Octava Minerals set to get its ASX party started as the critical minerals scene just keeps getting hotter

Ready to make its AS debut, Octava Minerals isn’t just a pretty face. Pic via Getty Images.

The West Australian-based company has a few key things going for it and we aren’t just talking about its extensive exploration plans once it lists on the ASX in August.

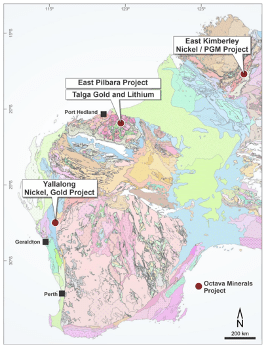

Octava was only established back in 2021, but what sets this explorer apart from the rest is its broad exposure to critical minerals across three main project areas in Western Australia; The Talga Project in the east Pilbara, the Panton North and Copernicus North Projects in the Kimberley, and Yallalong near Chalice Mining’s (ASX:CHN) Julimar discovery.

Critical minerals are considered essential for modern technologies, economies, and even our national security, however the supply chain may be at risk.

These minerals include things like platinum group metals (PGMS) or platinum group elements (PGEs), cobalt, graphite, lithium, manganese, rare earth elements, vanadium, and others.

Here in Australia, we have a list of 26 ‘critical minerals’, as well as a growing awareness of a whole bunch of other minerals that are just as essential but aren’t in the list, like copper and nickel.

In Octava’s case, the company has exposure to lithium, PGEs, and nickel, as well as gold, and its hoping to raise a maximum of $6m at $0.20 per share to get boots on the ground, explore, and find some discoveries.

Successful track record in mining

Octava’s founding members include veterans with more than 40 years’ experience in the mining game such as Damon O’Meara, who previously worked for Denis O’Meara Prospecting – the founder of Atlas Iron (ASX:AGO), Kalamazoo Resources (ASX:KZR) and De Grey Mining (ASX:DEG).

Non-executive chairman Clayton Dodd is a chartered accountant with more than 35 years’ experience – he is also the current executive chairman of Podium Minerals (ASX:POD), another platinum group metals explorer developing the Park Reef PGM Project in WA’s mid-west.

Then there’s CEO and managing director, Bevan Wakelam, who has a diversified skill set as geologist and resource marketing executive, having previously worked with the likes of Rio Tinto (ASX:RIO) for 10 years and played a crucial role as part of the start-up team at Roy Hill Iron Ore.

All things lithium and gold at Talga Project

In an interview with Stockhead, Wakelam says funds will be used to get to work immediately on its key asset – the Talga Project, where the company is exploring for both lithium and gold.

“Talga is about 10kms to the north of the Archer lithium deposit (10.5Mt @1% Li2O) held by Global Lithium Resources (ASX:GL1),” he says.

“We have a similar geology to Archer, and while lithium mineralisation has been identified on the tenement already there has been no previous drilling, so we are keen to get in there and get to work with mapping and sampling to line up some targets for drilling and better under the mineralising environment within the project area.”

Wakelam says there is some history on the area that dates back to a few years ago when rock chip samples were taken on a LCT-type (lithium-caesium-tantalum) pegmatite at Talga.

“Results came back with anomalous recordings of lithium oxide including 0.22% but at the time the market for lithium wasn’t interesting and the previous operators tended to focus more on the gold,” he says.

“A number of potential lithium targets have been identified so we want to hit the ground running upon listing.”

On the gold front, he says previous drilling has intersected significant results such as 16m at 1.99g/t, 8m at 1.57g/t from 50m and 9m at 1.2g/t from 62m at the Razorback prospect.

“Basically, Razorback has only been tested over about 700m of a 4km strike length,” Wakelam says.

“There is still a lot of opportunity there – we completed a geophysical survey last year which identified 11 gold targets including six high priority targets, so the gold is a very interesting opportunity for us.” And the Warrawoona Gold Mine, held by Calidus Resources (ASX:CAI) is only 40km to the south.

Eyeing PGMS in the East Kimberley

Another key asset for the company is the East Kimberley Project, comprising Panton North and Copernicus North, where the focus is more on nickel and PGMs. Both projects have recorded strong nickel, copper & PGM geochemistry.

PGMs are a group of six precious metals – platinum, palladium, iridium, osmium, rhodium, and ruthenium and are used in hydrogen fuel cells and as a catalyst to clean nitrous oxides out of internal combustion engines (ICEs).

Wakelam says the East Kimberley Project is immediately adjacent to Future Metals’ (ASX:FME) Panton platinum group metals project, which hosts a 5M oz palladium, platinum and gold resource as well as 238,000t of nickel.

“FME’s resource is right next door to us, and we have the same geology on our tenement,” he says.

The region is widely regarded as having a high potential for magmatic nickel-copper sulphides and PGM mineralisation and is considered one of the more extensively mineralised igneous associations in Australia.

While Panton North has been explored in the past, Wakelam says much of the work has been surficial with only limited drilling.

Here, the company plans to use deep penetrating electromagnetic (EM) geophysics to assist in defining high-quality drill targets.

Yallalong PGE, gold, and nickel sulphide play

The Yallalong project is located in the northwestern portion of the Murchison region about 220km to the northeast of the port town of Geraldton and 600km north of Perth.

There has been little exploration within the 300km2 Yallalong Basin and up until 2013, the project area covered by E70/5051 remained untested by any modern exploration.

Although exploration at Yallalong is at a very early stage, Wakelam says the results from previous explorers have been encouraging and indicate a potential for a prospective mafic/ultramafic layered intrusion within the project area.

“Upon listing, we plan to follow up the previous exploration that has been carried out for shear hosted gold mineralisation and nickel-PGM magmatic style sulphide mineralisation with geochemical sampling and ground electromagnetic surveying.

“If these studies are positive then drilling in the following year of the gold and nickel –PGM targets will be undertaken.

“All Octava projects have either returned significant drill intersections or highly anomalous sampling results that require follow up work so there should be a steady news flow from the work we will be doing.”

This article was developed in collaboration with Octava Mineras, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.