Okapi Resources is making its move in the cobalt-rich Congo

The Democratic Republic of the Congo accounts for over half of the world's cobalt supply. Pic: Getty

Special Report: The Klaus Eckhof-backed Okapi Resources is on the hunt for cobalt in the Democratic Republic of the Congo (DRC), which accounts for more than half the world’s supply.

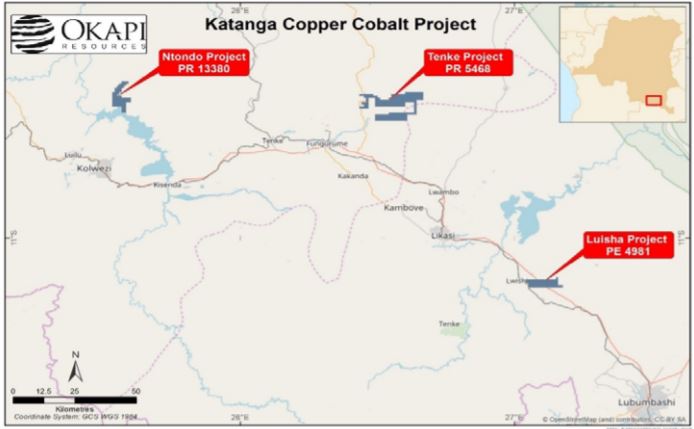

Earlier this year Okapi (ASX:OKR) secured an option agreement to earn a 70 per cent stake in three projects – Tenke, Ntondo and Luisha – all in the cobalt and copper-rich Katanga Province in the DRC.

The area immediately surrounding the Tenke project hosts several copper and cobalt mines, including Tenke Fungurume, which is one of the world’s largest known copper and cobalt deposits.

Freeport sold its 56 per cent stake in the Tenke Fungurume mine, located about 40km west of Okapi’s Tenke project in May 2016 for $US2.65 billion.

Okapi is currently completing due diligence on the projects and while it is still early days, the company believes it has its hands on some potentially large-scale projects.

Cobalt is a by-product of copper and nickel mining.

“They are proving to be very positive with regards to their geological setting and potential,” Managing Director Nigel Ferguson told Stockhead.

“We have good indications from first pass sampling, immediately to the west of Okapi’s optioned Tenke licence, that mineralised units of the Roan Mine Sequence are present within our licences.

“Initial sampling has returned up to 30 per cent copper from supergene mineralisation and 2 per cent to 3 per cent within the mineralised Roan Mine Sequence units.

“These grades are very impressive in themselves, but to have this much mineralisation within the units striking onto our licences is very encouraging.”

The Ntondo project is further to the south and west of Tenke and is believed to host the same rocks as Robert Friedland’s world class Kamoa project, which has been ranked as the world’s largest, undeveloped, high-grade copper discovery by Wood Mackenzie.

Positive mapping results have identified Roan & Kundulungu Group sediments in the project areas which are well known to host world class copper-cobalt deposits such as Kamoa.

Potentially 5km of strike-extent of the Roan sediments has been interpreted from field observations to date.

Long history in the DRC

Mr Eckhof and Mr Ferguson have both been working in the DRC for over 15 years and have developed good relationships with the local community and all levels of government.

Mr Eckhof took Moto Goldmines through to 11 million JORC ounces and then sold the company to Rand Gold Resources for around $485 million.

He has also been successful with the high-grade Bissie tin project for Alphamin Resources and more recently the Manono lithium project for AVZ Minerals (ASX:AVZ).

Meanwhile, Mr Ferguson has worked mainly in the Katanga copper-cobalt belt with the likes of Tiger Resources and also concurrently with AVZ and its world class Manono project.

He undertook the initial assessment for licences that Tiger was looking to acquire and later took into production. Mr Ferguson has done extensive consultancy work in the DRC, both on the Katanga copper-cobalt belt and on the Moto gold belt further north.

Cobalt in demand

Cobalt stocks have become highly sought after because of the anticipated growth in supply needed to satisfy demand from electric vehicle makers.

One recent example is Taruga Gold (ASX:TAR), which saw its share price spike 212 per cent to a peak of 39c at the start of March after it told the market it had picked up an option to acquire high-grade cobalt-copper projects in the DRC.

According to BMO Capital Markets, even without the battery market, the market for cobalt is tight and the forecast is for an increase of 60 per cent in cobalt demand to 2025.

The LME cobalt price recently hit a decade long high of US$94,500 ($122,398) per tonne, up 26 per cent since the start of the year.

Canaccord Genuity recently revised its long-term (from 2025) forecast for cobalt pricing upwards by 32 per cent to around $US108,000 per tonne.

Gold potential

Okapi has also executed a joint venture agreement to earn up to a 70 per cent interest in the Mambasa gold project in the DRC.

The project has similarities to the 20-million-ounce Geita gold mine and is located in a greenstone belt where over 100 million ounces of gold has been defined over the past 10 years.

Okapi has received very encouraging soil samples of just under 1 gram per tonne (g/t) gold.

“We have a large gold in soil anomaly confirming the regional trend for mineralisation within the area. It’s looking positive for the next stage of work to commence,” Mr Ferguson said.

The Mambasa project is located along strike from Loncor Resources’ Makapela project, which hosts 1 million ounces at 7.6g/t gold and Kilo Gold Mines’ Adumbi project, which has a resource of 1.9 million ounces at 1.7g/t gold.

Growing the portfolio

Okapi is also looking to add more projects to its portfolio and is seeking a more advanced project or one with potential for a world class resource.

“We are actively assessing other projects as they come through,” Mr Ferguson said.

The company is actively seeking to review and assess other mineral project opportunities with a focus on both gold and cobalt-copper styles of mineralisation.

Okapi had over $4 million cash in the bank at the end of the December quarter and added a further $1.5 million to the coffers in early February. The company is cashed up and ready to invest in solid projects

This special report is brought to you by Okapi Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.