest acreage holder outside of the majors in the Smackover area after increasing its landholding by 16.7% to almost 26,000 acres.

The project benefits from a crucial partnership with a commercial abstract company, underpinned by a 50,000-acre Exclusive Abstract Agreement.

This Exclusive Abstract Agreement facilitates access to comprehensive mineral ownership records, ensuring precise identification of owners and facilitating accurate execution of leases with the rightful mineral rights holders.

In the United States, the separation of mineral rights from surface rights underscores the importance of examining records dating back to the 1800s for precise ownership confirmation.

Pivotal advantage

PFE says the agreement confers a pivotal advantage, enabling the project to efficiently obtain accurate mineral ownership information for the project area, setting it apart from competitors.

“Our exclusive abstract agreement has continued to deliver with over 25,998 acres now under lease in America’s new ‘Lithium Capital’ as other groups in the play now surround us to the east, north, northwest and west of our acreage position,” PFE executive chairman Barnaby Egerton-Warburton says.

“This, alongside the strategic advancements in the area and the future construction of a large-scale processing facility by Exxon underscores the potential of the Smackover Formation.”

Next on the cards

PFE’s partnership with global technology company SLB (NYSE: SLB) and the imminent arrival of the advanced subsurface modelling will accelerate the explorer’s progress as it prepares for the first re-entry test well.

In the meantime, the company continues to grow its project through the acquisition of additional acreage.

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.