Optimised Feasibility Study tees off – delivering 46% cash flow gain to US$1.2bn

Theta Gold Mines’ optimised FS delivers golden improvements for the TGME mine project in South Africa. Pic: Getty Images

- Theta Gold Mines expects US$1.2bn free cash flow from optimised TGME project over 14.5 year mine life

- Study shows massive improvements driving 71% IRR and US$504m NPV10% (both post tax)

- Project construction underway with first gold production expected in Q1 2027, with ramp-up to 120 koz/year

- US$35m project finance support secured, with debt syndication progressing and strong interest from lenders

Special Report: Theta Gold Mines (ASX:TGM) is gearing up to generate a massive US$1.2 billion (A$1.9 billion) in free cash flow from its TGME gold project in South Africa, thanks to an optimised feasibility study that turbocharges project economics and positions TGME as a serious cash machine.

The optimised feasibility study reflects a dramatic shift in market conditions, including a more than twofold increase in gold spot prices compared to assumptions in 2022. It also extends TGME’s mine life from 13 to 14.5 years, adding long-term value to an already transformed project.

Back in 2022, Theta Gold Mines’ (ASX:TGM) feasibility study painted a more modest picture — post-tax free cash flow was pegged at US$508 million, with an NPV of US$219 million, IRR of 57%, and total revenue of US$1.75 billion. The latest numbers show just how far the TGME project has come.

The upgraded numbers come with all-in sustaining costs of just US$1,101/oz, underscoring the cost discipline and execution strength of Theta’s experienced project management team. Meanwhile, peak funding nudged up only slightly—from US$77 million to US$79 million.

What makes it even more intriguing is that these figures still look conservative given that the assumed gold price of US$2,710/oz – up from the US$1,642/oz used in the 2022 FS – is still significantly lower than the current spot price of ~US$3,767/oz.

“The strategy to produce the optimised feasibility study was driven by our belief that the TGME gold mine project is an exceptional gold asset and shows the true potential of the project in line with more recent gold prices,” chairman Bill Guy said.

“The completion of the optimised FS marks another significant milestone achievement for Theta Gold shareholders and brings with it the rebirth of one of South Africa’s historical mine projects offering significant opportunities for our employees and their families as well as economic prosperity to the local communities within the region.

“The optimised FS has confirmed the mining method, technical aspects, and the strong economic viability of the 540,000tpa mining and processing operation.

“The stand-alone CIL plant is to be constructed in modules using technology that enhances the design efficiency and construction of the metallurgical plant, with the optionality to expand production capacity in the future as additional mines are brought into production.

“Once up to seven mines are brought into production, including Vaalhoek, Desire and Glynn’s Mines, an annual production of in excess of 160 koz/pa will make Theta one of South Africa’s most significant, mid-tier listed gold doré producing companies.”

Optimised feasibility study

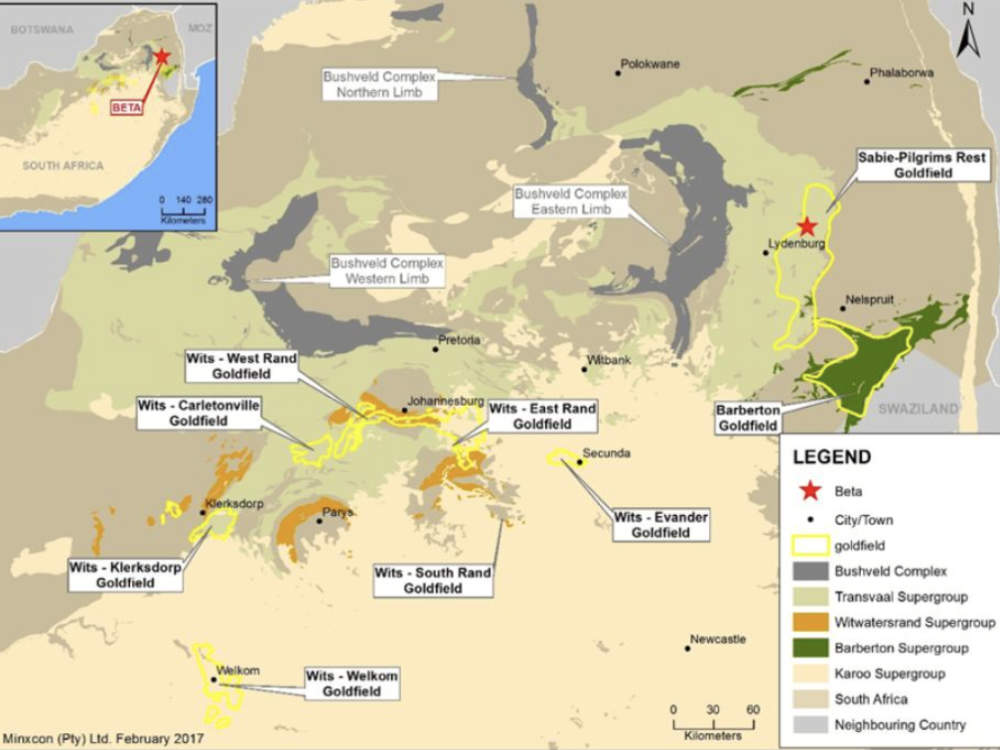

The optimised FS completed by independent mining engineers Minxcon only includes the Beta, Frankfort, Clewer-Dukes Hill-Morgenzon and Rietfontein mines out of a historical 43 mines.

It uses a resource of 1.3Moz of contained gold – including 174,000oz of surface gold available from historical rock dumps and the tailings storage facility that was not previously recognised in the mine plan.

The other historical mines underpin a long-term growth pipeline, with 3.6Moz of inferred resources available for future development — none of which is included in the current base case.

Production will be ramped up in multiple phases with early cashflow from the surface gold resources and first underground gold produced from the Beta mine within 18 months of development.

First gold production from the free milling standalone processing plant is expected in the first quarter of 2027 with output expected to exceed 80,000oz per annum by the third year.

Construction already underway

Bulk earthworks and civil works are already underway after TGM executed contracts with leading construction partners PICM and Mainpro during September 2025.

Front-end engineering and design work is already complete with the plant using modular, plug-and-play equipment that significantly reduces construction risk, enabling faster, more reliable commissioning.

The company has also secured an initial funding package of US$25m that will be used to complete the long lead items including earthworks, civils, water management and tailings storage facility.

It consists of US$6m paid within five-days of signing the agreement, two tranches of US$6m and US$3m in options with an exercise price of 20c and expiring on January 31, 2026, that will be issued by January 2026, and a US$10m unsecured loan agreement that will be available for draw down from April 1, 2026.

TGM had previously received an agreed credit approved loan facility for up to US$35m and indicative funding terms from the Industrial Development Corporation of South Africa for joint funding of the TGM underground gold mine project.

Finalisation of the facility with IDC is subject to conditions precedent including finalisation of definitive loan facility documentation.

This article was developed in collaboration with Theta Gold Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.