Ora Banda’s Sand King on track with strong initial ore reconciliation, potential gold boost

Sand King is progressing towards solid state production with ore reconciliation comparing favourably to previous expectations. Pic: Getty Images

- Ora Banda’s Sand King underground mine first development ore reconciled gold grade of 2.4g/t is 4.3% above expectation while recoveries are 1.2% at 88.2%

- Batch trial of Sand King processed through the Davyhurst mill has also produced 1907oz of gold

- Early grade control drilling shows a potential 19% uplift in the gold endowment of the deposit

Special Report: Development of Ora Banda Mining’s Sand King underground mine is progressing well with first ore now being processed through the Davyhurst plant at a reconciled grade of 2.4g/t gold that’s 4.3% above expectations.

If the higher grade wasn’t good enough, metallurgical recovery has also been reconciled at 88.2%, which is 1.2% above the expected 87% recovery rate while early grade control drilling has indicated a 19% uplift in gold endowment to date.

Ora Banda Mining (ASX:OBM) adds that grade control drilling has also identified at least three “blow-out” zones that support the potential for bulk stoping opportunities.

Sand King is shaping up to be a winner for the company since the underground portal was established in late August 2024.

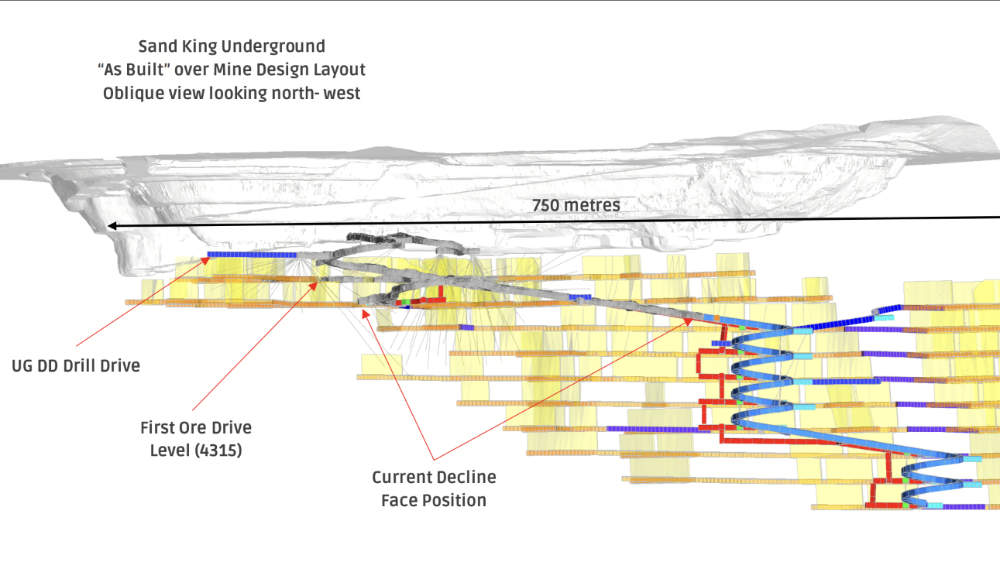

Since then, mine development has advanced through good ground conditions with a total of 1,866m development metres achieved to date.

Additionally, some 558m of ore development have been completed since first ore was intersected in December 2024.

Mining rates continue to improve as key mine infrastructure projects are completed and more headings become available. The first production level is progressing well with the second to commence ore-driving from early March.

Stoping remains on track to start in this quarter with steady state production to be achieved in Q4 FY2025.

“The seamless ramp up of Sand King underground towards steady state production has been a real credit to the operational and planning teams and demonstrates Ora Banda’s capability to find and rapidly advance underground opportunities,” managing director Luke Creagh said.”

“It is great to see the development ore reconciling positively compared to FID assumptions, and exciting that early grade control drilling shows a potential uplift in the gold endowment of the deposit.”

Drilling reveals ‘Big Dog’ potential

Underground infill grade control drilling carried out by a diamond rig since November 2024 has completed 10,844m to date and confirmed the grade and volume potential of the main ore structures.

It has also identified potential upside in newly defined additional discrete ore lodes.

This work has indicated a 19% increase in gold endowment from 17,000oz to 21,000oz.

Adding interest, limited extensional drilling has highlighted the potential for “Big Dog” lode extensions to the south of the current mine design and more drilling is being planned in this area with a second drill jumbo commissioned at the project.

Separately, drilling has confirmed the presence of “blow-outs” – areas in the ore lodes where the intersection of tension veins on shear structure results in a considerable localised volume increase to the ore mineralisation – that were first noted in historical open pit mining.

At least three such areas have been identified and the company is assessing how to best extract these bulk gold endowment zones.

Sand King underground mine

Sand King is part of the Davyhurst gold project in WA and, together with the Riverina Underground, is the centrepiece of the company’s Drive to 150 project, with an annual production outlook of 140,000oz to 160,000oz in FY26.

To date, the company has crushed and milled 24,910t of ore from Sand King at the Davyhurst mill to produce 1907oz of gold, which is 4.3% higher than the expected production of 1885oz.

Sand King has a resource of 3.4Mt at 2.8g/t for 304,000oz contained gold and an underground ore reserve estimate of 537k tonnes at 3.2g/t for 55,000oz.

This article was developed in collaboration with Ora Banda Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.