Okapi acquires ‘large scale’ kaolin halloysite projects

Pic: John W Banagan / Stone via Getty Images

The acquisition of multiple large scale kaolin halloysite projects in WA and South Australia is an “exciting new chapter” for Okapi Resources (ASX:OKR).

Kaolin is used in almost everything — paper, rubber, paint, ceramics, fibreglass, cosmetics and pharmaceuticals are just some notable examples. Demand for halloysite, a rare derivative of kaolin, is also increasing.

There is also huge potential for kaolin to be converted by processing from its natural clay form into high-purity alumina (HPA), a product used in the sorts of high-tech applications that are currently taking the resources world by storm.

HPA can be found in products like lithium-ion batteries, LED bulbs, electronic displays, and sophisticated automotive and medical applications.

The global market for kaolin is expected to reach a value of $US8.2bn by 2024 and has an annual compound growth rate of 6.5 per cent.

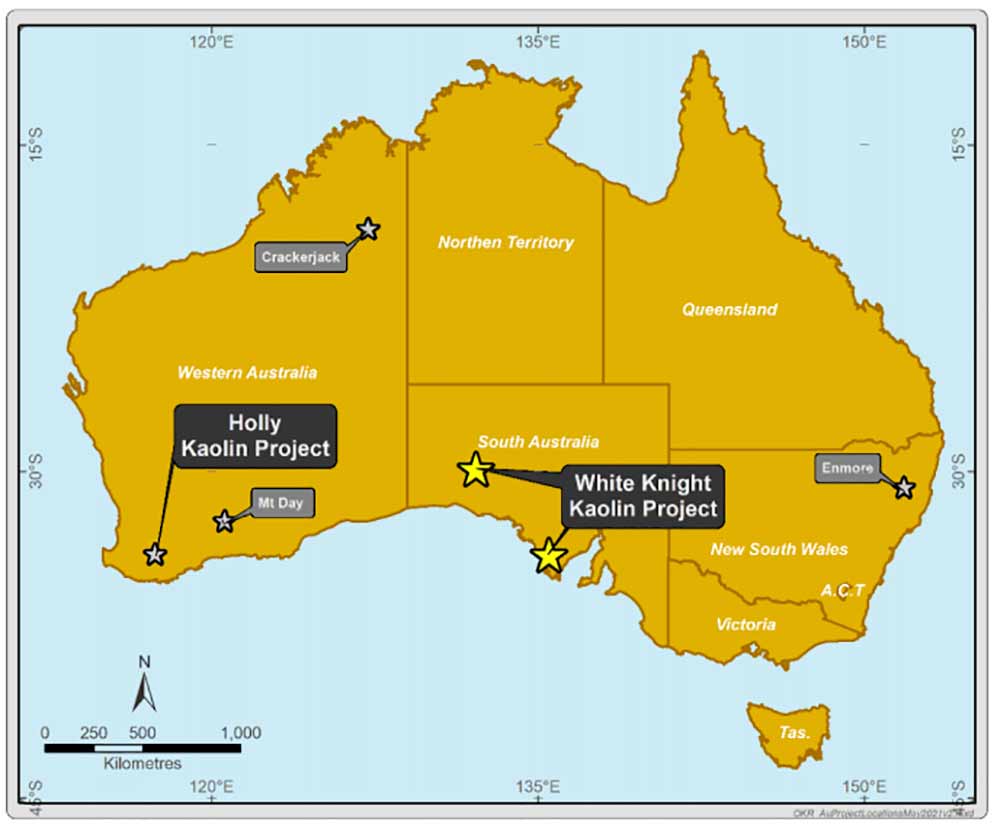

Okapi’s new acquisition — a combined land package of ~2,127sqkm — includes the ‘Holly’ kaolin project in WA and the ‘White Knight’ kaolin-halloysite project in South Australia.

Recent site visits to Holly confirmed widespread outcropping kaolin mineralisation, while historic drilling pulled up numerous ‘high brightness’ kaolin intercepts.

The package also includes four exploration licence applications prospective for heavy mineral sands and high purity halloysite on the western Eyre Peninsula in South Australia, bordering Andromeda’s (ASX: ADN) Camel Lake Project and Mt Hope deposit.

$420.77m market cap Andromeda aims to get the ‘Great White’ kaolin project in South Australia – already among the world’s largest by reserves and resources — into production in early 2022.

Okapi will kick off exploration work immediately at Holly, to be followed by a drilling program.

Okapi is excited to embark on this exciting new chapter, exec director David Nour says.

“With the fast-moving technological advances in kaolin halloysite, potential application extends beyond traditional uses to now include batteries and super capacitors, hydrogen storage and construction,” he says.

“This acquisition puts Okapi in a highly prospective ground in the heart of major known kaolin halloysite deposits neighbouring the likes of Andromeda Metals.

“Additionally, historical drill results show the potential of the Holly Kaolin Project in which we will commence exploration work immediately to confirm the quality of the project.”

“We are also excited about Okapi’s upcoming drilling campaign at our Enmore Gold Project where we aim to drill an initial 8-12 holes to confirm further gold mineralisation.”

This article was developed in collaboration with Okapi, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.