Tim Treadgold: Why the big Jupiter Mines float didn’t take off

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Last month Stockhead columnist Tim Treadgold told investors to take care with the massive Jupiter Mines float which hit the ASX today.

In light of the manganese producer’s soft debut, it’s worth having another read of Tim’s column from March 27:

Buy Jupiter Mines now or wait a while?

That’s a hot question in the market as one of the most interesting mining companies to float in several years prepares to open its $240 million offer today (Tuesday) and move towards a listing on April 18.

Many investors will be tempted to apply for shares in Jupiter (ASX:JMS), which is listing on the Australian Stock Exchange but whose best asset — part-ownership of an enormously profitable manganese mine called Tshipi — is in South Africa.

There is also the appeal of Jupiter’s high-profile chairman in Brian Gilbertson, a former chief executive of BHP when it was still known as BHP Billiton.

But off-setting the obvious attractions of Jupiter is a question of timing.

It’s an often-overlooked point. In mining, timing is perhaps the most important factor when assessing the value of an asset, because of the way commodity prices move in a perpetual cycle of rises and falls.

Up right now, down tomorrow?

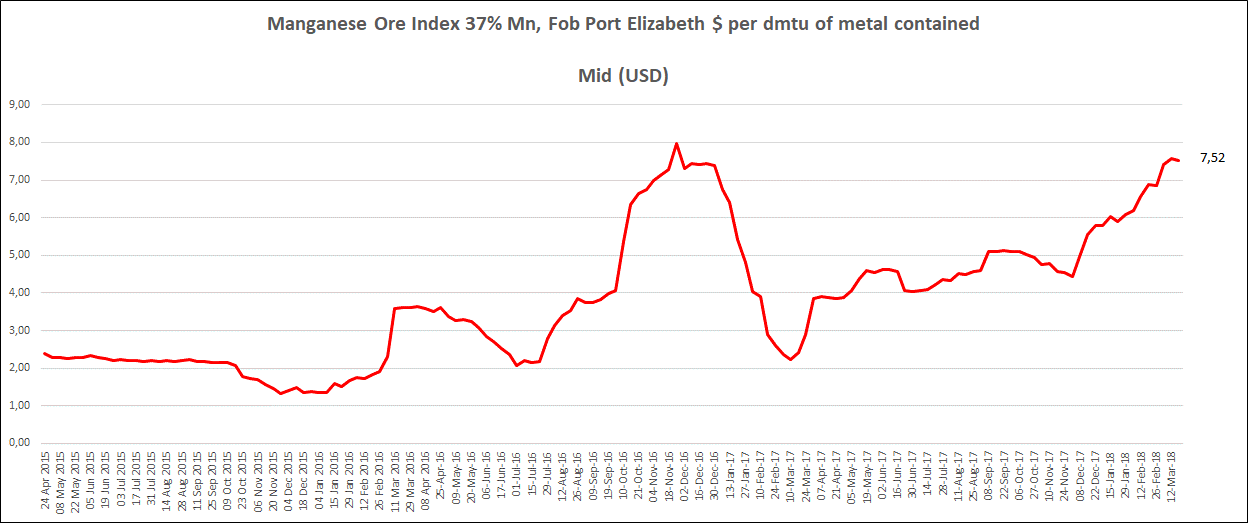

Right now, with the manganese price booming at $US7.52 per dry metric tonne unit (dtmu) for ore assaying 37 per cent manganese (the complex way in which the material is traded), Jupiter could not look healthier. This is largely because at its latest price manganese is close to double its long-term trend of $US4/dmtu.

Manganese is a steel-hardening material which is also used in the production of batteries.

The only problem with a sky-high manganese price is that it tends to not stay high — as a graph on Jupiter’s website illustrates.

At this time last year, the price was just above $US2/dmtu. Three years ago it was around $US1.50/dmtu.

In between that low reached in late 2015 and the latest price, manganese — as shipped out of Port Elizabeth in South Africa — hit a high of $US8/dmtu – before its latest plunge and return.

If a picture is worth a thousand words, as the old saying goes, then a manganese graph could also be worth $1000 — or a lot more depending on the timing of the investment.

Like a number of commodities, manganese is one that has multiple sources of supply. When the price surges higher it flushes out marginal producers who quickly fill the market and depress the price – until the next cycle.

Greater use of manganese in the production of batteries could expand the overall market for the mineral.

But the major use is likely to remain steel — and that’s a material under pressure as the China vs. US trade war heats up.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

By now you should be getting the point.

Jupiter — high-quality company that it might be with a high-quality mine — is totally exposed to the manganese price which has, over time, displayed extreme cyclical moves.

For Mr Gilbertson, a man with deep connections in the business of mining the raw materials used to make steel, the Jupiter float satisfies a number of objectives.

These include a chance to sell down the stake in Jupiter held by Pallinghurst Resources, a company with which he is closely associated.

It also represents a return to the ASX for Jupiter.

It was listed until 2014 when it went private during a downturn in the manganese market — and because management did not believe the market was correctly pricing a business which had shifted from exploration to production.

A world class mine, but there are questions

Over the past four years Tshipi has evolved into one of the world’s biggest manganese mines, heading towards exports of 3.6 million tonnes of ore per year — and potential to increase to five million.

Everything about Tshipi is world-class.

The orebody it’s mining is part of the world’s best manganese deposit. The infrastructure, including loading and rail systems, are new and profits flows have been strong during the start-up years.

In a perfect world, Jupiter would be an excellent investment, if it wasn’t a number of nagging questions, such as:

- The price of manganese which as can be seen in Jupiter’s own graph, moves rapidly up and down as marginal suppliers re-open their mines to catch periods of peak pricing

- The 40c price for shares being offered in the float, an amount determined before the outbreak of the China v US trade war and widespread share price correction, especially for miners exposed to a downturn in trade

- The location in a country with superb geology and a deep mining history, but also one still struggling to deal with the transition of power that occurred after the end of apartheid

- The deeply concerning political push in South Africa to accelerate the transfer of ownership of major assets, such as mines, to black empowerment groups. The more successful the Tshipi mine becomes, the bigger it is as a target.

Outright nationalisation of all mines in South Africa remains a debating topic in that country, and while unlikely to happen it’s something a wise investor will watch carefully.

None of those issues should affect Jupiter in its capital raising phase, or it’s listing price, if manganese continues to trade at $US7.50/dmtu.

Float participants should do well if global power struggles do not derail commodity demand.

But, if the price returns to its long-run trend of $US4/dmtu, which is assumed by Jupiter to be the “base” price for manganese, then the company’s share price is likely to be affected.

Which leads back to the original question: is Jupiter a buy today, or a better buy tomorrow?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.