Omega is bringing a new perspective to its Permian gas play

Omega Oil and Gas is pushing ahead with a bold new approach to tackle a looming gas shortage head on. Pic via Getty Images.

With Australia’s East Coast facing a growing shortfall in gas supplies, the scramble is now on to secure new supplies to ensure energy security.

The Australian Competition and Consumer Commission has forecast a 56 petajoule shortfall in 2023, pinning the blame on LNG exporters based out of Gladstone, who have been net withdrawers of gas from the domestic market since 2021.

This finding had Resources and Northern Australia Minister Madeleine King firing a warning shot, by extending the Australian Domestic Gas Security Mechanism (ADGSM) to 2030 – allowing her to issue a notice of intent to make a determination to use the measure, which will restrict exports to ensure that enough gas is available for domestic use.

And while the industry’s lobby body, the Australian Petroleum Production & Exploration Association has claimed that there is enough gas for domestic supply, the findings nonetheless indicate that new sources of gas will be welcomed.

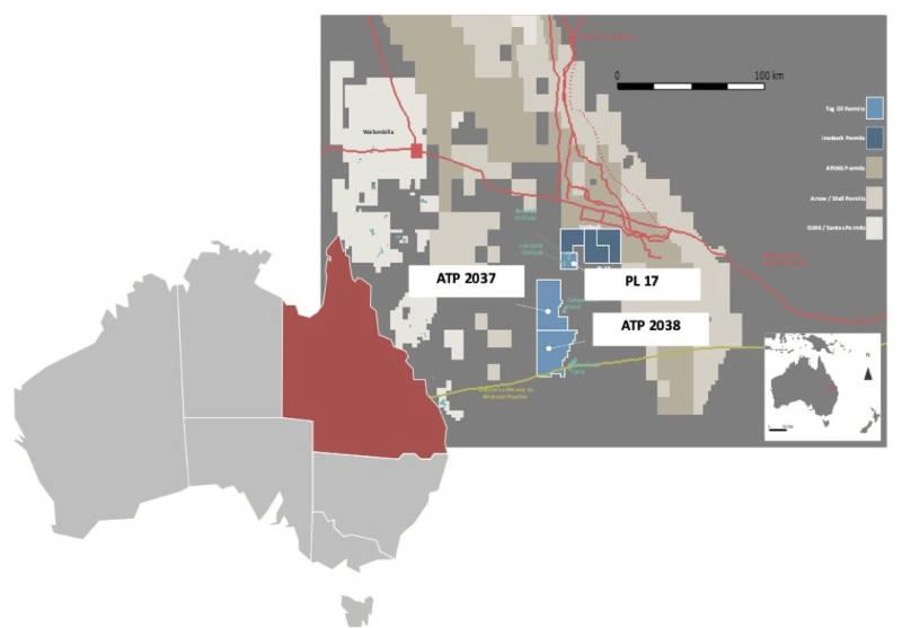

This is exactly the scenario that Omega Oil and Gas – formerly Luco Energy – is hoping to see as it moves to carry out drilling at its ATP 2037 and ATP 2038 to test a potential multi-trillion cubic feet basin-centred gas play in Queensland’s Surat Basin.

Omega is looking to raise between $12.5m and $15m through an initial public offering for a listing on the ASX with the proceeds used to fund drilling of two wells (one in each ATP) that will test the gas and liquids potential of the target Permian Kianga Formation.

Taking a new tack to Permian gas exploration

It’s worth noting at this stage that the company is not venturing into the unknown here as BG Group had drilled five exploration wells targeting the same play.

While these wells all flowed gas to surface, their production rates had flow rates ranging from 0.1 to 1 million standard cubic feet per day however with Omega and their new design, they are hoping to achieve substantially higher flow rates.

Speaking to Stockhead, Managing Director Lauren Bennett said that while Omega is not the first company to chase the Permian gas play in this area, it was probably the first in modern times to take the learnings from early movers such as BG, improve on them and put together a genuine path to commercialisation.

“The end goal of our drilling is to de-risk the ATPs enough to define a pathway to commercialisation rather than just de-risking them a little and hoping to get taken over or farming out the project,” she explained.

“Likewise, I think it is extremely difficult at this point in time given the size of Omega, our relatively modest entry to the listed market as well, to say that we are going to undertake over the next 5-7 years what could be a $1bn gas development.”

Omega has a further card up its sleeve for its plan to make a meaningful contribution to the East Coast gas market. Its Chief Operating Officer Regie Estabillo was working with BG back when they developed their exploration drilling campaign and was involved with the pilot wells, giving the company direct insight to the historical operation.

“Unlike BG, we are small and nimble, and can do things very efficiently by keeping well costs down so we can go back to market and still present quite a strong value proposition,” Bennett added.

“More practically, aside from bringing that efficiency to well design and the actual execution of the drilling program by drilling slimmer wells, we are also looking to fracture stimulate the whole gas column.”

This plan to fracture simulate the entire column – volcanics, clays, clastics and all – is aimed at addressing BG’s apparently unsuccessful move to isolate the best gas-bearing sand in the Kianga Formation.

“I don’t think we need to be too precious about trying to isolate or pinpoint the needle in the haystack,” Bennett explained.

“If we can get the wells away, this slim hole design away, then tick! – that de-risks the appraisal methodology moving forward.

“And if we are able to design a frac program that balances out that big and sexy IP (initial production) number with EUR (estimated ultimate recovery), or sustained recovery, then that ticks off the pathway to commerciality for us.

“Then we can start looking at improving and enhancing those results using other methods such as 3D seismic to look for what deviation or horizontal drilling could add to that in the future.”

While the gas potential of the two exploration licences is certainly what drew Omega to pick them up from TAG Oil, they also contain a significant amount of hydrocarbon liquids as well with independent expert Fluid Energy working out that they could host up to 250 million barrels of liquids.

This presents the potential for Omega to produce the liquids first though Bennett noted that it would only do so if it could reinject the gas into the formation without causing production to drop-off.

Location of Omega’s oil and gas projects. Pic: Supplied

Oil production potential

It’s not all about gas at Omega though. The company also has a proven oil resource with historical production at its PL17 permit.

In fact, operations are currently underway to bring the existing Bennett-1 and Bennett-4 wells, which were suspended back in mid-2020 due to low oil prices, back into production before the end of this year.

“When the wells do come online, we are expecting modest production, somewhere on the order of 20-50 barrels per day, it’s not much but for a company of Omega’s size, that more than washes its face as well as makes a meaningful contribution to our operating costs,” Bennett explained.

“That’s the beauty of having a small company, even a little bit of revenue goes a long way.”

It also means that most – if not all – of the funds raised by the company will go into the ground at the gas ATPs.

The oil asset also offers the company a degree of insurance in the event that the first gas exploration well doesn’t return the results that it is expecting.

Omega Oil and Gas will then leverage the increased revenue and time bought by the infill drilling to evaluate what to do with the gas exploration licences.

Diversified executive team

Of course strong projects can only take one so far and the company boasts a small but well-resourced and diversified team to manage its assets.

Bennett herself is a management professional with experience across various industries including oil and gas, mining, healthcare, and telecommunications.

An engineer by training who returned to university for legal qualifications, she added that there aren’t too many oil and gas companies led by a young female executive and that she brings a “very commercial lens” and a network outside of conventional oil and gas to play.

Chairman Stephen Harrison also brings extensive experience both from the oil and gas sector – having served as a director of both Blue Energy (ASX:BLU) and Exoma Energy – and other sectors as the current Chairman of NobleOakLife (ASX:NOL) and Incentiapay (ASX:INP).

He is also familiar with the company’s acreage as he had the opportunity to pick up while working for Exoma but wasn’t able to do so.

“[Stephen] always thought it was a good idea and it was always the unanswered question at the back of his mind. So, he jumped at the chance when he was approached to join Luco,” Bennett added.

“We have Michael Sandy, who’s also a director of Melbana Energy (ASX:MAY). He’s well-known in the industry, he’s extremely successful listing other businesses, and he was an executive at Oil Search during their formative years in Papua New Guinea.

“I think between Stephen and Mike, we definitely round out that balance between strong capital markets and corporate expertise and technical expertise as well.”

Rounding out the company’s directors is Australian investor and philanthropist Quentin Flannery who brings his expertise and Ilwella’s network to support the company.

“I think for a junior gas company, having a board of directors as strong and diverse as ours yet having that technical expertise and capability sets us apart,” Bennett noted.

“And when you are at this phase of exploration as we are, you want as many different voices in the room just challenging the idea, making sure you have thought through everything, and you not being frivolous with any capital that you are able to raise.”

Forward plans

With the company having completed an oversubscribed pre-IPO funding round, it is now waiting to exit the exposure period for the prospectus it has lodged with the ASX before hitting the road in earnest.

“We will be in Perth at Good Oil then probably head to Melbourne after that before finishing with Sydney,” Bennett said.

“On the operational side of things, it is just business as usual, we have the team working really hard securing all the necessary critical path items for the drilling campaign itself as well as locking up landholder agreements.

“On PL17 we are continuing that work to get production back online.”

This article was developed in collaboration with Omega Oil and Gas, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.