Ora Banda eyes record gold production in FY26 as it sets course for 150,000ozpa

Ora Banda is set to take another massive leap in 2026, with production to grow ~60%. Pic: Getty Images

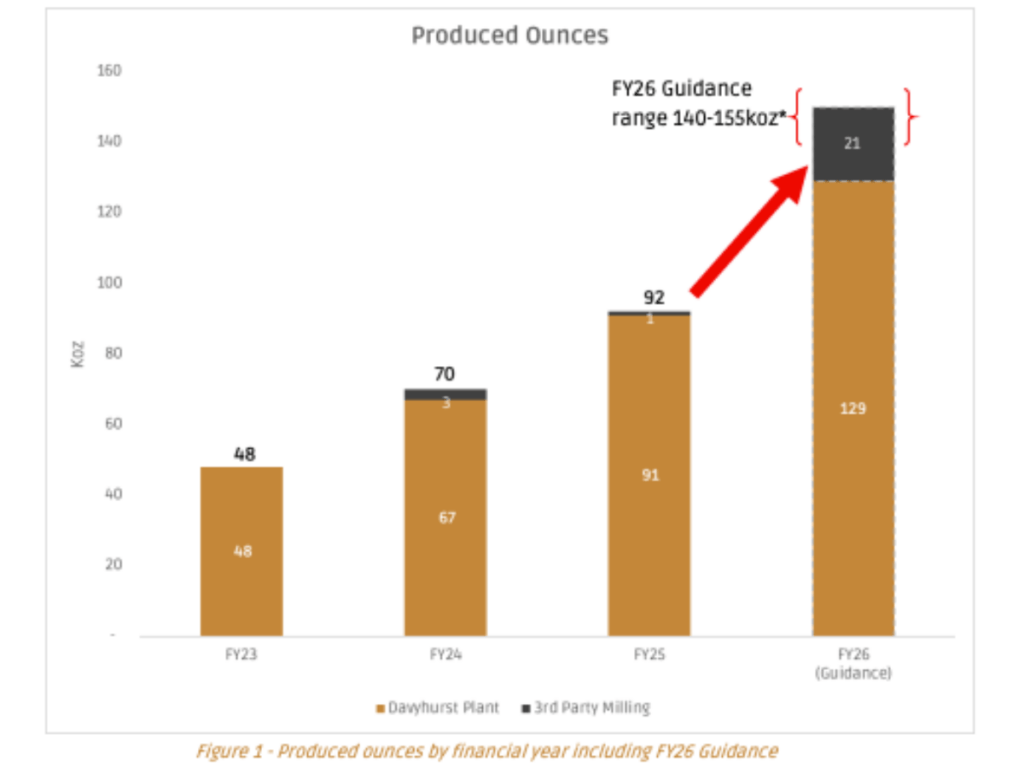

- Ora Banda has set guidance of 140-155,000oz for FY26 at the Davyhurst gold hub

- That’s a rise of ~60% and more than triple the company’s 2023 production, making it one of Australia’s most compelling gold growth stories

- $73m to be spent on exploration, fuelling a massive 329km drill drive

Special Report: Ora Banda has underlined its status as the Australian gold market’s most compelling growth story, revealing plans to lift production at its Davyhurst operation near Kalgoorlie to as much as 155,000oz.

The $1.4 billion capped WA miner has set guidance at 140-155,000oz in FY26 at all-in sustaining costs of $2800-2900/oz, as it eyes a first full year contribution from the Sand King underground mine and announces a third party ore sales agreement that will see excess ore milled by Zijin’s Norton Goldfields subsidiary at the nearby Paddington plant.

It’s been an extraordinary rise, with Ora Banda (ASX:OBM) already upping production from just 48,000oz in FY23 to 70,000oz in FY24 and 92,000oz in FY25.

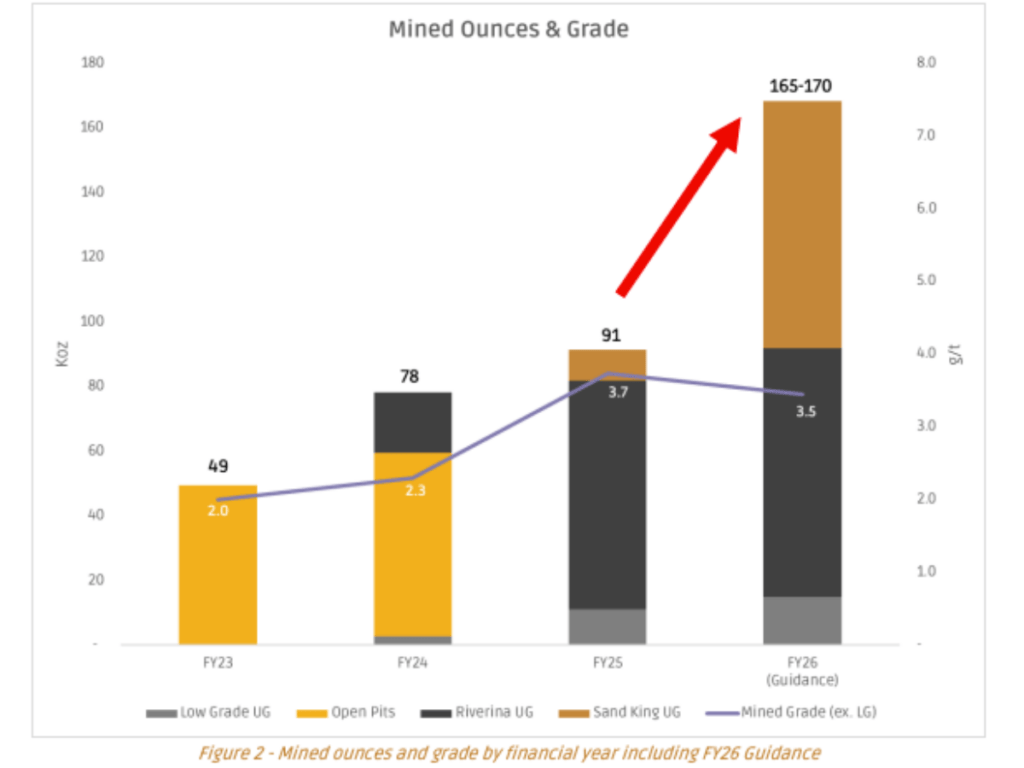

The planned uplift in mined ounces shines a light on the quality of the geology at the project, expected to lift from 91,000oz in FY25 to 165-170,000oz in FY26.

Around half of that will come from the new Sand King underground, with Davyhurst clearly now mill constrained rather than mine constrained.

A feasibility study is underway to ratchet up the scale of the Davyhurst plant from 1.2Mtpa to 3Mtpa, expected to lift recoveries by up to 4% and lower unit costs, as well as enabling the development of new mines and larger open pits.

Around 1400oz was processed through NGF under a third-party milling arrangement in FY25. That will expand to 21,000oz in FY26 under a non-binding MoU expected to become a full form binding ore sales agreement.

NGF will process up to 400,000t of ore from Davyhurst under the arrangement.

Major investment

At the same time, Ora Banda is not wasting today’s record +$5000 per ounce gold price environment, locking in on investment in the project’s rich geology to future proof its expansion plans.

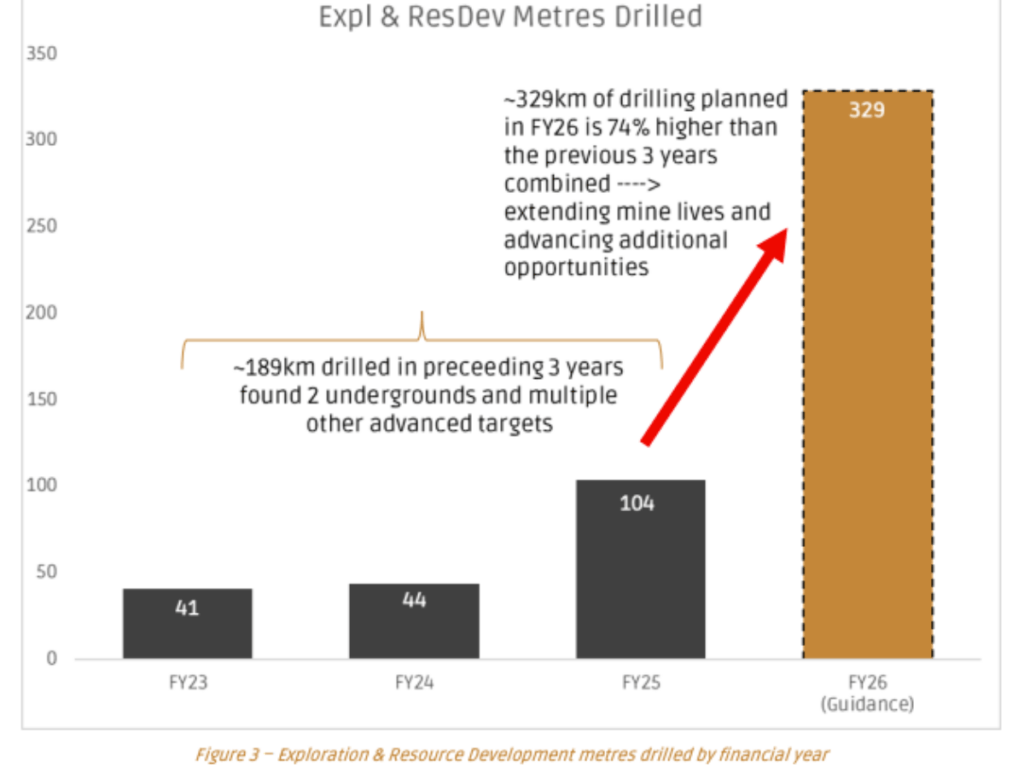

$73m has been budgeted to deliver an extraordinary 329km of drilling. To put that into context, its half the length of the trek from Perth to Kalgoorlie and double the last three years of drilling activity combined.

The previous spend saw 189km punched into the ground to find two now developed underground mines and numerous advanced targets.

The $73m splash will underpin mine life extension at the key Riverina and Sand King undergrounds, assess whether the Waihi deposit can be taken underground, advance the Little Gem, Round Dam and Mulline prospect and pursue belt-wide exploration over 140km of tenure.

Added to that is $86m of growth capital, including $37m for underground development in the form of drill drives and support infrastructure, $6m on process plant improvements and $43m to develop new infrastructure that will speed up timelines and improve operations across the site.

That includes a new on-site airstrip, upgraded camps, haul road, workshops, offices and an on-site assay lab that will speed up grade control drilling.

“Despite the previously announced challenges in the June quarter, the operations and OBM team are set up well going into FY26,” OBM managing director Luke Creagh said.

“This has set a strong platform as FY26 commences our next phase of growth, with production anticipated to increase over 60% to between 140 and 155 thousand ounces, and strong cash flow underpinning capital investment to right-size our infrastructure, including a feasibility study to increase processing capacity to approximately 3Mtpa.

“The most exciting element of FY26 is the $73M allocated to exploration and resource development drilling. This is aiming to extend mine life at Riverina and Sand King, as well as rapidly advance other key prospects including Little Gem, Waihi and the Round Dam trend.”

Cashed up

As Creagh was quick to point out, Ora Banda is generating strong cash flow numbers, banking $57m in FY25 to finish the financial year with $84.2m in the bank.

That came after 21,900oz of gold output in the June quarter, a number which was impacted by a slower than expected ramp up of its mill and mining delays at Riverina.

The 92,400oz produced for the full year FY25 was nonetheless 32% up on FY24, and OBM is set for a head start in FY26, with 165,000t of closing stockpiles at 10,000oz including mid-grade stocks of 63,000t at 2.8g/t for 5700oz.

The June quarter also ended with OBM holding 2800oz of gold in circuit.

“FY25 as whole was a very successful year for Ora Banda. We achieved record production with over 30% improvement on the previous year, commenced and ramped up Sand King as our second underground mine, extended Riverina mineralisation by over 500m to 1km depth, and advanced numerous potential underground mining targets with exploration drilling,” Creagh said.

This article was developed in collaboration with Ora Banda Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.