Oh yah! Canada is cutting red and green tape, making it quicker to get projects up and running

Canada is cutting the time it takes for exploration and development approvals to be processed. Pic via Getty Images.

- Canada is making moves to streamline permits and approvals for mining projects, slashing government regulatory process times by up to two-thirds

- Move is just another incentive on top of the government’s multi-billion dollar funding package for the critical minerals space

- ASX explorers and developers set to benefit

Explorers and developers are going to find it even easier to get projects off the ground in Canada after its government announced it will reduce the time required to approve projects by better funding its mining regulatory agency, getting rid of red and green tape backlogs and streamlining both so they can be processed at the same time.

The move comes on the back of billions of dollars worth of government funding incentives to get critical minerals projects off the ground to offset reliance on importing raw or refined commodities required in manufacturing products to help drive the country’s clean energy targets.

The Canadian government has also not held back with comments on Chinese hegemony over the world’s critical minerals supply chain lately and believes its own land mass, orientation to the world’s largest market – the US – and proximity to Europe, gives it a unique advantage to become a key destination for downstream processing.

While it says it will still have to import cobalt, other minerals such as copper, graphite, nickel, lithium and rare earths will fall into its funding mechanisms and have accelerated development timelines.

“Canada is addressing the dual challenges of decarbonisation and energy security, showcasing leadership in building an inclusive net-zero emissions economy and actively promoting the clean energy transition globally,” Canada’s energy and natural resources minister Jonathan Wilkinson says.

“We will continue to build a sustainable net-zero future at home and with partners around the world in a manner that benefits all Canadians.”

It’s also rolling out investment tax credits to pay for a “significant chunk” of capex to get projects underway as part of its 2022 Critical Minerals Strategy, aimed at drawing in private sector capital and investment.

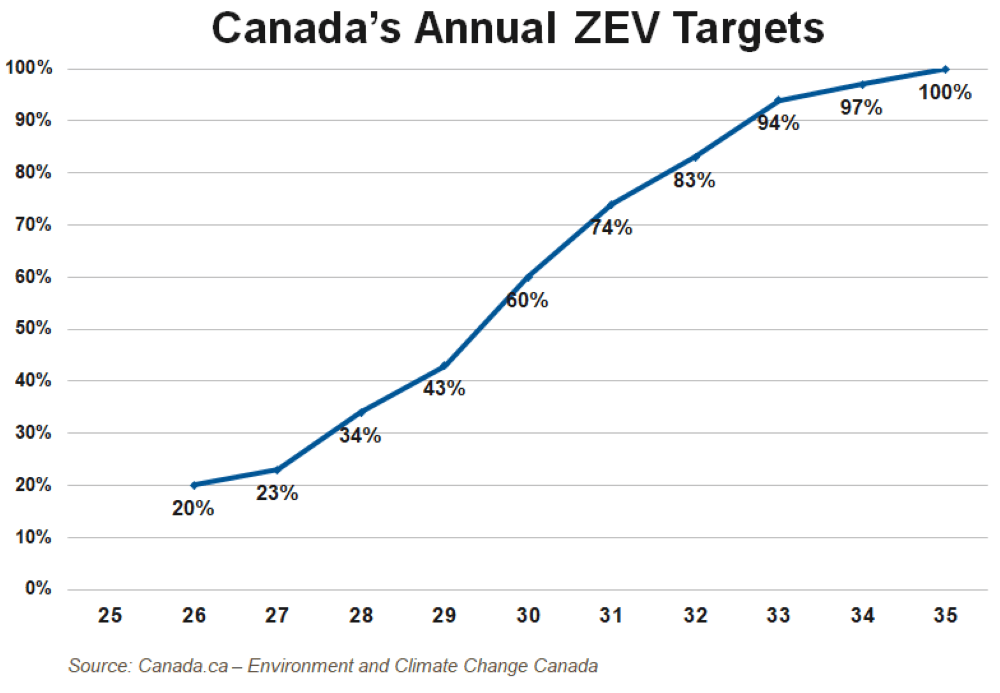

The Canucks are already at a stretch to meet their roadmap to 2035 carbon-free EVs, requiring >80% ZEV penetration within a decade, however these initiatives are pushing things forward at pace.

An uptick in future production is already being seen. As of Feb 4 this year Canada surpassed China in taking the top spot in its Global Lithium-Ion Battery Supply Chain ranking — an annual assessment that “rates 30 countries on their potential to build a secure, reliable, and sustainable lithium-ion battery supply chain,” according to BloombergNEF.

Canada’s top position was “propelled by policy commitment at both the provincial and federal level”.

ASX juniors in Canada set to capitalise

This could bode well for companies such as Green Technology Metals (ASX:GT1) which is developing lithium projects and downstream processing facilities to create battery-grade concentrates for OEMs such as battery makers and car manufacturers which are setting up shop in Canada.

It’s looking to become Ontario’s first battery-grade lithium producer where it has a resource of 24.9Mt @ 1.13% Li2O across its Seymour and Root Bay projects and recently raised $14.6m to progress further exploration.

It splits its projects into the Western and Eastern Hubs – where processing plants near each project will produce battery-grade lithium concentrate to feed into the supply chain.

GT1 exec director and ex-Primero (ASX:PGX) founder Cameron Henry believes the increase in government support both on the provincial and federal level will be a boon for explorers and developers and will attract partnerships from manufacturers.

“The government’s mine-to-EV strategy is getting into top gear and the additional support is going to accelerate approval timeframes which are already some of the quickest we’ve seen, especially when compared to WA,” Henry says.

“Honda and other OEMs are already entering into Ontario spending billions to set up manufacturing plants, so for us, we feel that we’re well-placed to capitalise on our project strategies.”

Others such as Burley Minerals (ASX:BUR) will also see a trickle-down effect by finding it easier to get exploration off the ground for projects – especially since it recently bought five lithium projects in Manitoba from Aurora Lithium late last year.

Others include James Bay Minerals (ASX:JBY) which is exploring its La Grande lithium project areas along trend from Winsome Resources’ (ASX:WR1) Cancet and Patriot Battery Metals’ (ASX:PMT) Corvette projects.

It recently mapped more than 250 targets across the 301.68km2 La Grande greenstone belt, of which some high-priority ones at the Aqua prospect have been identified ~200m east of Fin Resources’ (ASX:FIN) Cancet West claims.

Up in Manitoba, Leeuwin Metals (ASX:LM1) could use the extra streamlining of paperwork as it explores its Crosslake project where a 10,000m drill campaign is getting underway on the back of sampling assays that returned up to 4.31% li2O.

At Stockhead we tell it like it is. While Burley Minerals, Green Technology Metals, Fin Resources and Leeuwin Metals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.