Ora Banda boosts Davyhurst gold stash despite growing production

Ora Banda Mining has grown its Davyhurst gold resource faster than it can produce from it. Pic: Getty Images

- Ora Banda grows Davyhurst gold resources by 160,000oz to 2.11Moz despite mining 108,000oz from June 1, 2024

- Total ore reserves jumped 24% to 236,000oz of contained gold at the Davyhurst project

- Series of agreements reached with Davyston Exploration relating to non-gold mineral rights at Davyhurst

Special Report: Ora Banda Mining’s efforts to boost resources and reserves at its Davyhurst gold project in WA’s Eastern Goldfields have more than paid off with gains outstripping production.

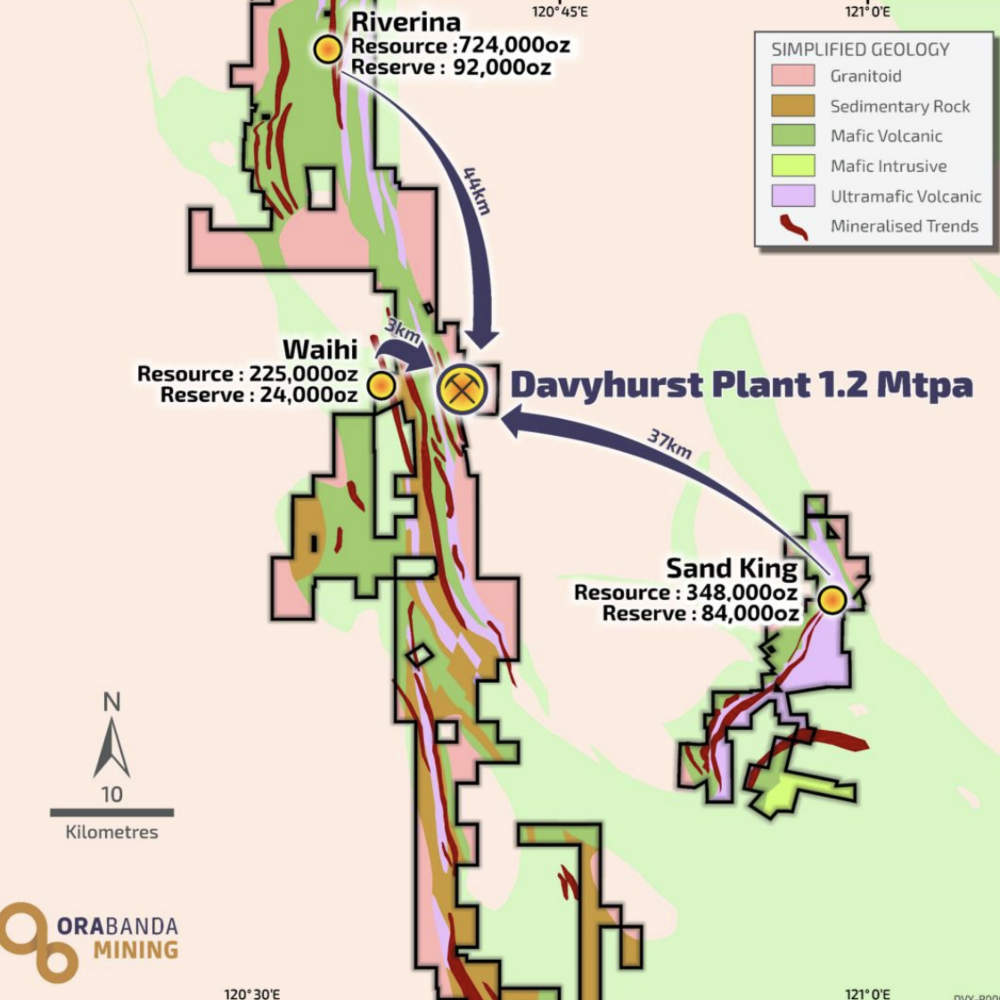

Overall resources increased 160,000oz to 2.11Moz (26.8Mt grading 2.4g/t) after mining 108,000oz from June 1, 2024, while ore reserves increased 24% to 3Mt at 2.4g/t for 236,000oz.

The Riverina underground resource increased 25% to 7Mt at 2.6g/t, or 586,000oz contained gold, while its reserves crept up 5% to 825,000t at 3.5g/t, or 92,000oz, after mining extracted 92,000oz.

Meanwhile, the Sand King underground resource rose 14% to 3.9Mt at 2.8g/t to 348,000oz while reserves jumped 54% to 829,000t at 3.2g/t, or 84,000oz, after mining 17,000oz.

The latter highlights Ora Banda Mining’s (ASX:OBM) belief that Sand King has grown from just a support play for the main underground operation at Riverina into a meaningful, long-term feed source for the 1.2Mtpa Davyhurst mill.

“The rapidly improving underground resources and reserves after depletion is testament to the continuity and quality of the Riverina and Sand King underground mines, both of which remain open at depth and laterally,” managing director Luke Creagh said.

“Riverina and Sand King underground drill platforms are currently being developed, which puts us in a position to drill significant extensional programs to extend and convert mineralisation at both mines in FY26.

“The most exciting element to this resource and reserve growth story is that the recent successful programs announced at Waihi, Round Dam and Little Gem have not been included in this announcement.

“However, the company will provide an update on these deposits upon the completion of meaningful follow-up drilling as part of our $73 million exploration and res dev drilling program in FY26.”

Separately, the company has executed a series of agreements with Davyston Exploration (DEPL), a wholly owned company in the Wesfarmers Chemicals, Energy & Fertilisers division, in relation to the non-gold mineral rights at Davyhurst.

This includes a farm-in and joint venture agreement, a minerals sharing agreement and a mineral royalty deed governing the 2% royalty payable by DEPL to Ora Banda in respect of non-gold minerals.

Davyhurst project

The Davyhurst project is about 125km from Kalgoorlie with the tenement package extending from 44km north of Coolgardie at the southern extent to 20km north of Menzies at the northern extent.

It is well connected via rural roads to Coolgardie, Menzies, Ora Banda and Canegrass.

Besides the Davyhurst mill, the project also hosts multiple workshops and stores, a 7.5Mw gas power station providing power for the Davyhurst central hub that is supported by a mains connection and two accommodation villages.

Operations at Riverina Underground became commercial on August 1, 2024, following two consecutive months of steady-state production while a final investment decision for Sand King was reached in July 2024.

Riverina achieved payback of its capital investment within 18 months and still delivered 74,800oz contained gold mined at 4.6g/t despite mining delays in June 2025 deferring ~3000oz of high-grade material into FY2026.

Meanwhile, Sand King reached steady state production in the June 2025 quarter.

This allowed revenue to increase from $214.2m in FY2024 to a record $404.3m in FY2025 on record gold sales of 91,687oz at an AISC of $2693/oz from its Davyhurst mill.

EBITDA rose 243% to $184.6m while net profit soared 575% increase to $186.1 million.

Looking ahead, OBM expects to produce between 140,000oz and 155,000oz of gold at an AISC range of $2800-2900/oz in the 2026 financial year.

This represents an increase of ~60% and is due to the expected full-year contribution from Sand King along with third-party ore sale and processing of excess ore with Norton Gold Fields.

During FY2026, OBM plans to spend $73m on exploration and resource development along with a further $86m on capital for growth.

The exploration and resource development spend is expected to extend mine life at Riverina and Sand King, test the downdip potential of Waihi as a third underground mine, advance the Little Gem, Round Dam and Mulline prospects, and continue belt-wide exploration.

A feasibility study is also underway to expand the Davyhurst plant to ~3Mtpa with the goal of addressing the current 1.2Mtpa bottleneck.

Doing so is expected to deliver lower unit processing costs, higher recoveries and support development of additional mines and larger-scale open pit potential while removing the need for costly third-party milling.

This article was developed in collaboration with Ora Banda Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.