Pan Asia Metals all set to claim monster Chilean lithium brine asset

Spanning 1,200km2, the Tama Atacama lithium brine project is a South American beast. Pic via Getty Images

- Pan Asia Metals signs Option Agreements for Chilean lithium asset Tama Atacama

- This will give it 100% control over one of the largest Tier 1 lithium brine projects

- PAM is currently fielding interest from potential strategic partners

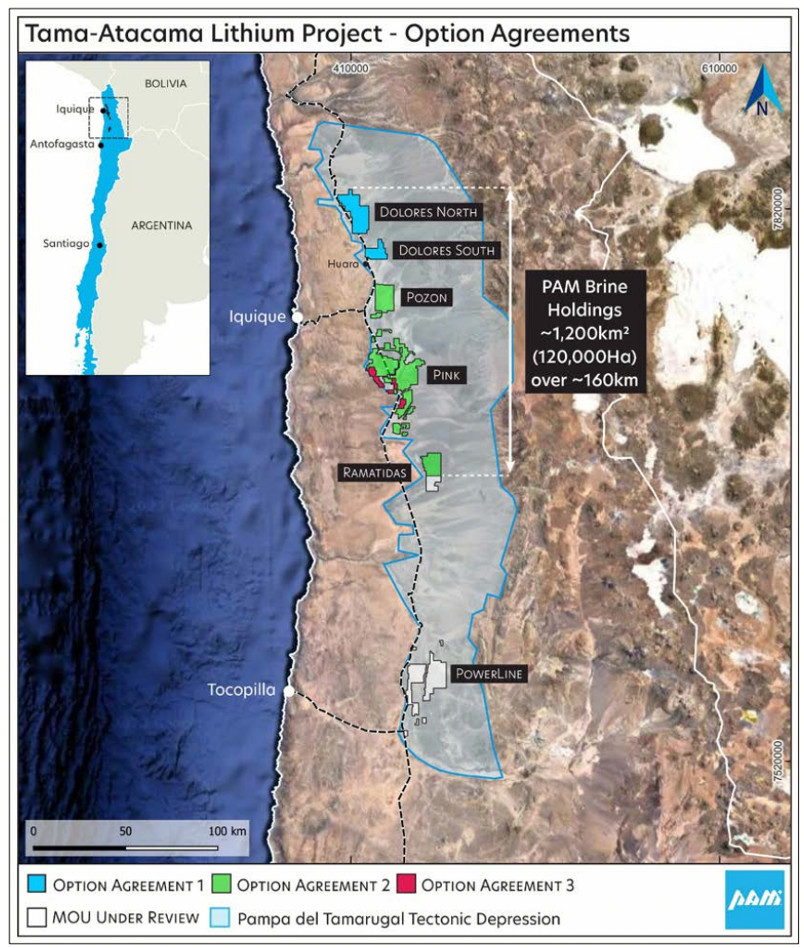

Special Report: Pan Asia Metals (ASX: PAM) has put pen to formal papers to acquire 100% interest in the massive Tama Atacama Chilean lithium brine asset, which comprises some 1,200km2 of “Tier 1” ground.

Pan Asia Metals has been eyeing off full control of Tama Atacama for good reason – the project is one of the largest lithium brine projects in South America, with its holdings extending across three massive salars (salt lakes).

The area, roughly 13% of the highly prized Pampa del Tamarugal Basin in Chile’s Atacama Desert, boasts super high-grade lithium in surface assays up to 2,200ppm Li, averaging 700ppm Li extending over 160km north to south.

Geographically, the project has plenty going for it, with its lower elevations (altitude of 800-1,100m) offering water-replacement options such as the use of seawater to replace extracted brine and solve water balance issues, while from an infrastructure POV, it has major highway, ports and airports access, solar power and more.

Pan Asia Metals’ Managing Director, Paul Lock, said: “The Tama Atacama Lithium Project has the potential to be one of the largest lithium brine projects in the global peer group.

“Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied.

“Waste and water balance solutions are available should straight evaporation or a DLE-evaporation hybrid lithium extraction model be adopted.”

Lock also noted the progressive changes happening in the Chilean lithium sector, with the recent MOU between SQM and Codelco (following several other strategic multinational mining moves) quelling speculation around nationalisation – something that initially spooked investors but appears to be overblown. You can read more about that on Stockhead, here.

An ‘attractive timeline’

Zeroing in further on the details, PAM has progressed MOUs into three binding Option Agreements to purchase 100% of the Dolores North, Dolores South, Pozon and Pink project areas, which form the Tama Atacama project, along with the northern half of the Ramatidas project area.

The total area of 1,200km2 is equivalent to 22x the area of Sydney Harbour, or 10x the size of San Francisco city.

The company notes that the Option Agreements have timelines and expenditure commitments, “which are attractive and achievable when considered in the context of similar lithium brine project transactions in Chile and the United States.”

What happens next?

Potentially quite a lot.

As PAM MD Paul Lock told us recently, the company “is also fielding interest from potential partners, targeting LIB and EV OEMs with an interest in securing future supply – which is still a hot topic despite the weaker LCE price as can be noted by corporate activity in Chile, in conjunction with corporate activity in Australia.”

Now the Options Agreements are in place, PAM also has initial discussions with key Chilean Government organisations slated for early 2024.

And the company is in discussions, too, with geophysics and drilling service providers and plans to begin drilling on granted license areas at the Pink Project in early 2024 with the aim of identifying lithium bearing aquifers at depth.

PAM will then conduct detailed drilling in anticipation of defining an initial resource later in 2024.

This article was developed in collaboration with Pan Asia, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.