Paladin Energy presses play on Langer Heinrich restart study

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Paladin Energy (ASX:PDN) wants to be a uranium miner again.

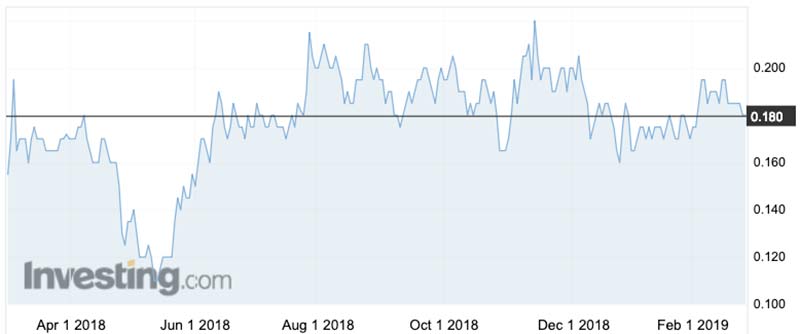

The resurgent uranium price, which is up by 45 per cent to just under $US30/lb since March last year, has seen Paladin’s shares move up from 11c to 18.5c – even with its mines in care and maintenance mode.

In March, the former mid-tier miner is kicking off a pre-feasibility study (PFS) into restarting its Langer Heinrich mine in Namibia.

It follows a concept study which identified ways to reduce operating costs, improve uranium process reliability, and potentially recover and sell vanadium as a by-product.

The concept study estimated restart costs of about $US100 million.

Paladin is targeting average life of mine all-in cash costs of $US30/lb after vanadium credits, so it needs uranium prices to improve further before it makes a final investment decision.

The PFS will reduce operating costs by expanding the mineral resource through additional drilling of the highest-grade remaining resource, as well as implementing processing and operational improvements.

The two stage PFS will examine a “rapid, low-risk restart” for Langer Heinrich to be completed in the first quarter of FY20, and a more detailed study for process upgrades to be completed in the third quarter of FY20.

Paladin chief Scott Sullivan says the mine could be back in full production as early as mid-2021, allowing it to be a first mover in the market if the uranium price recovery continued.

“The study identified improvements to resolve known processing issues we have encountered in the project’s life to date and also to make well considered, low cost investments in the rapid restart option,” Mr Sullivan says.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“The PFS would also examine Langer Heinrich’s capacity to produce a saleable vanadium product as a way of increasing the project’s long-term value.

“As a co-product credit this would effectively lower Langer Heinrich’s cost of uranium production.

“We have assembled a first class project team with both international uranium experience and demonstrable experience in driving cost and operational improvements in mines globally.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.