Off the beaten track: Who’s got a gold project in far flung corners of the world?

Pic: via Getty Images

Usually, gold explorers flock to a proven gold region, like WA’s goldfields, California in North America, South Africa, or even to South America.

But what about those juniors who’re on the hunt for a gold in the other, less well-known regions?

That’s what we’re checking out today, gold explorers in distant locations where they’ve picked up tenure, confident of a discovery far from the crowds.

Arctic-ish

Location: Alaska, USA

Market Cap: $18.98m

The company’s flagship Treasure Creek project is right in the heart of the Fairbanks Gold District, where historical gold production exceeds 16 Moz.

While Alaska is considered remote, in Fairbanks, FXG’s tenements are surrounded by infrastructure, sitting within one of the largest gold production centres in the entire Tintina belt.

Plus, they’re in close proximity to both Kinross Gold’s mine, Fort Knox, and the rapidly growing Freegold Ventures’ discovery, Golden Summit, which recently upgraded the resource from a still substantial 3Moz to a world-class Indicated and Inferred Resource of more than 20Moz of gold.

In May the company kicked off 3,500m of infill drilling at Treasure Creek in May with the goal of converting the NW Array exploration target of 76Mt to 92Mt at 0.4g/t to 1.1g/t gold – or between 1.1Moz and 3.6Moz of contained gold – into a Mineral Resource Estimate (MRE) this year.

Location: Newfoundland, Canada

Market Cap: $19.55m

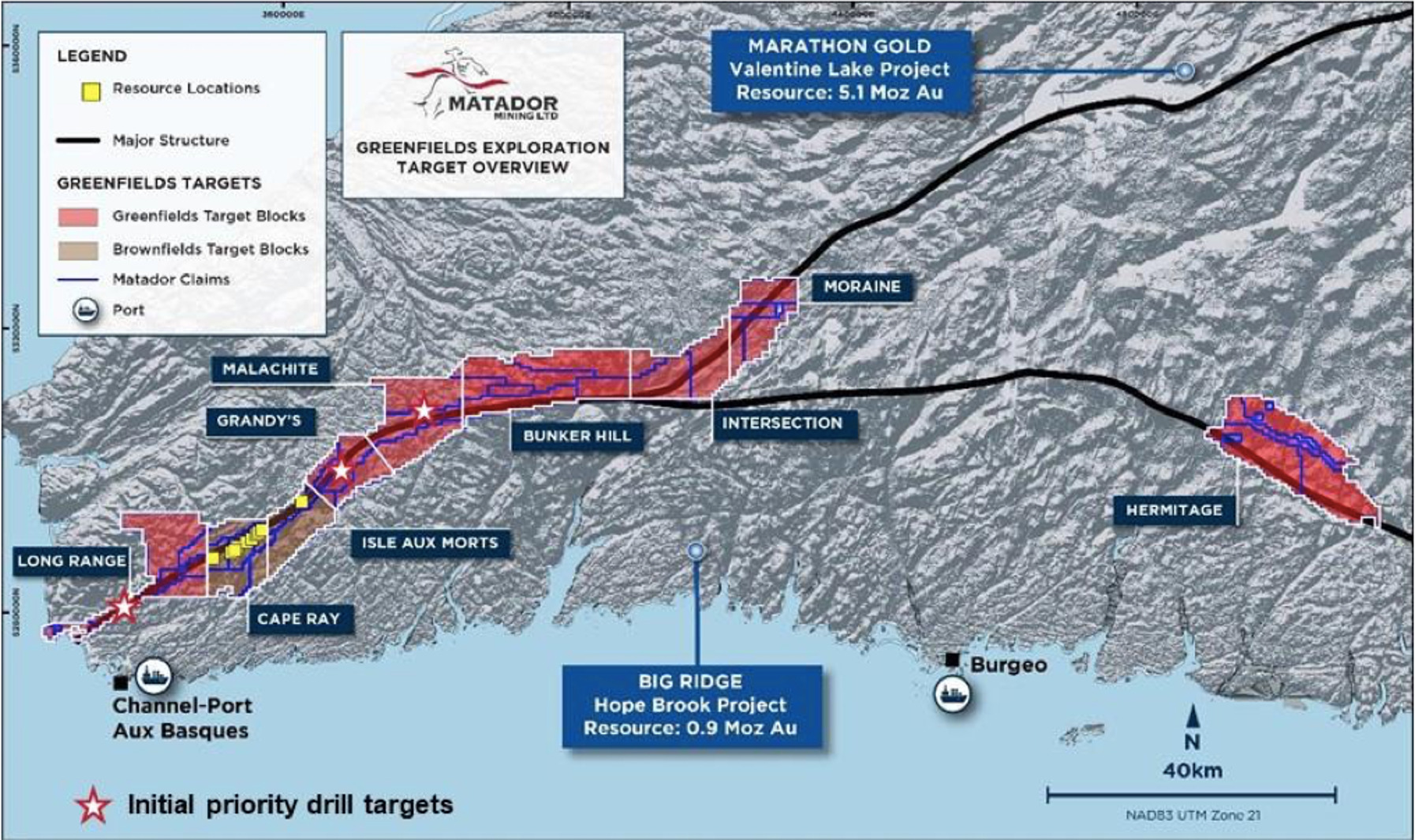

Matador’s primary project is the Cape Ray gold project where in May they updated the total mineral resource estimate to 9.7 million tonnes of ore grading an average 1.96g/t for a total of 610,000 ounces of gold.

The project is in the southwestern area of Newfoundland, Canada, about 25km northeast of the coastal town of Port aux Basques and on the Cape Ray shear, one of the most prospective, yet under-explored gold regions in North America.

The company’s tenement boundary is also approximately 50km along strike from Marathon Gold’s (MOZ.TSX) 4.2Moz Valentine Lake Gold Project.

This month, MZZ commenced diamond drilling focused on the Malachite target, but really they’ve got no shortage of strong targets along the 120km of continuous strike along the Cape Ray shear.

A second phase of diamond drilling is planned during the Canadian summer, guided by the results from phase 1.

Europe

Location: Slovakia

Market Cap: $49.98m

The company has the Sturec gold mine in Slovakia, where last month it released a mineral resource estimate of 68.347Mt at 1.22g/t Au and 10.11g/t Ag (1.31g/t AuEq), containing 2.686 Moz of gold and 22.210 Moz of silver (2.868 Moz of gold equivalent).

That’s a 75% increase to the previous MRE, with 60% of the resource in the measured and indicated categories.

Plus, the project is still open along strike and down-dip, which the company says indicates “significant exploration upside.”

“The expanded resource will directly feed into the PFS where the company is investigating the potential to target a high-grade subset of the resources for a low impact bulk underground mining operation,” director Gino D’Anna says.

Asia

Location: Malaysia

Market Cap: $84.42

The company is focused on the exploration and development of the 3m ounce Bau Goldfield the island of Borneo in East Malaysia, with its Bau Project hosting 3.4 mt at 1.5g/t for 166.9k ounces (measured) and 16.4mt at 1.6g/t for 824k ounces (indicated) and 47.9mt at 1.3g/t for 1989.4k ounces (inferred).

In May, Besra had its environmental impact assessment (EIA) approved by Malaysia’s Natural Resources and Environment Board for its proposed pilot gold mining for the Jugan project – its most advanced prospect within the Bau Gold Field corridor.

The plan now is to look at finalising construction plans for the plant, which will have an initial nominal throughput capacity of 50 tonnes per day (tpd), although it can be expanded to 400tpd.

In addition, the company secured the second tranche US$3m payment from its US$300m gold purchase agreement with Quantum Metal Recovery to fund development of its Bau project.

The priority is updating the 2012 Feasibility Study, which envisages the project as a base case +110,000oz gold open-pit mine with a four-year life of mine based on a 1.1Moz Measured and Indicated resource and a 12-18 month construction period.

The updated study will refresh cost estimates for a +100,000oz project, which will benefit from drilling in 2021-22 that confirmed standalone development potential including higher grades at the Jugan ore body.

South America

Location: Cuba

Market Cap: $23.21m

The Cuba-based gold-copper play is aiming to develop a pipeline of projects through its 49:51 mining joint venture with the Cuban Government’s mining company, GeoMinera SA.

The goal, initially, is to fund a copper porphyry hunt via its part-owned La Demajagua mine.

The La Demajagua open pit would produce 53,146tpa gold and 5905tpa silver and antimony concentrates for nine years, which is expected to be followed by underground operations.

An open pit Definitive Feasibility Study (DFS) is nearing completion which should allow construction to kick off Q4 2023.

FXG, MZZ, MTC, BEZ, and AAU share prices today:

Challenger Gold (ASX:CEL)

Location: Ecuador

Market Cap: $109.55m

Earlier this month, Challenger estimated initial resources totalling 4.5Moz gold equivalent for its El Guayabo project in Ecuador.

Plus, the inferred resource of 270Mt at 0.52 grams per tonne (g/t) gold equivalent confirmed a large-scale gold-copper-silver-molybdenum system is present at the project, which is adjacent to Lumina Gold’s giant 17Moz Cangrejos project.

And with the Cangrejos Pre-Feasibility Study outlining production of 469,000oz gold equivalent per annum over its 26-year mine life at a capital cost of US$925m and operating cost of all-in-sustaining costs of US$671/oz, Challenger has a picture of just what might be possible at El Guayabo.

There’s plenty of potential for further resource growth, since the resource covers just two of the seven targets at El Guayabo that have produced mineralised intercepts greater than 500m.

Once drilling results are received those five remaining holes will be included in a mineral resource update.

Pacific

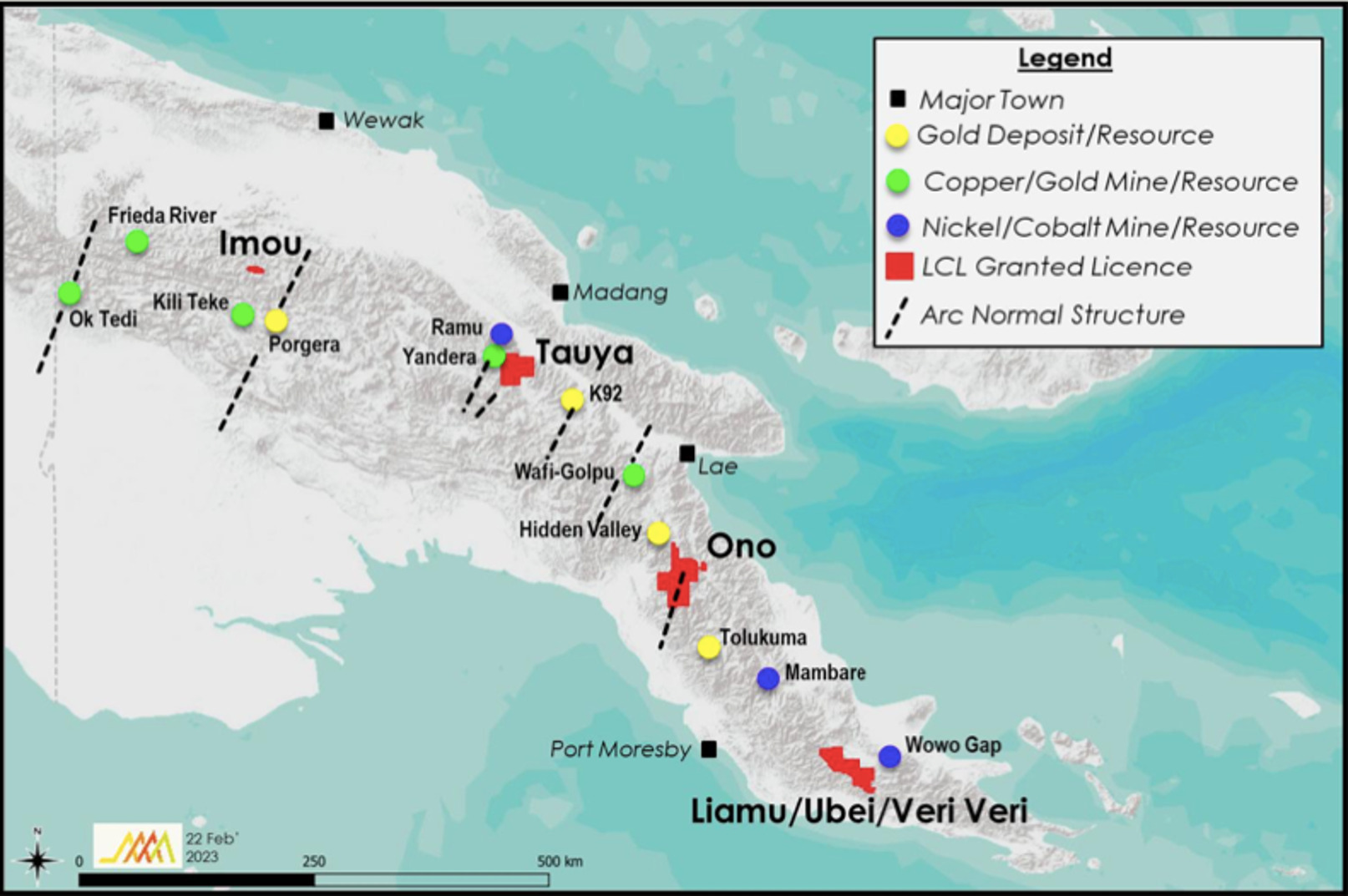

Location: PNG

Market Cap: $29.38

In May, LCL reported up an incredible 52m grading 3.65g/t gold from 160m in maiden drilling at Kusi, part of the Ono project in Papua New Guinea.

Drill results received thus far have exceeded grade expectations, the company says, which is only five holes into an 18-hole, 3000m program.

That hit included a couple of high grade chunks: 6.68m at 10.91g/t from 171.75m, and 7.5m at 14.87g/t from 191.7m.

The advanced South American gold stock recently diversified into PNG as it waits for “greater clarity on new government mine development policies” in Colombia.

Africa

Location: South Africa

Market Cap: $24.67m

WWI’s Witwatersrand Basin Project (WBP) is in the Central Rand Goldfield in South Africa and boasts a 4.28Moz gold at 4.58g/t.

The company’s Phase 1 Qala Shallows’ Definitive Feasibility Study (DFS) supports an underground mining operation with a robust rate of 3.2MT at 2.81g/t recovered grade for total production 680,000oz Au over a 17-year Life-of-Mine.

It is set at an average Steady-State production of 55,000oz per annum for 10 years at an AISC of US$962/oz.

But a DFS update is in the works, including new information gained from underground survey works, optimisations of the mine plan and updated market assumptions – with results expected in July.

As an added bonus, the project’s shallow deposit ranges from 50-800m below surface, unlike the average of other projects in SA being up to 2,000m below surface.

Location: West Africa

Market Cap: $16.35m

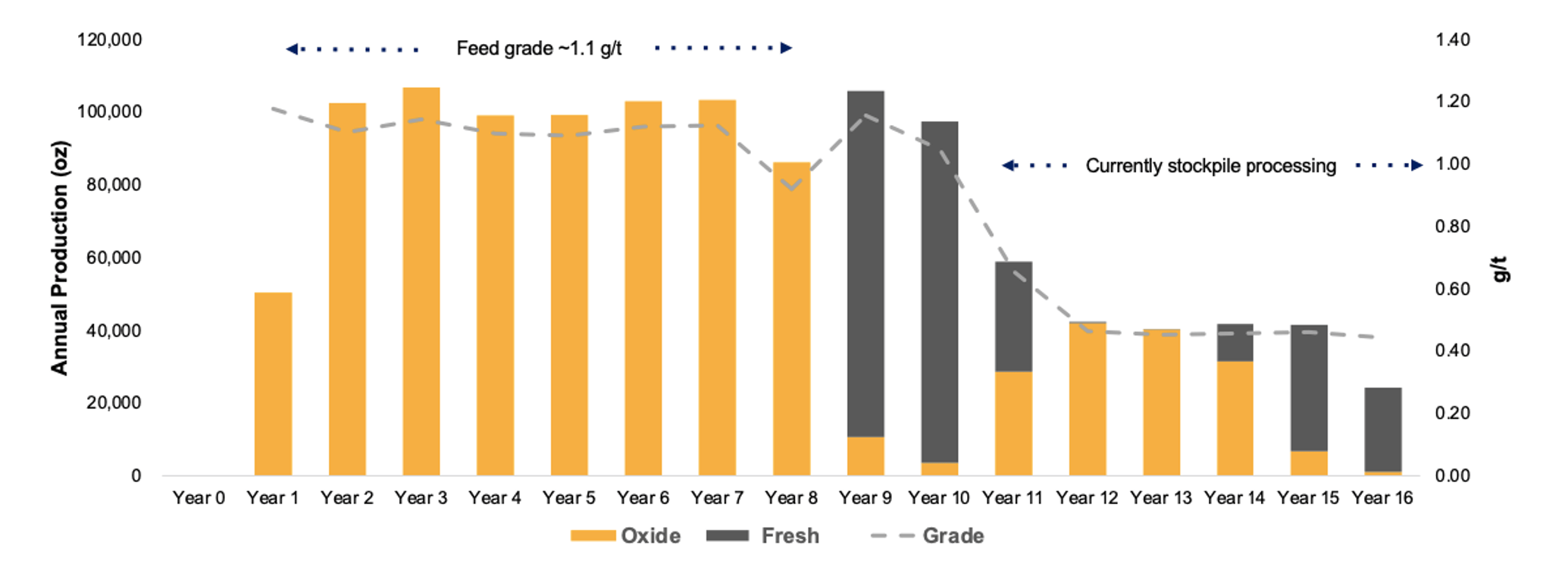

The company’s Kobada Gold Project in southern Mali has a resource of 3.1Moz – including 1.71Moz in the higher confidence Measured and Indicated categories – and an existing DFS outlining low costs and the potential to produce more than 100,000 ounces of gold per annum for over 10 years.

The large oxide-dominant ore inventory is free digging and very soft rock, which reduces both the capital expenditure and operating expenditure for the project.

There’s also potential to further grow mineralisation, with recent exploration drilling extending the project’s strike extent from 5km to 11km.

Once exploration is wrapped up, Toubani plans to feed the results into an update of the DFS by the end of 2023.

A final investment decision is scheduled for 2025.

Australia

Location: Far North Queensland

Market Cap: $27.07m

Pacgold’s Alice River Project is located 280km northwest of Cairns in Far North Queensland, and is one of the northernmost mining projects in Australia.

While there is an airstrip, the project is only accessible by helicopter in the wet season.

To date, the company has identified high-grade gold over 7km of strike and is systematically exploring the +30km of shear zone that runs through the project.

The current 5,000m drilling program is expected to continue into June on the Central and Southern Targets with a steady stream of assay results expected to flow over June and July. Planning is also underway for a maiden drill program on the Southern Target extension and expected to commence in early Q3, 2023.

CEL, LCL, WW1, TRE and PGO share prices today:

At Stockhead we tell it like it is. While Challenger Gold, Felix Gold, Besra Gold, Pacgold, Toubani Resources and West Wits Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.