Okapi has the power with transformational uranium acquisition

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

When Okapi Resources announced a transformational acquisition in US uranium on Monday, the market responded in overwhelming favour.

Okapi’s (ASX:OKR) share price closed up 45% that day, a clear sign that the market sees the same potential in the move as the company’s management.

The overarching uranium narrative is that nuclear will be an essential baseload power source in a green energy future.

That story is driven by a number of factors, not least that the US Government is building a strategic uranium reserve and that the world is setting highly ambitious climate targets of great importance as we move toward a goal of carbon neutrality.

It’s a great backdrop against which to purchase a uranium project, according to Okapi executive director Leonard Math.

“With the US Government, Europe and now Australia pushing towards clean energy and electric vehicles, the world needs to find sufficient clean power,” he said.

“Coal is obviously not going to be a sustainable source of clean energy, and uranium is obviously the next best thing for reliable carbon-free baseload power.

“Over in the US, the Democrats under President Biden have thrown their support behind nuclear for the first time in more than 50 years, while forecasts from recent research are showing an upward trend for uranium and prices are reflecting that.

“We really saw this as a massive opportunity to move into the space, and to get a project with a resource is a massive bonus for Okapi.”

Projects of enormous potential

It’s not just the macroeconomics that work in Okapi’s favour when it comes to the foray into US uranium. The company has struck a deal for a company with some serious assets.

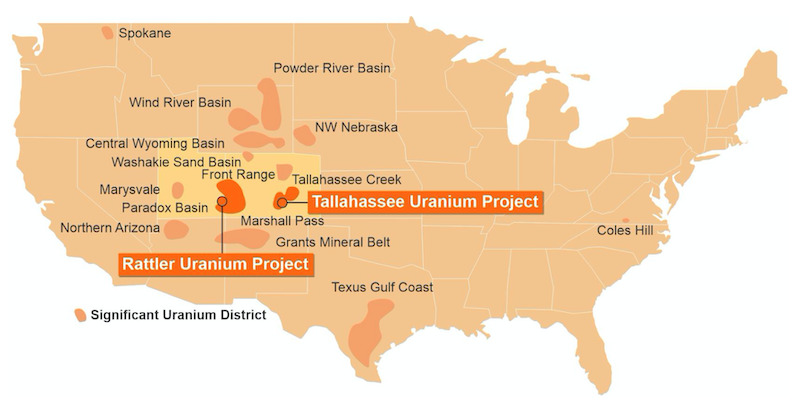

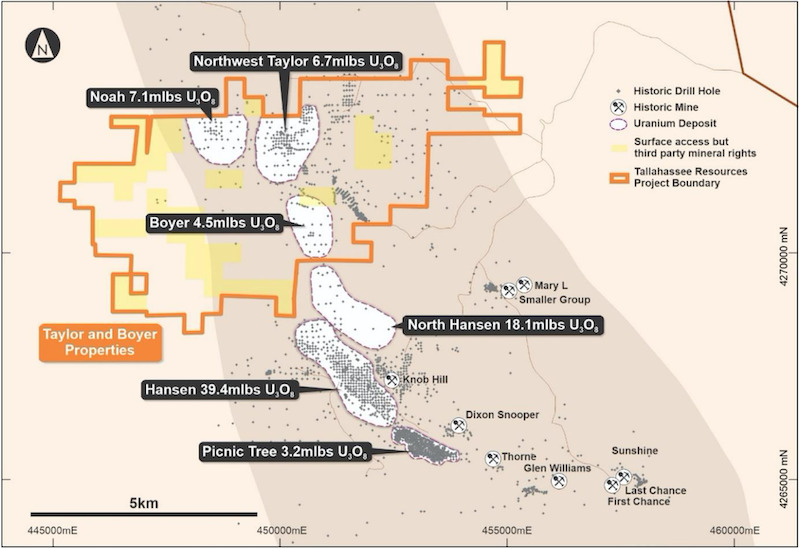

The 100% acquisition of Tallahassee Resources provides access to a portfolio of large, high-grade uranium projects in one of the most prolific uranium districts in the US – Colorado’s Tallahassee Creek uranium district.

The Tallahassee uranium project contains a JORC 2004 mineral resource estimate of 26 million pounds of uranium oxide at a grade of 540 parts per million, with serious exploration upside.

The asset once sat on the books of Black Range Minerals Limited, which had a market capitalisation of more than $180 million in 2007 before the resource was delineated.

“The project has a resource with good grades, and we will continue to expand the portfolio by exploration and acquisitions. We see the upside of exploration potential, while also having regional ground as well – more than a pure exploration play.”

Former Black Range Exploration Manager (USA) Ben Vallerine will join the Okapi Board as a Non-Executive Technical Director, adding much valued expertise to the company’s foray.

The purchase of Tallahassee Uranium also includes an option to acquire 100% of the Rattler uranium project in Utah – home to the high-grade Rattlesnake open pit mine and 85km from the White Mesa Mill, the only operating conventional uranium mill in the US.

Rattlesnake produced 1.6 million pounds of uranium oxide and 4.5 million pounds of vanadium pentoxide between 1948 and 1954.

A shift in focus

Okapi continues to explore its gold interests in New South Wales and Western Australia, but Math said uranium would be the company’s focus moving forward.

“We’re continuing to drill at the Enmore gold project, which we expect to be completed this week – we’ll be interested to see what that brings us,” he said.

On the uranium front, the company is excited by the deal it’s made.

This article was developed in collaboration with Okapi Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.