Pacific Nickel says all stakeholders on board for Kolosori project

The company hopes to start development of the Kolosori project early next year. Pic: filadendron (E+) via Getty Images.

Pacific Nickel Mines is confident it has all three levels of stakeholder approval required to kick off its Kolosori nickel project in the Solomon Islands.

The company recently lodged its mining lease application and is now focused on completing an environmental impact assessment and definitive feasibility study (DFS).

“We’re hoping for the mining lease to be approved by the end of this year, and we’re working on the DFS which will allow us to arrange financing for the project,” Pacific Nickel Mines (ASX:PNM) CEO Geoff Hiller said.

“Our goal is to start development of the project after the wet season which runs January through to March every year.

“We’re aiming to get our first shipment out of Kolosori by the end of 2022, that’s our target.”

Infill drilling is also underway to increase the confidence of Kolosori’s existing mineral resource of 5.89 million tonnes at 1.55% nickel.

Solomon Islands stakeholders on board

Some investors may be familiar with the failed history of past projects on the Solomon Islands, but Hiller said the difference now is that the company has all three levels of stakeholders on board with their project.

“Firstly, we’ve got the landowners onside because of the way we’ve structured the deals and how they’re incentivised to make sure the project goes ahead,” he said.

The Kolosori landowners are 20% owners of the project and shareholders of PNM.

“Then we’ve got the Provincial Government of Isabel Island onside – because once the landowners are happy, they’re happy,” Hiller said.

“And we’ve got a business licence to do what we needed to do, other companies didn’t actually achieve that and that led to issues with their projects.

“Thirdly, you need to have the National Government onside and given the impacts of COVID-19, they’re very, very keen to make sure that they get development and funds and capital into the country.

“So, the National Government is very much onside, and they’re looking to a mining company that can demonstrate it’s got the personnel and the support from the financial community to actually develop its projects.”

Not just tooting its own horn

A recent report from Bridge Street Capital Partners’ Dr Chris Baker said they’d spoken to a senior bureaucrat in Honiara who expressed his wish to see the project advance as quickly as possible.

“He said to us that the Solomons has been waiting almost since Independence to see nickel production out of the country,” the report said.

“As the company successfully crosses hurdles in the lead-up to the completion of a definitive feasibility study, the grant of the Kolosori mining lease, a clear decision on Jejevo’s ownership, and then to first production (we think late 2022 is a realistic goal), we believe PNM’s heavy discount will reduce, triggering a significant rerating of the share price.”

“PNM is in the process of renewing the Jejevo PL for a further two years.

Report and Resindo numbers stack up

Bridge Street Capital developed a conceptual model for the company with a proposed production rate of 1.3 million tonnes per annum at 1.4-1.7% nickel.

A total of 6-7 million tonnes of DSO is proposed to be mined over an initial 5 year mine life with the potential to increase the resource with future exploration success.

As part of the company’s mining lease application, Resindo Resources and Energy Group completed a financial and technical study based on the mining schedule prepared by Mining One Consultants.

Notably, Bridge Street Capital’s research and the Resindo’s numbers are much the same.

The Resindo study confirmed that the proposed production rate of around 1.3mtpa is comparable with direct ship ore (DSO) nickel operations in Indonesia.

Plus, the capital cost estimates are in the range US$18-20 million and the operating costs in the range of US$15-17/tonne are also comparable to similar Indonesian operations.

Combined production will generate solid cashflow

With a current share price of A$0.075, the Bridge Street Capital report presents a fully funded, post tax valuation for Pacific Nickel of A$0.29/share – assuming production from Kolosori from late 2022 and from Jejevo two years later.

“Add just another 2 years of 1.3 million tonnes per annum for each project and our conceptual valuation jumps to $0.46/share,” the report said.

“We forecast that at current commodity prices both projects at a combined production rate of 2.6 million tonnes per annum have the capacity of generating after tax cashflows of over A$40m per year.

“All this for an EV of around $11 million. This looks very inexpensive to us.”

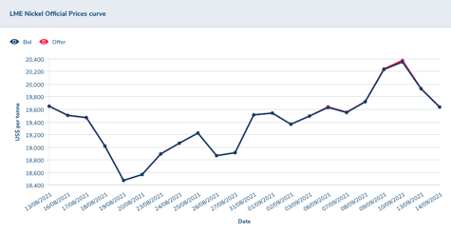

Nickel price is looking strong

Dr Baker said that there is no question that LME nickel prices are high because of buoyant global economic conditions.

“However, we see other drivers here, especially into the current and seemingly never-ending demand for lithium batteries, where nickel is a key ingredient for the cathode,” he said.

“Two of the most commonly-used types of batteries, Nickel Cobalt Aluminium (NCA) and Nickel Manganese Cobalt (NMC) use 80% and 33% nickel respectively.

“Nickel is an essential component of this new generation of energy resources, and we see little likelihood of substitution in the short term.

“LME nickel seems to be treading water in a US$8-9/lb range. With declining LME stocks and a solid demand outlook, there seems to be plenty of upside to us.”

This article was developed in collaboration with Pacific Nickel Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.