Redbank Copper says a review shows cobalt potential; shares jump 20pc

Pic: John W Banagan / Stone via Getty Images

Another junior is heading down the cobalt path due to the surging price in the battery metal.

Redbank Copper (ASX:RCP) has completed a review of its 1050 sq km of tenure in the Northern Territory’s South McArthur River Basin that indicates the potential for cobalt.

Cobalt prices rocketed 130 per cent last year, making it a top commodities performer among HSBC’s “Commodity Prices Snapshot”. The price is currently sitting at around $US81,000 per tonne.

The soaring price is largely due to rising demand from electric vehicle makers and constrained supply. Cobalt is a component of the lithium ion battery technology used in electric cars.

Redbank’s review of data has highlighted an area of some 50 sq km on one of its exploration licences, where cobalt values are recorded in stream sediment samples.

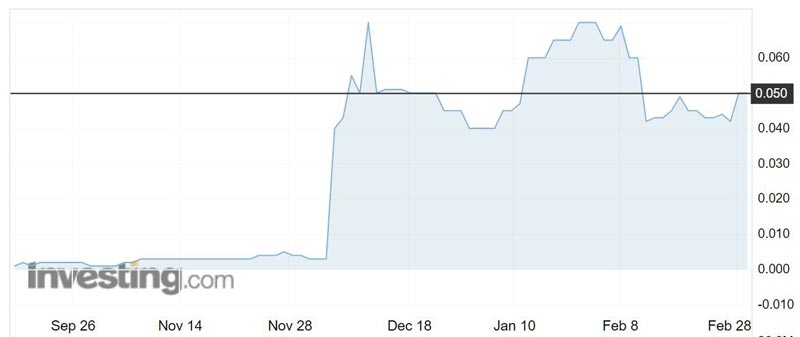

Investors applauded the company’s foray into cobalt, pushing shares up more than 19 per cent to 0.5c by 2.30pm AEDT.

The area contains numerous copper showings and targets, most of which remain untested for copper, and in particular for associated cobalt, to the east of the known copper resources in the historic mining centre of Redbank.

Redbank now plans to fly a survey early over the area to identify possible targets for further investigation and drill testing.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

The company has also uncovered a drill-ready polymetallic target at the GC2 prospect.

Redbank has been contacted for comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.