One dig to rutile them all: Sovereign’s at top of pack with new study of “globally significant” Kasiya

Pic: Getty

With rutile supplies declining, Sovereign’s scoping study shows the Kasiya project in Malawi is ‘globally significant’ and will take SVM to greater heights.

Kasiya is the largest undeveloped natural rutile deposit in the world.

When combined with the high-grade of its material, the project makes for exceptional economics, especially the triple-combo of high margins with low capital and operating costs.

Under the scoping study, the project is expected to generate after-tax net present value (NPV) and internal rate of return (IRR) – both measures of profitability – of US$861m ($1.2bn) and 36% respectively, at a capital cost of just US$332m.

Sovereign Metals (ASX:SVM) noted this is based on throughput of 12 million tonnes to produce 122,000t of rutile and 80,000t of graphite per annum at an operating cost of US$352 per tonne to generate annual earnings before interest, taxes, depreciation, and amortisation (EBITDA) of US$161m.

Resistance is rutile: quarter century of mine life

Mine life is expected to be 25 years and is based on the recently updated resource estimate, which shifts more than half of the resource into the higher confidence Indicated category.Kaisya now has an overall resource of 605 million tonnes grading 0.98% rutile which includes a 304Mt Indicated resource at 1.02% rutile.

“To have achieved this fantastic Scoping Study milestone for the Kasiya Rutile Project within just 20 months of the initial discovery is a huge result for Sovereign and a testament to the dedication and hard work of our Malawi and Australia-based team,” managing director Dr Julian Stephens said.

“The Kasiya Rutile Project is the largest undeveloped natural rutile resource in the world and is therefore highly strategic in an environment of severe global supply deficit.

“We believe that Kasiya is also just the beginning of the story in the new Central Malawi Rutile Province,”Dr Stephens added.

“We will expand our resource significantly early next year with the addition of the Nsaru Rutile Deposit and potentially other regional prospects.”

Room to grow

While the updated resource provides a greater level of certainty for the company, it is also worth noting that it covers just 49sqm of its 129sqkm drill-defined, rutile mineralised footprint, which includes the Nsaru project.

Most peripheral and extensional mineralisation at Kasiya that was previously drilled on an 800m by 800m drill spacing has now been infilled to a closer 400m by 400m spacing and is expected to contribute to its Inferred resource.

Additionally, further core drilling results are expected in the coming months which will contribute to the Indicated resource.

Nsaru

Sovereign has also completed infill and extensional hand auger and core drilling at the nearby Nsaru deposit, which is expected to contribute to a component of the Nsaru maiden resource estimate being classified in the Indicated category.

The expansion of the Kasiya resource and the maiden Nsaru resource is expected to be completed in the first quarter of 2022.

Resource upgrades are also expected to further improve the project’s economics or mine life.

Rutile production overview

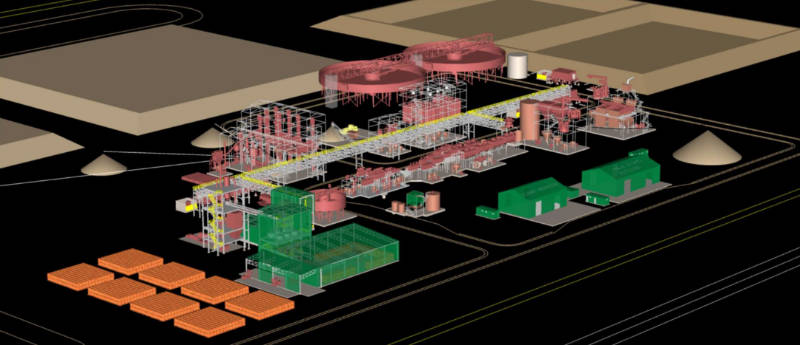

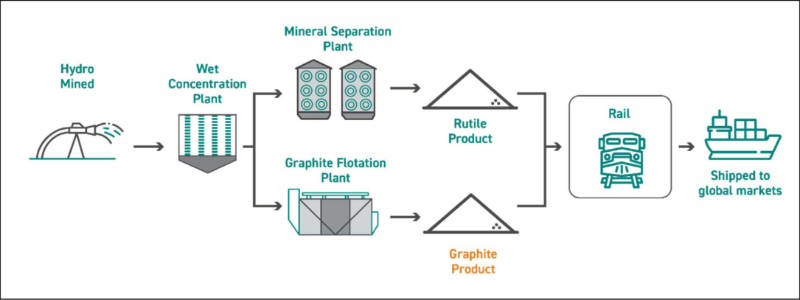

The proposed large-scale operation at Kasiya is expected to process soft, friable mineralisation mined from surface, which has no waste stripping requirements, that will be subject to conventional hydro-mining to produce a slurry that is pumped to a Wet Concentration Plant for sizing.

A heavy mineral concentrate (HMC) will be produced via processing the sand fraction through a series of gravity spirals.

The HMC will then be transferred to the dry Mineral Separation Plant to produce a premium rutile product using electrostatic and magnetic separation.

Graphite-rich concentrate will be collected from the gravity spirals and processed in a separate graphite flotation plant to produce a coarse-flake graphite product.

The rutile and graphite products will be trucked a short distance via existing bitumen roads to the Kanengo rail terminal from where they will be railed via the Nacala Logistics Corridor to the deepwater port of Nacala on the eastern seaboard of Mozambique.

ESG and low emissions

Kasiya is also expected to be a champion on the ESG and emissions fronts.

The project will provide a significant benefit to Malawi in terms of fiscal returns, employment, training and social development.

Carbon emissions are also expected to be low thanks to hydro and solar power while processing natural rutile results in a far lower carbon footprint compared to other titanium feedstocks used in the pigment industry.

Graphite is also a significant component of lithium-ion batteries and plays a key role in underpinning the energy transition.

This week, Sovereign officially listed on the AIM sub-market of the London Stock Exchange (LSE) under the ticker code SVML.

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.