Ora Banda breaks revenue, profit and gold sales records as Davyhurst ramps up

Ora Banda Mining’s strong operational performance and high gold prices are smashing records. Pic: Getty Images

- Ora Banda’s net profit soars 575% to $186.1m on record gold sales

- Revenue hits record of $404.3m on high gold price and output from Sand King

- Production target jumps 60% to 140,000oz-155,000oz for FY2026

Special Report: High gold prices and the quality of its underground operations have enabled Ora Banda Mining to deliver a 575% increase in FY2025 net profit to $186.1 million.

Revenue increased from $214.2m in FY2024 to a record $404.3m in FY2025 on record gold sales of 91,687oz at an AISC of $2693/oz from its Davyhurst mill – up from 67,255oz at an AISC of $2767/oz in FY2024 while EBITDA increased 243% to $184.6m.

This strong performance also increased Ora Banda Mining’s (ASX:OBM) closing cash by $57.4m to $84.2m despite spending more than $124.2m on exploration, resource development and capital works.

Highlighting the strength of its operations, Riverina Underground achieved capital payback in just 18 months and delivered enough free cash flow for the company to self-fund development of the Sand King underground mine.

This was due in no small part to higher realised prices – up $1159/oz compared to FY2024.

To support future growth, the company secured a $50m revolving credit facility in March 2025 for an initial two-year term with ANZ and Commonwealth banks.

“FY25 is a testament to the quality of Riverina Underground which has paid itself back in just 18 months and is delivering free cash flows that have enabled the company to self-fund the group’s second underground mine at Sand King,” managing director Luke Creagh said.

“The operating margins of the business continue to improve, as reflected by the 575% increase in net profit after tax.

“Supported by the current gold price environment, we expect this trend to continue to grow in FY26 with two underground operations filling the mill with high-grade ore, targeting record production of 140-155koz.

“The cash build of $57.4m and execution of the $50m RCF demonstrates the strengthening operational and financial position of the company.

“This newfound financial strength positions the company to rapidly advance additional opportunities that exist in our portfolio through the ~$160M earmarked for exploration, resource development and growth capital in FY26.”

Gold operations

Riverina Underground reached commercial production on August 1, 2024, following two consecutive months of steady-state production and achieved payback of its capital investment within 18 months.

Despite mining delays in June 2025 deferring ~3000oz of high-grade material into FY2026, Riverina Underground still delivered 74,800oz contained gold mined at 4.6g/t.

In July 2024, OBM also approved the final investment decision for Sand King, making it the company’s second underground mine at Davyhurst.

Since then, operations at the mine have started with all key metrics completed on schedule – portal commencement in the September 2024 quarter, first development ore in the December 2024 quarter, stoping commencement in the March 2025 quarter and steady state production of 60,000ozpa in the June 2025 quarter.

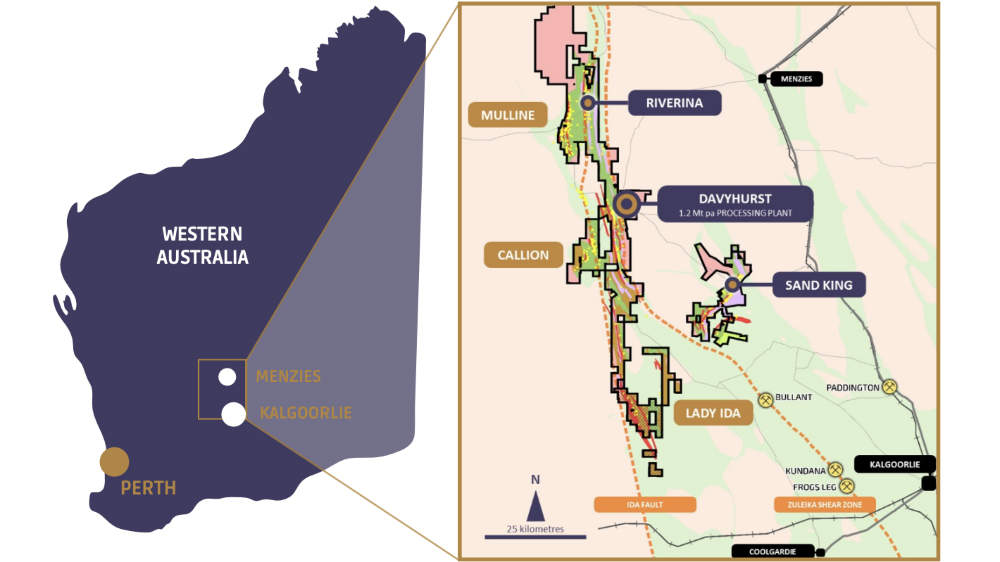

The Davyhurst project consists of 67 granted tenements covering about 1135km2 about 120km northwest of Kalgoorlie.

It includes a 1.2Mtpa conventional carbon-in-leach processing facility, two camps totalling more than 500 rooms and a large water bore field.

Exploration has identified Little Gem as a greenfields discovery while delivering high-grade intersections 300m below the current mine plan and 700m below the current decline face at Riverina, which confirms the mineralised system expands for 1000 vertical metres.

More from Ora Banda Mining: Gold growth, big grades, and bigger ambitions

FY2026 guidance

For the 2026 financial year, the company expects to produce between 140,000oz and 155,000oz of gold at an AISC range of $2800-2900/oz.

This represents an increase of ~60% and is due to the expected full-year contribution from Sand King along with third-party ore sale and processing of excess ore with Norton Gold Fields.

The higher AISC reflects additional third-party crushing costs and processing costs of ore sold by the company, a full-year of Sand King mining costs and increased sustaining development costs, and higher royalties due to strong gold prices.

During FY2026, OBM plans to spend $73m on exploration and resource development along with a further $86m on capital for growth.

The exploration and resource development spend is expected to extend mine life at Riverina and Sand King, test the downdip potential of Waihi as a third underground mine, advance the Little Gem, Round Dam and Mulline prospects, and continue belt-wide exploration.

Growth capital will be used for ongoing underground mine development, process plant improvements and for new infrastructure.

A feasibility study is also underway to expand the Davyhurst plant to ~3Mtpa with the goal of addressing the current 1.2Mtpa bottleneck.

This is expected to deliver lower unit processing costs, higher recoveries and support development of additional mines and larger-scale open pit potential while removing the need for costly third-party milling.

This article was developed in collaboration with Ora Banda Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.