Oro Verde’s clay-hosted project in Uganda offers a unique spin to its rare earths tale

Standing out from the crowd Pic: Getty Images

Special Report: A large exploration target, simple metallurgy and a product that continues to see growing demand, these are all the ingredients that make up Oro Verde’s highly prospective Makuutu Rare Earths Project in Uganda.

There are many projects around the world that are looking to provide alternative supplies to China, the predominant supplier of the valuable group of metals that make up rare earths elements (REE).

However, Oro Verde’s (ASX:OVL) Makuutu Rare Earth Project has several qualities that differentiate it from its peers, the most significant being one of the very few ionic adsorption clay-hosted rare earth projects outside of China.

This offers several advantages over hard rock rare earth deposits, the chief being the ease of extracting the rare earths and the large size of the deposit.

Initial metallurgical test work has shown that the REE extraction of up to 75 per cent is achievable through the simple, low-cost method of salt desorption – literally washing the rare earths from the clay using a salt solution.

All this without the need for crushing, milling, mineral separation techniques and ‘cracking’ / leaching required in hard rock REE applications.

The company’s recently appointed project manager for Makuutu, Tim Harrison, says that from a processing prospective, this has the potential to reduce the cost of entry to production for the company through lowering operating and capital costs.

Mining costs are also expected to be low as the orebody itself is very shallow.

Clay-hosted deposits like Makuutu are generally considered to be the lowest-cost sources of rare earths globally.

“It means that this project has got a head start on other rare earths projects with the low capital and operating costs, which will be a fraction of that expected for the alternative hard rock REE project peers, an enabler for Makuutu to faster implementation to production,” he told Stockhead.

The low cost of operations will also allow Oro Verde to start small and scale up through the use of multiple static leach modules – either vat or heap leach – pumping REE liquors to a centralised finishing plant.

It’s all about the size

However, it is the size of Makuutu that has Harrison really excited.

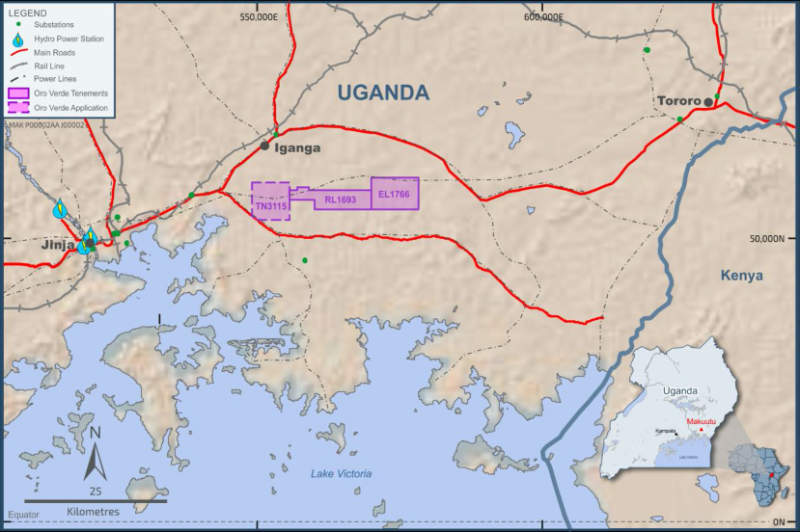

Preliminary drilling has mapped out the widespread presence of REE clays through a 26km corridor within the 132sqkm project area, which accounts for the large exploration target of between 270 million to 530 million tonnes grading 0.04 per cent to 0.1 per cent Total Rare Earth Oxide (TREO).

And Oro Verde is not content to leave it at that.

Work is already underway to define a maiden resource, with Harrison noting that it is planned for release during the current quarter.

The company has also kicked off a scoping study to assess the project’s potential.

Makuutu Rare Earths Project also benefits from proximity to good local infrastructure – including low-cost hydroelectric power and proximity to sealed highways and railway, and access to locally available reagents for processing.

Harrison added that Makuutu benefited from having practically no uranium and thorium, which contrasts with other REE projects that have to contend with waste streams containing elevated uranium and thorium concentrations.

“We have a fundamental advantage there as we don’t have the legacy issue with radioactive content,” he said.

Little wonder than that the company is proposing to rename itself Ionic Rare Earths to reflect the unique nature of its project.

Future Activity

Oro Verde is also looking to add to the initial resource and initiate local work that will be required to understand the project’s true potential.

Harrison added that the company would be looking to optimise the process to increase the overall metallurgical recovery for the deposit.

“The initial test work we completed was a very conventional ionic clay processing route whereby we effectively just wash the ore with a salt solution,” he explained.

“We are looking at other processing techniques that promise to increase the recovery and then ultimately further bolster the overall economics of the project.”

The results from all project activities – drilling, resource definition, metallurgy, product marketing agreements – will culminate in an economic assessment to demonstrate the overall economics of the Makuutu Rare Earths Project.

“The fundamentals of this project are very strong and if you look at the pillars of the project, the orebody is very large and the metallurgy is initially very good and we anticipate that we will be able to continue improve that,” Harrison said.

“Rare earths is certainly an area where we foresee there is going to be significant growth.

“The world is very keen to secure alternative rare earth sources external to China to offset potential availability and supply issues that may eventuate, as we see now with the coronavirus.”

Oro Verde currently has a 20 per cent initial interest in Makuutu and can acquire a further 40 per cent through planned earn-in on the project to increase its total interest up to 60 per cent.

Read: Could the coronavirus fuel development of non-Chinese rare earth projects?

This story was developed in collaboration with Oro Verde, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.