Ora Banda sells non-core tenements ahead of Riverina final investment decision

The company will retain mineral rights for all non-gold and silver over the tenements. Pic: via Getty Images.

Ora Banda Mining has entered into an agreement with Lamerton Pty Ltd and Geoda Pty Ltd for the sale of certain non-core Lady Ida tenements for a total consideration of $10 million.

The company will retain mineral rights for all non-gold/silver over the sale tenements of M16/0262, M16/0263, M16/0264 plus corresponding miscellaneous licences (L15/224, L16/58, L16/62 and L16/103) and applications for L16/138 and L16/142.

As one of the conditions precedent, Ora Banda Mining (ASX:OBM) is negotiating with Hawke’s Point for the release of the sale tenements from its existing royalty.

Notably, the company’s production target of 100kozpa in FY25 did not include any material from the sale tenements.

Strengthening the balance sheet

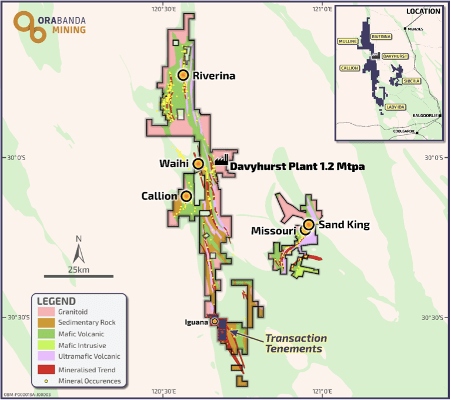

OBM says the transaction will strengthen its balance sheet ahead of a Final Investment Decision (FID) on the Riverina Underground gold mine at the Davyhurst operation in WA.

“The sale of these tenements for $10 million is a great outcome for OBM shareholders as they do not align with OBM’s strategy to target high-grade underground deposits, nor is it included in our production target of 100kozpa supported by reserves,” MD Luke Creagh said.

“In addition, the Lady Ida tenements are approximately 65km from the Davyhurst Plant with significant capital requirements to establish haul roads and access for OBM, and the deposit is lower grade than other resources on the OBM tenements.

“The $10 million sale proceeds will strengthen OBM’s balance sheet as we progress the Riverina underground toward Final Investment Decision and continue exploration on other advanced high-grade targets.”

Riverina drilling planned this month

The Riverina underground mineral resource has been doubled to 303,000oz at 4.1g/t.

The company has also revealed a maiden underground ore reserve at the mine of 73,000oz at 4.3g/t – all extractable at a 2.2m minimum stoping width conservative reserve gold price of $1850/oz (almost $1000/oz below current prices) and only limited by the density of its drill results.

More drilling is expected to begin in March, with just 3% of the reserve comprising the largely inferred Murchison lode.

Infill grade control drilling is planned to convert resources to reserves, with a Phase 2 drilling program to extend the mineralised envelope further south and at depth.

The delivery of the reserves has opened the door to a planned 34% year on year lift in production output from between 55,000-60,000oz in FY23 to 100,000ozpa by FY25 – subject to a decision from the OBM board to invest in the Riverina underground development.

This article was developed in collaboration with Ora Banda Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.